|

Companies and special purpose acquisition companies (SPACs) are now targeting cryptocurrencies beyond Bitcoin. – Image: FT montage/Dreamstime

|

No longer limited to Bitcoin, numerous listed companies are now acquiring various cryptocurrencies such as former US President Donald Trump’s memecoin, HYPE tokens, and Litecoin to diversify their portfolios and boost their stock prices.

The fever for issuing stocks or bonds to raise funds for Bitcoin purchases has spread globally this year as more businesses want to emulate the digital asset speculation strategy of billionaire Michael Saylor, the head of Strategy with a market capitalization of up to $116 billion.

However, many listed companies and SPACs are now shifting their focus to tokens other than Bitcoin to stand out among hundreds of other Bitcoin-holding entities.

Brittany Kaiser, the former director of Cambridge Analytica, is raising $200 million in equity capital through a public shell company to buy Toncoin at a discount compared to the current market price. This deal is done in collaboration with RSV Capital, a Canadian investment fund. Toncoin is a cryptocurrency on the Telegram-applied blockchain developed by founders like Pavel Durov.

“TON is currently the exclusive blockchain serving Telegram, a platform with over 1 billion monthly active users, so the potential for demand growth is enormous,” said Kaiser, adding that the deal would focus on developing Telegram’s ecosystem.

In another development, the Avalanche blockchain platform is also experimenting with a similar model by planning to sell a portion of its tokens to a listed public shell company. After the deal is completed, the company will hold and stake AVAX tokens to earn yields, expected to attract new investors, according to sources. Avalanche representatives also chose to remain silent when asked to comment on the deal.

The trend of businesses expanding their investments beyond Bitcoin comes as the world’s largest cryptocurrency recently hit a new high of over $123,000, partly due to the open policy on digital assets during Trump’s presidency. Notably, last week, Washington passed a significant cryptocurrency bill, marking a historic step toward integrating crypto into mainstream finance.

Bitcoin continues to assert its dominance with an impressive 77% growth over the past year, far surpassing Ethereum’s 6% and Litecoin’s 52% gains over the same period. This gap has prompted some businesses to consider investing in cryptocurrencies other than Bitcoin.

In some prominent deals, freight management company Freight Technologies has raised $20 million through the issuance of convertible bonds to invest in $TRUMP, the official coin of the US President. Javier Selgas, CEO of the company, believes that buying this coin will help “diversify the digital asset portfolio in the treasury and attract attention to trade policies.”

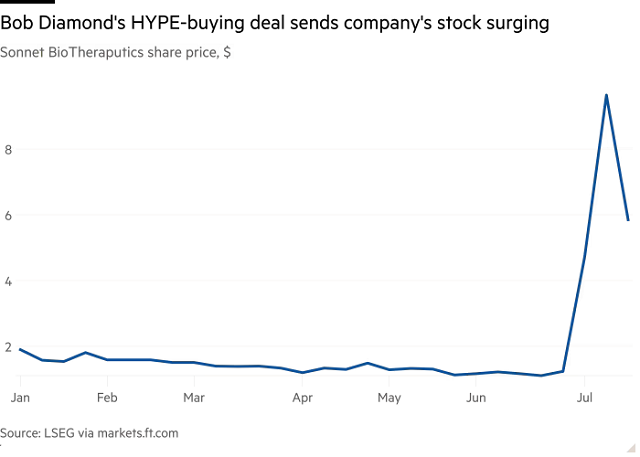

In the pharmaceutical industry, cancer treatment company Sonnet BioTherapeutics signed an $888 million merger agreement with a representative company backed by former Barclays CEO Bob Diamond to acquire HYPE tokens on the Hyperliquid blockchain. Sonnet’s stock price once surged 200% after the deal was announced, although it has since shown signs of adjustment.

|

Bob Diamond’s purchase of HYPE tokens boosts Sonnet’s stock price

Sonnet BioTherapeutics stock price, USD. Source: LSEG via markets.ft.com

|

However, many experts remain skeptical about the sustainable value of smaller coins in the market.

Eric Benoist, a technology and data researcher at Natixis CIB, said that investing in coins other than Bitcoin and Ethereum is highly speculative. He also believes that struggling businesses cannot expect to salvage their situation by buying tokens, which is not a long-term strategy.

