The afternoon session saw intense selling pressure across the board, with over 260 tickers in the red and the HoSE drowning in a sea of red.

Bank stocks, which had been the main drivers of the VN-Index’s recent rally, found themselves at the epicenter of profit-taking. BID led the negative contributors, shaving off nearly two points from the index, followed by VCB (1.9 points) and CTG (1.6 points). Other lenders like TCB and LPB also witnessed steep declines, exacerbating the downward pressure.

Banking stocks undergo a correction.

It wasn’t just the financial sector feeling the heat; heavyweights like FPT, GVR, MSN, and HVN also underwent corrections, widening the main index’s loss.

On the flip side, a handful of stocks provided some support to the market, notably VJC, BSR, MBB, and VIX. However, their positive contributions fell short of countering the downward pressure from the decliners. MBB topped the volume charts, clocking in at over VND 3,385 billion in trading value.

Most sectors ended in negative territory, including real estate, securities, retail, and construction. Nonetheless, pockets of buying interest emerged, evident from the climbing turnover.

Despite their corrections, HPG, SSI, and FPT remained among the most actively traded stocks, each recording transactions between VND 2,000 and 3,000 billion. The banking and securities sectors continued to attract substantial capital inflows, indicating that investors remain keen on these sectors despite the short-term selling pressure.

A rare bright spot was observed in the oil and gas sector, with BSR hitting the daily limit-up, while PLX and PET also posted significant gains, helping to offset some of the losses elsewhere.

At the close, the VN-Index shed 10.69 points (-0.65%) to finish at 1,630. The HNX-Index fell 2.81 points (-0.99%) to 282.34, and the UPCoM-Index dropped 0.34 points (-0.31%) to 109.61. Total trading value across the boards surged to VND 65,567 billion amid the selling pressure.

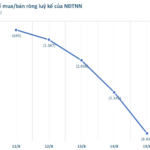

Foreign Investors Continue Their Selling Spree: Net Sell-Off Exceeds VND 3 Trillion on August 15

Let me know if you would like me to continue refining or expanding this title to better suit your needs.

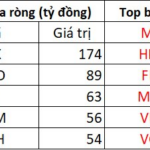

Foreign investors continued their selling spree on HPG stock, offloading a staggering 700 billion VND worth of shares. FPT and MBB also witnessed substantial sell-offs, with outflows of 509 billion VND and 500 billion VND, respectively.

Market Beat: Foreigners Maintain Heavy Sell-off, VN-Index Retreats to 1,630 Points

The trading session concluded with the VN-Index dipping 10.69 points (-0.65%), settling at 1,630 points. Likewise, the HNX-Index witnessed a decline of 2.81 points (-0.99%), closing at 282.34 points. The market breadth tilted towards decliners, as 609 stocks closed in the red, while 242 stocks ended in the green. The VN30 basket mirrored this trend, with 19 stocks losing ground against 9 gainers and 2 stocks remaining unchanged.