Let’s say you’re a die-hard boba tea enthusiast, treating yourself to a cup from premium brands every workday, averaging 55,000 VND per cup. From the first workday of the year (2/1/2025) until today (8/13/2025), you’ve gone through 224 days, spending over 12.3 million VND.

Now, imagine a different scenario. Instead of ordering boba tea, you invest that exact amount of 12.3 million VND in the stock market during the past seven months.

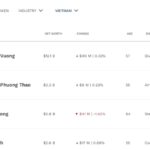

With the top-performing and highly liquid stocks below, your boba tea money could have doubled, tripled, or even quadrupled.

The champion among these stocks is Gelex Electric (GEE). If you had invested all your boba tea money in this stock, with its impressive 372% growth, your initial 12.3 million VND would have turned into nearly 58.2 million VND. That’s a profit of over 45 million VND – enough to buy yourself a brand new motorbike!

Even if you missed the Gelex Electric train, investing in its parent company, Gelex (GEX), would have yielded a 200% return, turning your 12.3 million VND into over 36.9 million VND.

The Vin duo, Vingroup (VIC) and Vinhomes (VHM), also offered substantial profits of 186% and 132%, respectively. Investing in these stocks would have grown your money to 35.2 million VND and 28.5 million VND. Following billionaire Pham Nhat Vuong could have earned you enough to buy the latest iPhone model.

SHS and SHB stocks also performed exceptionally well, with returns ranging from 117% to 150%. Investing in these stocks would have easily doubled or tripled your 12.3 million VND.

Of course, this is a hypothetical scenario filled with lucky breaks, and stock market investments always carry risks. Not everyone can catch these super-performing stocks.

Nonetheless, this illustrates a valuable lesson in personal finance, showcasing the power of small expenses and their opportunity costs.

Stock Market Update: Riding the Wave or Missing Out?

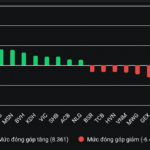

Today’s session (August 13th) saw the VN-Index fluctuate around the 1,600-point mark multiple times. The intense back-and-forth movement at this strong resistance level has put investors in a tricky situation: buying now risks buying at the peak, but selling early could mean missing out on potential gains. Experts suggest that if the market undergoes a technical correction until the end of August, it would present an opportunity to enter instead of rushing to buy at higher prices.

A Rogue Bank Code: The Sudden Surge of Prop Trading in Vietnam’s Stock Market

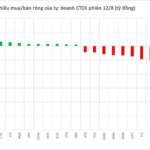

The HoSE witnessed a notable trading session on Thursday, with foreign investors and securities companies taking center stage. While foreign investors displayed confidence in the market by snapping up stocks, securities companies offloaded a substantial amount, amounting to a net sell value of VND 621 billion. This contrasting behavior between the two key market players has left market participants intrigued, with many wondering what the future holds for Vietnam’s stock market.

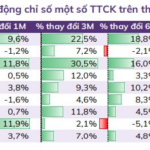

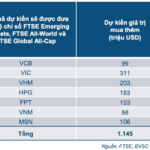

7 Stocks That Could Attract Over $1.1 Billion in Foreign Capital as Vietnam’s Market is Upgraded

The story of the market’s upgrade has an obvious silver lining: it could attract billions of dollars in foreign capital into Vietnam’s stock market.