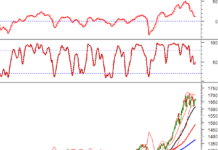

Gold prices fluctuate as investors weigh geopolitical tensions and economic data. (Source: Kitco News)

According to Kitco News, Matt Simpson, a senior analyst at City Index, attributed the recent dip in gold prices to the anticipated meeting between US President Donald Trump and Russian President Vladimir Putin in Alaska on August 15th, aimed at negotiating an end to the Ukraine war. “Gold’s safe-haven appeal tends to wane when geopolitical tensions ease,” he noted.

Additionally, markets are eagerly awaiting the release of the US Consumer Price Index (CPI) report for July, expected on August 12th. Forecasts predict a 0.3% month-over-month rise in core CPI, pushing the annual increase to 3%, surpassing the Fed’s 2% target. “A higher inflation reading could strengthen the US dollar, exerting downward pressure on gold prices. However, some investors may view price dips as buying opportunities,” Mr. Simpson added.

The prospect of an imminent Fed rate cut continues to provide underlying support for gold. Weaker-than-expected July jobs data has heightened expectations for a September rate reduction. Fed funds futures markets are now pricing in a roughly 90% probability of a cut next month, with at least one more reduction expected before year-end. Gold, a non-interest-bearing asset, typically benefits from a low-interest-rate environment.

Gold prices were also impacted by speculation around import tariffs. The metal hit a record high of $3,534.10 per ounce last week amid reports that the US might impose a 39% tariff on gold bars from Switzerland. However, according to Reuters, the White House may clarify or exclude gold from the tariff list, easing concerns and triggering profit-taking.

From a technical perspective, analyst Wang Tao believes that gold prices could breach the $3,364 per ounce support level, opening the possibility of a further decline towards the $3,314 – $3,342 range.

Looking ahead, some experts remain bullish. James Stanley, a market strategist at Forex.com, commented, “I don’t see a reason to change my outlook. Gold reached $3,435 in May, June, and July, and subsequent pullbacks have been minor, suggesting that significant buying power could propel it higher.” He identified the current support level at $3,350 per ounce.

In contrast, Ole Hansen, head of commodity strategy at Saxo Bank, cautioned against expecting a sharp upside breakout in the near term. “Gold has been range-bound since April, and a decisive move above $3,450 would be required to shift the status quo,” he explained.

Sources: Reuters, Kitco News

The Central Bank Pumps Over 11 Trillion VND into the Open Market

Between August 4 and August 11, the State Bank of Vietnam (SBV) continued its four-week streak of net injections into the open market, primarily through new issuances in the form of term deposit offerings.