SHB’s Deposit Interest Rates for August 2025

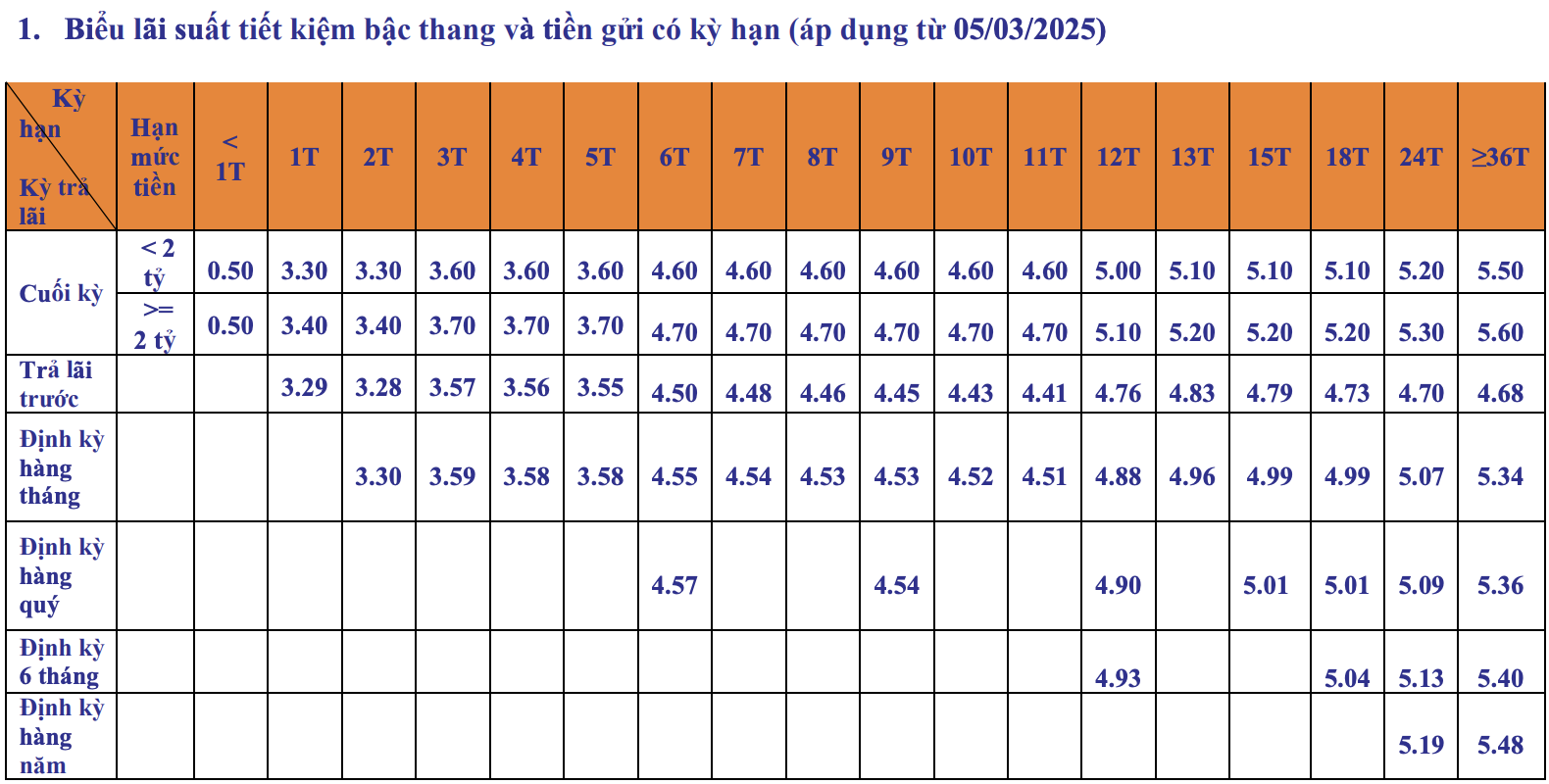

For customers making deposits at the counter through the step-up savings product and receiving interest at maturity, SHB offers two interest rate tiers based on deposit amounts: Below VND 2 billion and VND 2 billion or above.

For deposits below VND 2 billion, interest rates range from 0.5% to 5.5% per annum. Specifically, for tenors of less than 1 month, the interest rate is 0.5%/year; for 1-2 months, it is 3.3%/year; 3-5 months earn 3.6%/year; 6-11 months receive 4.6%/year; 12 months earn 5.0%/year; 13-18 months have an interest rate of 5.1%/year; 24 months earn 5.2%/year; and for tenors of 36 months or more, the highest interest rate offered is 5.5%/year.

