On August 16, the Ho Chi Minh City Business Association (HUBA) celebrated the 9th anniversary of its “HUBA Business Cafe” program with a talk show on the 20% retaliatory tariff and its specific impact on businesses.

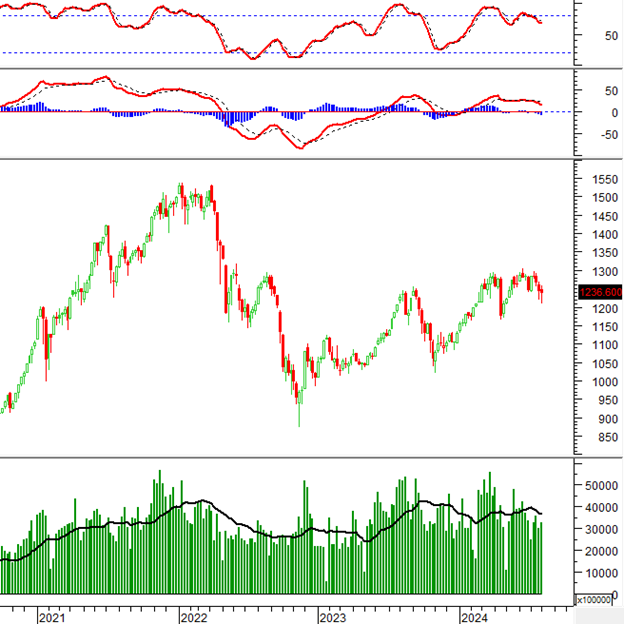

US Retaliatory Tariff and Expected Scenarios

Speaking at the event, economist and Dr. Can Van Luc, a member of the Advisory Council for the Prime Minister, shared that due to US tariffs, the global growth forecast for this year is 2.3%, lower than last year’s 2.8%.

The US growth has slowed (from 2.8% to 1.9%), and China’s growth has also decelerated, leading to a gradual decline in global trade.

Dr. Can Van Luc presenting at the HUBA Business Cafe

While Vietnam’s economy performed well in the first seven months, it may start feeling the impact from August onwards. The reorganization of provincial and city governments is beneficial in the long run but currently presents challenges and disruptions.

Regarding the US retaliatory tariff, Dr. Luc stated that after comparing Vietnam’s situation with its competitors exporting to the US, the average tariff of 20% is “acceptable” and was within the expected scenario.

