Silver prices soar as global inflation hedges boost demand.

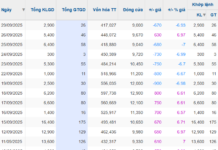

According to data from Phu Quy Gemstone and Gold Group, silver prices surged today, with 999 silver quoted at VND 1,476,000/tael (buying) and VND 1,522,000/tael (selling) in Hanoi. Over the past year, silver bar prices have skyrocketed by 49.8%, outpacing gold’s growth of 32.88%.

Meanwhile, the 999 silver bar (1kg) is priced at VND 39,359,902/bar (buying) and VND 40,586,565/bar (selling), as of 08:57, August 14th.

In the global market, silver prices surged to USD 38.64/ounce.

Silver prices surge past the $38.35/ounce mark as investors seek inflation hedges.

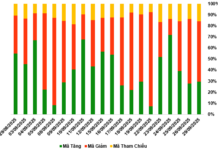

Silver prices breached the $38.35/ounce level, extending gains after US inflation data bolstered expectations for a Federal Reserve rate cut in September. Core inflation rose to 3.1%, a six-month high, while overall inflation held steady at 2.7%, lower than the expected 2.8%. Traders now predict a 94% chance of a 0.25% cut next month and another move by year-end.

Senior analyst Christopher Lewis noted that investors should pay attention to gold’s movements as gold and silver often trend together. Watching gold’s price action can offer critical clues about silver’s potential next move.

Today’s Silver Price Extends Its Bullish Run

Today’s silver prices in both the domestic and international markets continue their upward trajectory as US economic data signals weakness, boosting investor confidence.

July CPI Rises 0.11% Month-Over-Month

According to the latest data released by the Statistics Bureau, the consumer price index (CPI) rose 0.11% in July from the previous month, primarily due to increases in housing maintenance material prices, food prices, and dining out. The CPI for July increased by 2.13% compared to December 2024, and by 3.19% year-on-year. On average, in the first seven months of 2025, the CPI rose by 3.26% year-on-year, with core inflation up by 3.18%.