Mr. Hoang Tuyen, Chairman of the Board of Directors of TNH Joint Stock Hospital Group (Code: TNH), has reported the transfer of 5 million TNH shares through a matching transaction.

The transaction was executed between July 18 and August 5, 2025. Upon completion, Mr. Tuyen’s ownership decreased from 9.6 million shares, or 6.67%, to 4.6 million shares, representing 3.2% of TNH’s charter capital, thus ceasing to be a major shareholder of TNH Hospital.

Chairman Hoang Tuyen at the 2025 Annual General Meeting of TNH Hospital

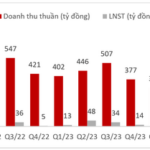

TNH Hospital has recently announced disappointing financial results, reporting a post-tax loss of over 20 billion VND in the second quarter of 2025, a significant decline from the profit of 38 billion VND in the same period last year.

During this period, TNH’s net revenue amounted to 122 billion VND, a 7% decrease year-on-year. Soaring cost of goods sold led to an 80% evaporation in gross profit, leaving only 10.6 billion VND.

The surge in cost of goods sold, coupled with mounting pressure from expenses, pushed TNH into the red. The company attributed this to extended holidays and prolonged unfavorable weather conditions, which disrupted medical services at TNH’s healthcare facilities.

Additionally, the newly operational Viet Yen TNH Hospital has not yet been registered for health insurance for initial medical examinations, resulting in unstable patient numbers and impacting revenue.

In the second quarter of 2025, the company also incurred additional costs for the completion and implementation of electronic project proposals at Pho Yen TNH Hospital and Viet Yen TNH Hospital, as well as further investments in AI applications for image diagnosis.

For the first half of the year, TNH Hospital recorded a slight 3% decline in revenue, totaling 216.3 billion VND. After deducting expenses, the hospital reported a loss of over 55.1 billion VND, contrasting the profit of 53 billion VND in the previous year.

For 2025, TNH Hospital aims for a revenue of 620 billion VND and a net profit of 31.3 billion VND. As of the end of the second quarter, the company has achieved 35% of its revenue target but remains far from its profit goal.

As of June 30, 2025, TNH’s total assets stood at 2,735 billion VND, a 7% increase from the beginning of the period. Cash and cash equivalents amounted to 42 billion VND, a 23% decrease.

Construction work in progress accounted for 403 billion VND, a 40% increase. This primarily comprised the TNH Lang Son Hospital project with 332 billion VND, the Phase 3 development of the International Thai Nguyen Hospital with 61 billion VND, and an additional 10 billion VND for the Da Nang Oncology Hospital project.

TNH Hospital’s total liabilities amounted to 942 billion VND, a 35% increase from the beginning of the year. Borrowings and finance lease obligations stood at 893 billion VND, a 36% rise.

The Timber Industry’s Profit Divide: A Tale of Two Fortunes

The second quarter of 2025 wasn’t a bumper season for the timber industry, but it did provide a clear test of each enterprise’s intrinsic capabilities. Nearly 80% of the industry’s profits were concentrated among three major players, while the rest downsized, resorted to financial maneuvering, or cut costs to stay afloat.

“Leading Vietnamese Export Company Reports Record Profits; Stock Soars with Dragon Fruit Success”

The surge in stock prices came after the company unveiled stellar second-quarter financial results, boasting record-high revenue and profits.

“Q2’s Big Win: Vinaconex and Industry Giants Invest in the Nearly 20-Trillion Dong Highway Project”

Vinaconex reports a remarkable surge in net profit for the second quarter of 2025, reaching nearly VND 309 billion, an impressive over-threefold increase compared to the same period last year. Alongside this impressive financial performance, the company has also ventured into a significant investment, committing funds towards the development of a nearly VND 20,000-billion highway project.

Introducing the Prime Real Estate of Dong Nai: Now Open for Business

Introducing the future of real estate in Dong Nai: a transparent and accessible journey towards your dream property. The province is set to unveil auction-bound land plots through a multi-channel approach, utilizing the power of media, e-government portals, and dynamic real estate exchanges. Get ready to navigate the exciting world of real estate with ease and confidence!

“Record-breaking Revenue and Profits: Nafoods Commences Construction of NASOCO Phase 2”

Nafoods Group (HOSE: NAF) has reported record-breaking revenue and profits for the second quarter of 2025 and the first half of the year. Along with this impressive financial performance, the company is also embarking on an expansion journey with the second phase of the Nasoco project, positioning itself to capitalize on future growth opportunities.