“In this way, they are also unlikely to survive in the long run. Ultimately, the enterprise value will only depend on the volume [of crypto] recorded on the balance sheet,” he emphasized.

Geoff Kendrick, Global Head of Digital Asset Research at Standard Chartered, said that the market for corporate Bitcoin buying has become too crowded, and the shift to other tokens is just a “passing fad.” He warned that if the value of these tokens plunges, “the loss will be borne by shareholders or bondholders.”

In addition, investment vehicles for digital assets are becoming a channel for individuals with large crypto holdings to store their wealth with expectations of future profits.

The case of Saylor’s Strategy is exemplary: the company’s stock is currently trading at nearly double the total value of the Bitcoin they hold. Using financial leverage to serve crypto purchases benefits shareholders due to the expected price appreciation.

Recently, Andrew Keys, co-founder of Consensys Capital, completed a SPAC deal to buy Ethereum, investing about $645 million of his Ethereum and $800 million from major investors such as Pantera Capital and Blockchain.com.

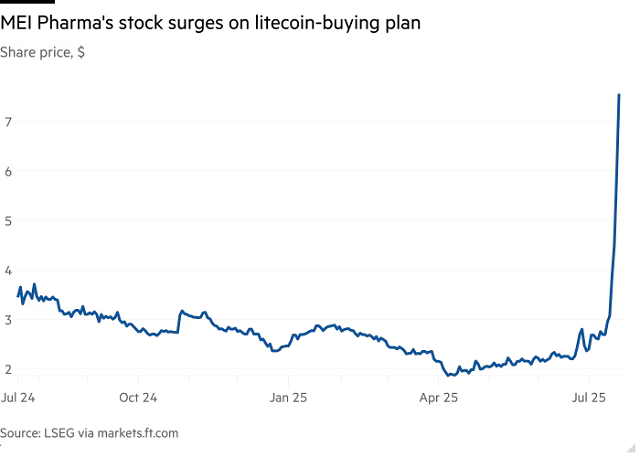

In another notable development, Litecoin co-founder Charlie Lee invested $100 million in MEI Pharma to help the pharmaceutical company become “the first and only listed company to own Litecoin.” Following the announcement, MEI Pharma’s stock surged 78% in the past week.

|

MEI Pharma’s stock surges on Litecoin purchase plan

Stock price, USD. Source: LSEG via markets.ft.com

|

Meanwhile, YZi Labs, a fund backed by Changpeng Zhao, Binance’s co-founder, recently announced it would support the establishment of a treasury company specializing in collecting BNB, Binance’s primary token.

Many experts believe that Bitcoin’s most significant attraction is its limited supply of 21 million coins, a rule “hard-coded” into its programming. However, most other tokens have no specific limit on their supply, and their quantity can be increased at any time. This fact makes many analysts doubt the sustainability of hoarding strategies for these tokens.

Many industry experts doubt the real prospects of most companies pursuing this trend, whether in Bitcoin or other tokens.

A recent report by venture capital firm Breed predicts that more global businesses will adopt this strategy and even expand into other asset classes and use more significant leverage to seek success.

“However, most will fail. In the end, only a handful of rare businesses will be able to maintain superior stock valuations,” the report emphasized.

– 1:00 PM, July 26, 2025

Establishing Four Special Economic Zones in Ho Chi Minh City

The master plan for Ho Chi Minh City includes the development of four free trade zones: Can Gio, Cai Mep Ha linked to the seaport, Binh An, and Bau Bang. These zones are strategically designed to boost economic growth and facilitate trade within the region.

The Smart City Development: A Visionary Proposal for Chu Lai

“Secretary of the Danang City Party Committee, Nguyen Van Quang, emphasized the importance of developing a vibrant ecosystem within the Chu Lai Open Economic Zone and industrial parks. He envisioned the creation of a liveable environment with essential services, housing, and entertainment options. Mr. Quang proposed the development of “Truong Hai City” or “Thaco City,” potentially even a smart city, to transform the area into a thriving and attractive destination.”

The Ultimate Guide to Investing in Da Nang’s Real Estate Renaissance: Unlocking the Potential of Vietnam’s Rising Property Market

The impact of infrastructure planning and administrative boundary mergers is fueling expectations of a new price hike cycle in the Danang real estate market. With land prices in Danang still approximately 30% lower than in thriving tourist destinations such as Quang Ninh and Nha Trang, or even many other provinces, the city is attracting a wave of investment.