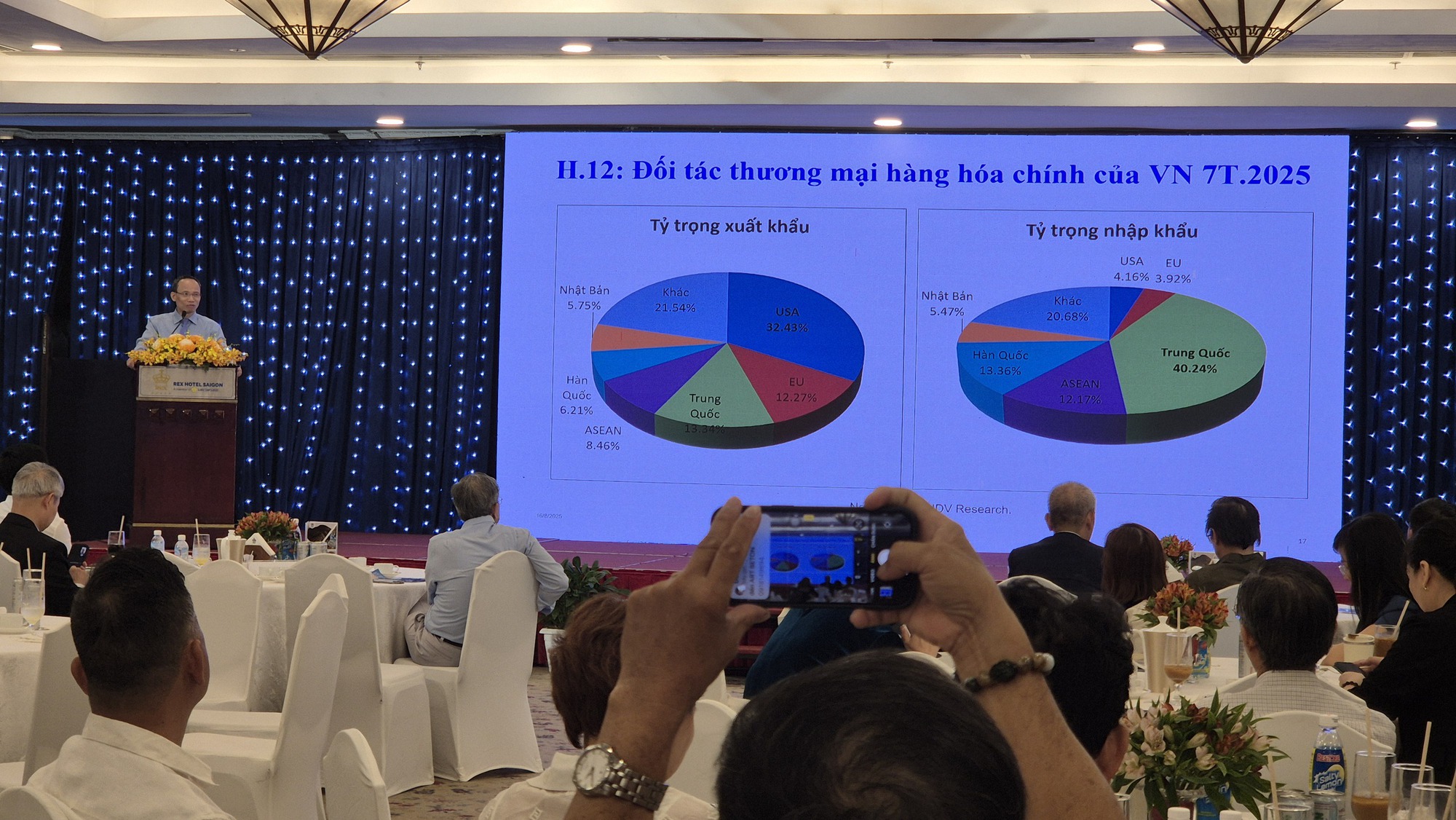

In the first seven months, exports to the US increased by 28%, but imports from the US also rose similarly. Therefore, businesses must be vigilant in proving the origin of their goods.

Wood Industry’s Unusual Developments After the US Retaliatory Tariff

According to Dr. Luc, by international standards, a 37% production content in Vietnam would qualify a product as made in Vietnam. He is advising businesses to increase this ratio to over 50% to ensure safety.

Talk show at the event

In the wood industry, Dr. Luc mentioned that 4 out of 10 kitchen products in the US are from Vietnam. With the new situation, there is a wave of Chinese businesses coming to Vietnam to acquire local wood companies and continue production with the existing workforce. Meanwhile, some large Vietnamese wood enterprises are expanding their investments in the US or Colombia.

Mr. Phung Quoc Man, Chairman of the Ho Chi Minh City Fine Arts and Wood Processing Association (HAWA), shared that the industry’s initial reaction was “shocked,” and orders decreased. However, they adapted by expediting deliveries during the tariff suspension period.

Since the retaliatory tariff took effect, to maintain the supply chain, the tax burden has been shared among producers, importers, and retailers. Despite the challenges, the wood industry has shown resilience, with a 7.6% increase in exports in the first seven months, including an 11.6% rise in the US market.

In the long term, the industry’s solutions include market diversification, improved governance, and reduced production costs. To avoid over-reliance on a single market, businesses will offer new products to traditional markets: Japan will receive more than just wood chips and pellets; South Korea will get something other than just industrial boards; and Europe will have a broader range of outdoor products.

At the event, Mr. Phan Minh Thong, Chairman of Phuc Sinh Company, noted that Vietnam exports a significant amount of agricultural products to the US, especially pepper, cinnamon, and anise, which cannot be grown in the US. Therefore, industry associations in the US are lobbying to reduce the retaliatory tariff to 0%.

Mr. Thong also mentioned that the entire burden of the retaliatory tariff falls on the buyers, creating significant financial pressure on them, leading to reduced purchases. If the situation persists, exports to the US are expected to decline sharply from the third quarter of 2025.

Trade Negotiations Need a ‘Pigs Might Fly’ Approach

“In the world of trade negotiations, it’s all about give and take to strike a successful deal. As Mr. Nguyen Anh Son, Director of the Import and Export Department at the Ministry of Industry and Trade, aptly puts it, ‘It’s like a barter system; you offer pork, and they offer wine.’ Knowing which industries to push forward and which to hold back is key to achieving the best outcome for all involved.”

The Timber Industry’s Profit Divide: A Tale of Two Fortunes

The second quarter of 2025 wasn’t a bumper season for the timber industry, but it did provide a clear test of each enterprise’s intrinsic capabilities. Nearly 80% of the industry’s profits were concentrated among three major players, while the rest downsized, resorted to financial maneuvering, or cut costs to stay afloat.

Export of Furniture and Textiles to the US May Slow Down

As we move towards the end of 2025 and into the first half of 2026, it is unlikely that export growth to the US will sustain the momentum witnessed in the first six months of this year.

The US Imposes 20% Tariff on Vietnamese Exports: Textile and Seafood Industries Seek New Opportunities to Maintain Market Share

The recent announcement of a 20% tariff on Vietnamese goods entering the US market has left the textile and seafood industries concerned. This additional cost will undoubtedly impact businesses’ competitiveness and increase their financial burden. However, there is a silver lining; businesses can still thrive by optimizing their operations and expanding their reach into new markets. It is a challenging yet opportune time for companies to showcase their resilience and adaptability.