SHB’s Counter Deposit Interest Rate Table for August 2025

For deposits of VND 2 billion or more, interest rates range from 0.5% to 5.6% per annum. Specifically, for tenors of less than 1 month, the interest rate is 0.5%/year; for 1-2 months, it is 3.4%/year; 3-5 months earn 3.7%/year; 6-11 months receive 4.7%/year; 12 months have an interest rate of 5.1%/year ; 13-18 months earn 5.2%/year; 24 months have an interest rate of 5.3%/year; and for tenors of 36 months or more, the highest interest rate offered is 5.6%/year .

In addition to receiving interest at maturity, customers can choose from various other interest payment options, including: receiving interest in advance, monthly, quarterly, semi-annually, or annually.

SHB’s Online Deposit Interest Rates for August 2025

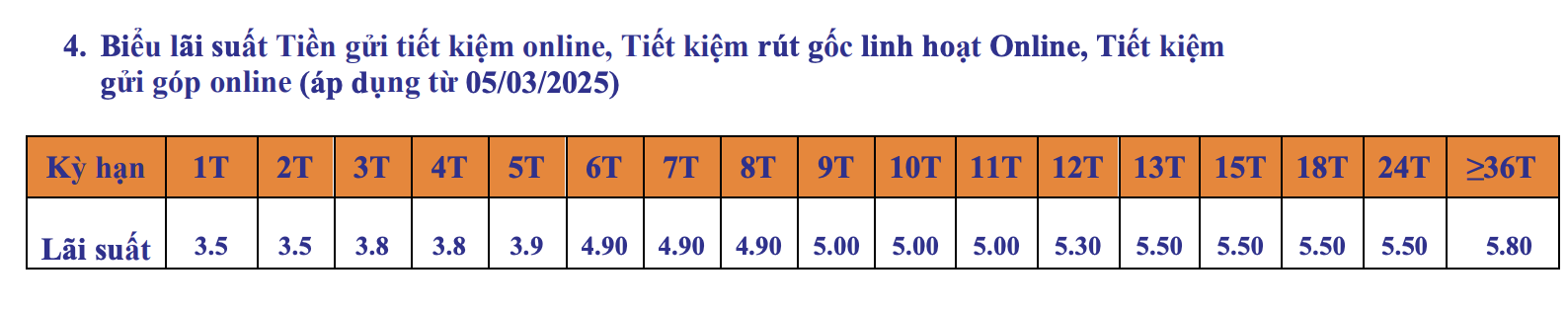

For online deposits, SHB offers higher interest rates for tenors of 1 month or more, with rates 0.1% per annum higher than counter deposits, ranging from 3.5% to 5.8% per annum.

Specifically, for tenors of 1-2 months, the interest rate applied is 3.5%/year; 3-4 months earn 3.8%/year; 5 months have an interest rate of 3.9%/year; 6-8 months receive 4.9%/year; 9-11 months earn 5.0%/year; 12 months have an interest rate of 5.3%/year; 13-24 months earn 5.5%/year; and for tenors of 36 months or more, the highest interest rate offered is 5.8%/year .

SHB’s Online Savings Interest Rate Table for August 2025

Latest VPBank Interest Rates for August 2025: Highest Interest Rates for 24-Month Fixed Deposits

“This August, VPBank is offering an attractive interest rate for online savings accounts with a term of 24 months or more. With a competitive rate that beats the competition, VPBank is the smart choice for those looking to grow their savings.”

Latest HDBank Interest Rates for August 2025: Which Term Deposit Offers the Best Returns?

As of early August 2025, HDBank offers a maximum interest rate of 6.1% per annum for regular deposits. This competitive rate positions HDBank as a leading financial institution, offering customers an attractive opportunity to grow their savings. With this rate, customers can rest assured that their funds are not only secure but also working hard to deliver substantial returns.

Latest ACB Bank Interest Rates for August 2025: Which Term Deposit Offers the Highest Returns?

As of August 2025, ACB introduces a new interest rate for online deposits, offering individuals an attractive opportunity to grow their savings. With this latest update, ACB is proud to provide one of the highest interest rates in the market for those who choose to invest their funds for 12 months or more.

The Bank’s Endeavor to Lower Interest Rates

The Central Bank, in a bid to heed the Government and Prime Minister’s directive on enhancing measures to reduce interest rates, convened a meeting with the credit institution system on August 4, 2025. The primary focus of this gathering was to discuss strategies for stabilizing deposit rates and reducing lending rates.

Over 15.3 Million Billion Dong Flows into the Banking System

As of the end of May, resident and business deposits in credit institutions reached a record high of over 15.34 million billion VND. This remarkable achievement underscores the robust financial landscape in Vietnam, showcasing the confidence and trust that individuals and enterprises have in the country’s banking system.