At the Extraordinary General Meeting of Lizen JSC (HOSE: LCG) on August 14, 2025, a resolution was passed to distribute a 7% stock dividend for the year 2024, equivalent to receiving 7 new shares for every 100 shares owned.

With nearly 193.1 million shares currently in circulation, LCG plans to issue over 13.5 million new shares. The capital for this dividend will come from undistributed post-tax profits as stated in the audited consolidated financial statements for the year 2024. The issuance is expected to take place within 2025.

Additionally, the meeting approved a plan to privately offer 100 million shares to a maximum of 50 professional securities investors at a price of 10,000 VND per share, approximately 15% lower than the closing price of 11,800 VND on August 15, 2025. These shares will be restricted from transfer for one year, and the offering is expected to take place in 2025-2026. If successful, the charter capital is expected to increase to nearly VND 2,951 billion.

| LCG Share Price Movement since the beginning of 2025 |

The company intends to use the proceeds of approximately VND 1,000 billion to repay bank loans, finance leases, and other debts (VND 700 billion) and invest in machinery and equipment for construction (VND 300 billion).

Extraordinary General Meeting of LCG on August 14, 2025. Source: Lizen

|

Target revenue of VND 1,900 billion and profit of VND 90 billion for the second half of the year

The meeting minutes also recorded the Chairman

For instance, Lizen has partnered with SCI to bid for hydropower projects in Indonesia. In the real estate sector, LCG is finalizing investment procedures in Thanh Hoa, Ninh Thuan, and Dong Nai, with construction expected to commence by the end of 2025. The company is also investing in large-scale PPP projects, including a strategic project with a total investment of approximately VND 19,000 billion.

LCG forecasts revenue of approximately VND 1,900 billion and profit after tax of VND 90 billion for the second half of 2025, thanks to key projects such as the Huu Nghi-Chi Lang Expressway, VD4 Hung Yen, Van Phong-Nha Trang, and new contracts signed in Q3.

Regarding new projects, the company has recently won a bid for the “Road of Heritage” project worth approximately VND 6,000 billion, of which Lizen will execute 60% (equivalent to VND 3,600 billion). The construction is expected to commence in Q3 2025. Lizen is also participating in bids for infrastructure and PPP projects with a total value of nearly VND 10,000 billion, which are among the priority projects for public investment in the 2025-2027 period.

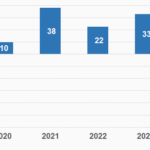

In the first half of 2025, LCG achieved a revenue of over VND 1,160 billion, a 10% increase compared to the same period last year, while net profit reached nearly VND 51 billion, a 12% decrease. The company has completed 36% of its annual plan.

– 15:27 15/08/2025

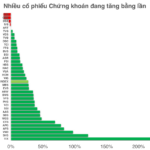

Valuing the Stock Market: Capital Increases Remain Vital Despite Premium Pricing

The stockbroking industry is riding a wave of success, with the Vietnamese stock market reaching unprecedented heights. While the valuation of stockbroking firms is no longer a bargain, capital increases remain pivotal for companies to compete and ride the wave of market upgrades and digital asset initiatives.

“Van Phu Reports 6-Month Profit Growth of 56% in First Half of 2025”

“The positive macroeconomic climate has had a significant impact on the real estate market’s recovery, and this is reflected in the impressive financial performance of Van Phu – Invest Real Estate JSC (HOSE: VPI). The company has announced a remarkable 56% year-over-year increase in its after-tax profit for the first half of 2025, amounting to VND 148.8 billion.”

The Foreign Securities Firm on the Verge of a Thousand Billion Capital Increase

On December 6, the Ministry of Finance granted a certificate of registration for public offering of shares to Guotai Junan Securities Joint Stock Company (Vietnam) (HNX: IVS). The offering entails the issuance of 69.35 million new shares, maintaining a 1:1 ratio, thus increasing the company’s capital to VND 1,387 billion.