I. VIETNAMESE STOCK MARKET WEEK 11-15/08/2025

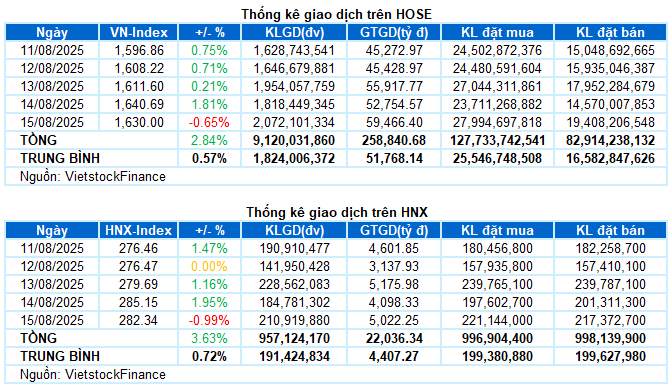

Trading: The main indices ended their winning streak in the last trading session of the week. The VN-Index closed the week at 1,630 points, down 0.65% from the previous session. The HNX-Index also fell nearly 1% to 282.34 points. For the week, the VN-Index gained a total of 45.05 points (+2.84%), while the HNX-Index added 9.88 points (+3.63%).

The Vietnamese stock market maintained its positive momentum this week with 4 out of 5 gaining sessions. The VN-Index continued its upward trajectory, setting new highs despite significant volatility at higher price levels. Notably, pillar sectors such as finance and real estate played a leading role, contributing to the consolidation of investor sentiment. However, strong profit-taking pressure in the final session curbed the index’s upward momentum. The VN-Index ended the week at the 1,630-point mark, up 2.84% from the previous week.

In terms of impact, BID was the stock that put the most pressure on the market in the last session, taking away nearly 2 points from the VN-Index. This was followed by VCB, CTG, and TCB, which caused a total loss of 4.5 points for the index. On the other hand, VJC and BSR made the most significant positive contributions, with each stock adding 1.2 points.

The heightened profit-taking pressure caused most sectors to end the week in negative territory. Media and information technology were the worst-performing sectors, declining by approximately 2.4%. This was mainly due to the sharp declines in VGI (-2.35%), FOX (-3.46%), CTR (-1.5%), SGT (-4.47%), and YEG (-4.49%); and FPT (-2.31%), CMG (-3.59%), and ELC (-2.74%), respectively.

The financial and real estate sectors also exerted considerable pressure on the broad market as they witnessed a wide-scale correction after a strong rally previously. Only a few notable names maintained buying interest, such as VIX and ORS, which hit the daily limit-up, along with MBB (+2.36%), ACB (+1.34%), SHB (+2.21%), EIB (+4.95%), and VND (+2.07%); and VPI (+1.07%) and CRE (+3.41%), respectively.

On the flip side, the energy sector stood out with a notable gain of 2.68%, thanks to the contributions of the two largest stocks in the industry: BSR, which hit the daily limit-up, and PLX, which rose by 1.58%. Additionally, the industrial sector also had several bright spots, including CII (+5.78%), VGC (+2.03%), FCN (+2.75%), PC1 (+3.27%), VJC (+6.82%), and VSC and IPA, both hitting the daily limit-up.

