Vietnam’s Securities Commission Fines QP Green Investment for Disclosure Violations

On August 14, 2025, Vietnam’s Securities Commission (UBCKNN) issued Decision No. 541/QD-XPHC, imposing administrative sanctions for violations in the securities and stock market field against QP Green Investment Joint Stock Company (HNX: HKT), with its head office located at 31 Dien Bien Phu, Tan Dinh Ward, Ho Chi Minh City.

Specifically, QP Green Investment was fined VND 60 million for failing to disclose information within the prescribed time frame as stipulated by law. The company disclosed information related to the 2025 Annual General Meeting of Shareholders, the 2024 audited financial statements, the 2024 amended and supplemented charter, and the announcement of personnel changes No. 10/2025/HKT-CBTT dated March 31, 2025 (appointing the chief accountant) later than the deadline as prescribed in Clause a, Point 3, Article 42 of the Government’s Decree No. 156/2020/ND-CP dated December 31, 2020, detailing the sanctioning of administrative violations in the securities and stock market field (Decree 156/2020/ND-CP).

Additionally, the company was fined VND 125 million for disclosing misleading information. QP Green Investment reported a net profit after tax (PAT) for 2024 in the self-prepared Q4 2024 financial statements that differed from the audited 2024 financial statements. Specifically, the PAT for 2024 in the self-prepared Q4 2024 financial statements was VND 854,645,335, while the PAT in the audited 2024 financial statements was VND 255,560,863.

In total, QP Green Investment was fined VND 185 million for the above-mentioned violations. In addition to the monetary penalty, the UBCKNN also requested the company to take remedial measures, including the cancellation or correction of the disclosed information in accordance with Clause 6, Article 42 of Decree No. 156/2020/ND-CP, as amended and supplemented by Point d, Clause 33, Article 1 of Decree No. 128/2021/ND-CP, regarding the disclosure of misleading information.

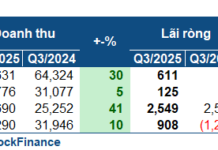

In terms of business performance, for the first six months of 2025, QP Green Investment recorded a nearly 55% decrease in net revenue to VND 39.2 billion. However, thanks to a significant reduction in cost of goods sold, the company reported a gross profit of VND 1.1 billion, doubling that of the same period last year (VND 502 million).

Additionally, other income contributed nearly VND 1 billion, a significant increase compared to the loss of VND 8.5 million in the previous period. Financial expenses also decreased by nearly three times to VND 226 million.

As a result, the company reported a post-tax profit of over VND 1.1 billion, up nearly 98% from the same period in 2024 (VND 564 million).

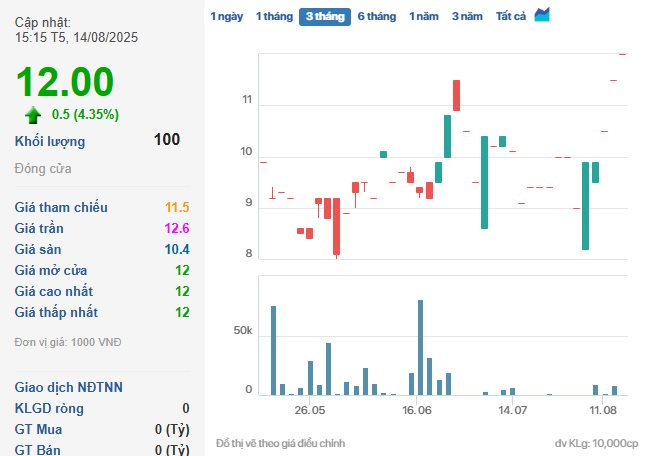

On the stock market, HKT shares have been on a sharp upward trajectory in the last three trading sessions. Specifically, at the close of August 14, HKT shares traded at VND 12,000 per share, up 4.35% compared to the previous session, with a meager matched volume of just 100 units.

This marked the third consecutive gaining session for HKT shares, including one session hitting the daily limit-up, with a surge of 21.21%, equivalent to VND 2,100 per share. Thanks to this strong rally, HKT shares have reached an all-time high since their listing. The company’s market capitalization stands at over VND 73.6 billion.

‘Former Steel King’ Reveals Phase of Capital Overrun, Negative Working Capital, Liquidity Crunch and Failed THACO Deal

THACO Industries is a professional investment company, but they are new to the intricacies of the steel industry. A thorough due diligence process is required, which means the collaboration timeline will be extended.

“DXS Profits Soar: First-Half Earnings Quadruple with 46% Increase in Down Payments for Condos and Land”

Recognizing an extraordinary performance in Q2, the net profit of the Real Estate Service Joint Stock Company (HOSE: DXS) for the first half of 2025 tripled that of the same period last year, reaching an impressive VND 258 billion.