Saigon Marina IFC: Forging the First Piece of Ho Chi Minh City’s International Financial Centre

On the morning of August 19, 2025, a grand opening ceremony was held for the Saigon Marina International Financial Centre (Saigon Marina IFC) at 02 Ton Duc Thang, Saigon, Vietnam. The event was graced by the presence of Vietnam’s government leaders, the Ho Chi Minh City People’s Committee, central ministries, representatives of consulates and international organizations, along with senior leaders from numerous domestic and international corporations, financial institutions, and businesses.

Marking one of the 80 key projects inaugurated and commenced to celebrate the 80th anniversary of the Socialist Republic of Vietnam (September 2, 1945 – September 2, 2025), this event also signifies the commencement of the construction of Ho Chi Minh City’s International Financial Centre.

The Saigon Marina IFC tower boasts 55 floors above ground and 5 basement levels, encompassing a total floor area of over 106,000 square meters. Approximately 87,000 square meters are dedicated to Class A offices, while the remaining area accommodates a commercial center, restaurants, meeting rooms, and premium amenities. Standing as one of the tallest towers in Vietnam, it is designed to LEED Gold standards with energy-saving and environmentally friendly solutions, allocating over 30% of its area to green spaces.

The architectural highlight of the tower is its full-height LED system capable of displaying vibrant artistic lighting shows, complemented by a modern musical fountain square. Together, they transform Saigon Marina IFC into a “beacon” for the urban economy.

Benefitting from its prime location and strategic connectivity, Saigon Marina IFC attracts multinational corporations, financial institutions, premium Grade A+ offices, international convention centers, consulates, and a host of high-end amenities. Developed and operated by Keppel Corporation (Singapore), the tower fosters a vibrant financial and commercial ecosystem right in the heart of the city.

Speaking at the ceremony, Deputy Prime Minister Ho Duc Phoc remarked, “Saigon Marina IFC marks the beginning of our journey towards establishing Ho Chi Minh City’s International Financial Centre – a new driving force for Vietnam’s economy, propelling the country’s integration and advancement on the global stage.”

Deputy Prime Minister Ho Duc Phoc delivers a speech at the Inauguration Ceremony

Strategically envisioned, Ho Chi Minh City’s International Financial Centre will serve as a hub for capital, technology, and human resources from prominent financial institutions, banks, and investment funds, following an interconnected industry cluster model. It will offer financial and banking services, implement Fintech sandboxes to foster innovation, and establish international commodity and derivative exchanges, supply chain services, logistics, and port development.

HDBank Vice Chairman, Dr. Nguyen Thi Phuong Thao, shares her thoughts at the Inauguration Ceremony

At the ceremony, HDBank Vice Chairman, Dr. Nguyen Thi Phuong Thao, expressed, “This moment intertwines the past and the present as we stride towards the future – from the Ba Son artisans of yesteryear to today’s engineers and experts – all bound by a common thread: the will and belief in a prosperous Vietnam that reaches out to the world.”

A Hub for Multinational Corporations and Leading Financial Institutions

With its pioneering mission, Saigon Marina IFC not only serves as a new architectural icon for Ho Chi Minh City but also as the “heart” of the urban landscape, ensuring the city’s economic pulse remains robust. It ushers in a new era of modern urban development and global integration.

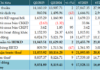

Prior to this, HDBank (Ho Chi Minh City Development Joint Stock Commercial Bank) presented to its shareholders the plan to relocate its head office to the Saigon Marina International Financial Centre Tower.

According to HDBank, the relocation aims to accommodate the bank’s expansion plans and align with its new phase of development. While awaiting shareholder approval, HDBank’s intention to move its head office to Saigon Marina IFC underscores a new trend among enterprises, especially in the financial sector, to seize opportunities presented by the development of Ho Chi Minh City’s International Financial Centre.

As per National Assembly Resolution 222/2025/QH15, the establishment of Ho Chi Minh City’s International Financial Centre is a long-term strategic orientation to position the city as a destination for capital and financial activities in the region. Saigon Marina IFC is the inaugural project in this journey, providing world-class infrastructure for global financial organizations, businesses, and investors.

At a conference held in early August 2025 to deploy Resolution No. 222/2025/QH15 in Ho Chi Minh City, Prime Minister Pham Minh Chinh emphasized that the development of the International Financial Centre must be a breakthrough in terms of institutions and policies, as well as resource mobilization.

According to Prime Minister Pham Minh Chinh, the International Financial Centre is not merely a special urban area or a cluster of financial skyscrapers. Instead, it is, first and foremost, a unique institutional design with a relatively limited geographic scope, distinct legal provisions, a specialized management apparatus, and a policy testing ground. It is a place where laws are “designed for the future,” enabling the operation of new models within a controlled framework.

With Resolution No. 222/2025/QH15 coming into effect on September 1, 2025, the coming period will witness accelerated progress in legal framework development, policies for attracting high-quality human resources, and incentives for investors. Backed by an increasingly robust legal foundation and clear political determination, the early and methodical involvement of the private sector will be pivotal in realizing Ho Chi Minh City’s aspiration to become a regional-level International Financial Centre.

According to experts, the combination of market dynamics and policy orientation will contribute to the formation of a multi-layered financial ecosystem in Ho Chi Minh City. The proactive realignment of corporate strategies and spatial arrangements in anticipation of the International Financial Centre underscores the high expectations for the emergence of a substantive and competitive financial hub within the global value chain.

The Newest and Largest Bridge on Ho Chi Minh City’s Ring Road 3 Opens to Traffic on August 20th

On August 16th, representatives from the My Thuan Project Management Board (Ministry of Construction) announced that they had submitted a proposal to the Departments of Construction in Ho Chi Minh City and Dong Nai, as well as relevant agencies. The proposal outlines a traffic management plan for Component Project 1A, which includes the Nhon Trach Bridge, a section of the Tan Van-Nhon Trach route, which is part of Ho Chi Minh City’s Ring Road 3.

The Grand Opening of Five Volkswagen Dealerships in Vietnam

“With a focus on expanding its network of ‘Urban Store’ dealerships, a pioneering concept, Volkswagen Vietnam is committed to strengthening its nationwide presence. Currently, the brand boasts an impressive 20 dealerships across the country, and this number is set to grow.”

“Social Housing Development: A Diverse and Accessible Future”

“The Vietnamese Prime Minister emphasized the importance of inclusivity and accessibility in social housing development, using the An Van Duong New Urban Area in Hue as an example. In his address, he highlighted the need for a diverse range of housing options, catering to varying income levels, and offering flexible purchasing and rental opportunities. This approach ensures that essential infrastructure and services are accessible to all, creating a more equitable and livable community.”

The Sky’s the Limit: Construction of Vietnam’s New 108-Story Financial Tower to Begin in Just 2 Days, Soaring Nearly 200 Meters Above Landmark 81 and Surpassing Bitexco by Over 370 Meters.

Standing at a staggering height of 639 meters, the 108-story supertall skyscraper, part of the Smart City Project in North Hanoi, is set to become Vietnam’s tallest building upon its completion.