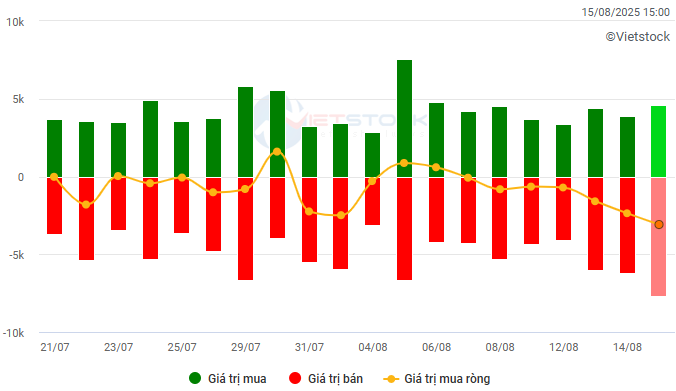

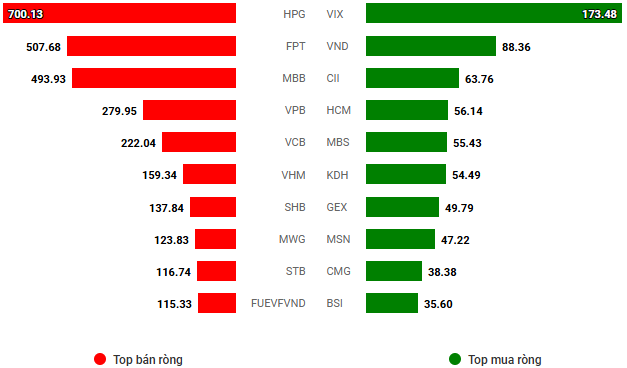

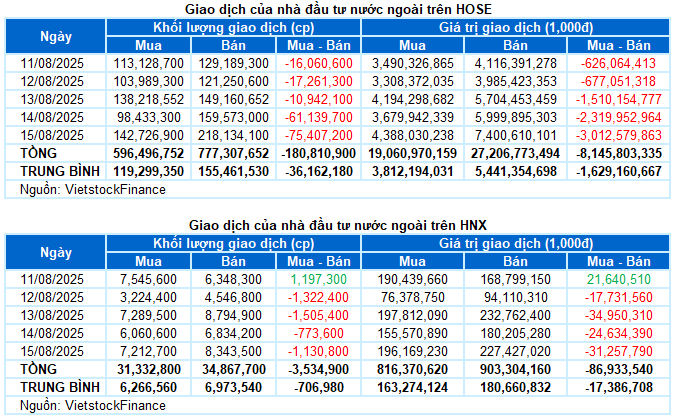

Foreign investors were net sellers this week, offloading over 8.2 trillion VND on the two main exchanges. Specifically, they net sold more than 8.1 trillion VND on the HOSE and nearly 87 billion VND on the HNX.

Trading value of foreign investors on HOSE, HNX, and UPCOM by day. Unit: Billion VND

Net trading value by stock ticker. Unit: Billion VND

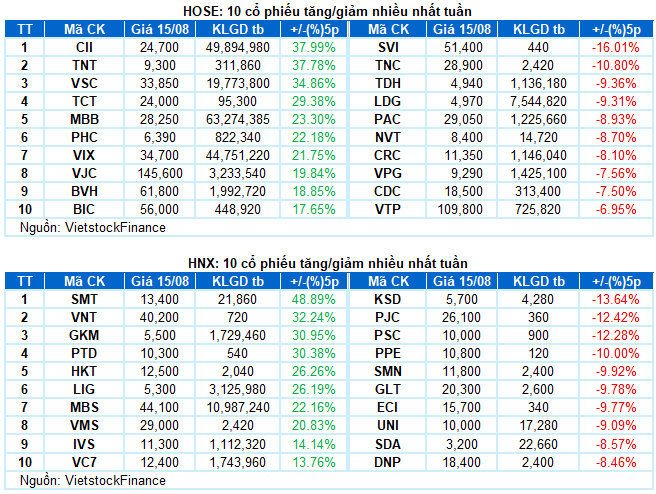

Stocks with significant increases this week include VSC

VSC rose 34.86%: VSC concluded a booming week with all five sessions ending in strong gains. The stock’s price surged above the Upper Band of the Bollinger Bands, indicating a robust upward trend.

Additionally, the MACD indicator continued to widen the gap with the Signal Line since giving a buy signal in early July 2025, suggesting that the positive outlook is likely to persist.

Stocks with significant decreases this week include TDH

TDH fell 9.36%: TDH witnessed a correction after a strong rally in the previous week and is currently testing the Middle Band of the Bollinger Bands.

At present, the Stochastic Oscillator continues to trend downward after giving a sell signal, while the MACD is gradually narrowing the gap with the Signal Line. If the MACD also generates a sell signal in the coming sessions, the short-term trend of the stock will turn more negative.

II. STOCK MARKET STATISTICS FOR THE PAST WEEK

Economic and Market Strategy Division, Vietstock Research Team

– 17:15 15/08/2025

The Stock Market Soars to New Heights

“An array of stocks with impressive returns, often exceeding multiples of the initial investment, has captivated the attention of many individuals, enticing them to channel their funds into this lucrative avenue.”

What Stock Symbol Was the Focus of Proprietary Trading Firms’ Accumulation on August 14th?

The HoSE-listed securities investment firms witnessed a net buy value of VND1.89 trillion by proprietary traders.