On August 13, Loc Troi announced the nomination of Supervisory Board candidates for the 2024-2029 term, to be presented to shareholders at the upcoming 2025 Annual General Meeting of Shareholders (AGM) scheduled for August 23 in An Giang, following two postponements.

|

According to the nomination, as the deadline for nominations passed, Loc Troi did not receive any candidate profiles from shareholders. Therefore, the current Supervisory Board has proposed two candidates: Mr. Nguyen Viet Cuong and Mr. Vu Thanh Tung.

Mr. Nguyen Viet Cuong (born in 1983) is a notable figure with a decade-long association with Bamboo Capital Joint Stock Company (BCG). Since 2015, he has held the position of Head of Internal Audit, and subsequently served as a member of the BCG Supervisory Board from 2020 until the present. Additionally, he is the Deputy Head of the Supervisory Board of BCG Land and BCG Energy, and the Head of the Supervisory Board of TRACODI (TCD), all of which are part of the Bamboo Capital ecosystem. This ecosystem also experienced a legal crisis in early 2025 when Bamboo Capital’s former Chairman, Nguyen Ho Nam, was prosecuted, leading to financial imbalances and a significant loss of market confidence for many member companies.

The second nominee is Mr. Vu Thanh Tung (born in 1991), a former auditor at A&C Audit and Consulting Company Limited, who joined Loc Troi in 2019. He currently serves as the Head of Internal Audit at LTG and the Head of the Supervisory Board of An Giang Real Estate Joint Stock Company.

The 2025 AGM of Loc Troi will also accept the resignations of Ms. Nguyen Thi Thuy and Mr. Tieu Phuoc Thanh from their positions as members of the Supervisory Board, following their respective resignations in July and September 2024. Currently, the Loc Troi Supervisory Board consists only of the Head, Uday Krishna. Additionally, the AGM will discharge independent member Johan Sven Richard Boden from the Board of Directors and elect one new member to the Board for the 2024-2029 term.

Ongoing financial crisis and delayed disclosures

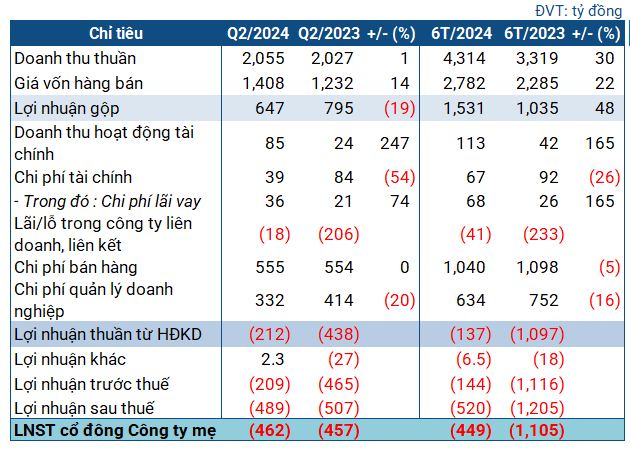

Loc Troi is facing a prolonged financial crisis, with negative cash flow, increasing overdue debt, and unprofitable operations. For 2025, the company has set a modest revenue target of VND 4,200 billion, the lowest in over a decade, and expects an EBITDA loss of up to VND 524 billion. Notably, LTG has yet to publish its semi-annual and audited financial statements for 2024. EY Vietnam, the auditing firm, is conducting further evaluations to determine the company’s ability to continue as a going concern.

| LTG’s financial performance in previous years |

Due to repeated violations of information disclosure obligations, LTG shares have been restricted from trading since October 24, 2024, and are only allowed to be traded on Fridays. As of August 15, the share price of LTG stood at VND 8,300 per share, reflecting a 30% increase over the past three months but a 45% decrease year-on-year. The average trading volume hovered around 230,000 shares per day.

| LTG share price movement over the past year |

– 05:58 17/08/2025

The Turbulent Times of Trung An: A Tale of Two Subsidiary Companies’ Demise

The decision to dissolve two of its subsidiaries was made by Trung An High-Tech Agriculture Joint Stock Company (TAR on UPCoM) as it struggled to stay afloat amidst challenges.

Enhancing SeABank’s Supervisory Board: Strengthening Oversight and Fostering Sustainable Growth for the Bank

On November 15, 2024, the Southeast Asia Commercial Joint Stock Bank (SeABank, HOSE: SSB) held an Extraordinary General Meeting (EGM) to elect two additional members to its Supervisory Board (SB) for the 2023 – 2028 term, bringing the total number of SB members to five. The election aimed to enhance the capabilities and effectiveness of SeABank’s SB and to align with international best practices in corporate governance.