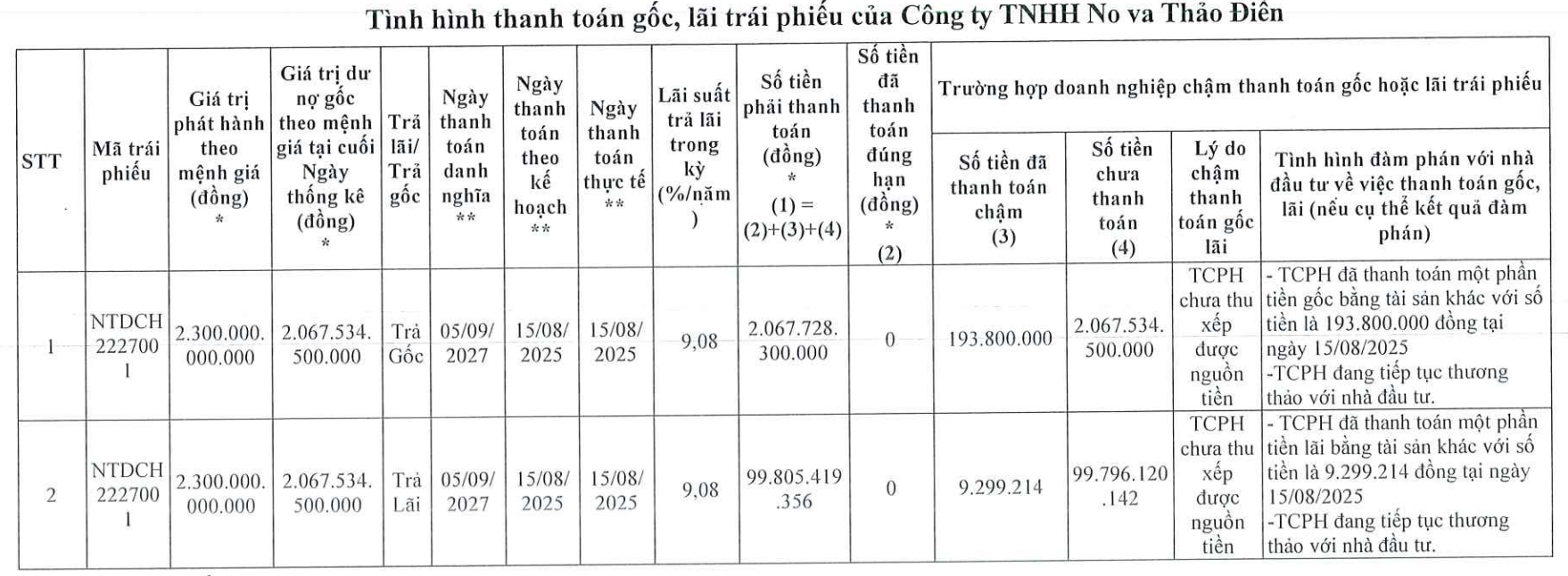

The Hanoi Stock Exchange (HNX) has recently disclosed information regarding the bond payment status of No Va Thao Dien JSC – a subsidiary wholly owned by Novaland Group JSC (HOSE: NVL).

According to the schedule, August 15, 2025, was the due date for principal and interest payments for the NTDCH2227001 bond batch, totaling nearly VND 2,176.5 billion. However, No Va Thao Dien has only made a payment of VND 203.1 million in non-cash assets, with the remaining VND 2,167.2 billion unpaid.

The company attributed this delay to insufficient funds and ongoing negotiations with investors regarding the repayment plan for the outstanding debt.

As per HNX information, the NTDCH2227001 bond batch has a total value of VND 2,300 billion, issued on September 5, 2022, with a 5-year term, maturing on September 5, 2027.

Previously, in early June, the company also delayed the payment of VND 2,172.2 billion in principal and interest for this bond batch. In 2024, No Va Thao Dien had also deferred a payment of over VND 45.2 billion and failed to pay more than VND 2,182.9 billion in principal and interest for the same bond batch.

Both of these delayed payments were due to similar reasons: insufficient funds and ongoing negotiations with investors regarding the repayment of the remaining debt.

The NTDCH222701 bond batch has a total value of VND 2,300 billion, issued on September 5, 2022, with a 5-year term.

No Va Thao Dien JSC was established in 2008 and primarily engages in real estate and land-use right businesses.

In terms of financial performance, No Va Thao Dien has only published its semi-annual financial statements for 2024, reporting a profit after tax of nearly VND 400.8 billion, a significant improvement from the loss of nearly VND 163.7 billion in the same period in 2023.

As of June 30, 2024, the company’s equity reached nearly VND 7,826.5 billion, a 4.7% increase compared to the previous year. Additionally, the debt-to-equity ratio improved from 0.52 to 0.37, indicating a total debt of approximately VND 2,895.8 billion.

The Ultimate Cash Cow: Unveiling the Financial Giant with a Stellar Performance that Rivals the Best

In Q2, the company reported a revenue of nearly VND 40 trillion, a 15% increase year-over-year, marking an all-time high since its inception.

A Former VIX Member Appointed as VTGS Chairman

On August 15th, VTG Securities JSC (VTGS) announced an unexpected change in leadership. The company relieved Ms. Nguyen Thi Thanh Thuy of her duties as Chairman and appointed Mr. Thai Hoang Long as the new Chairman. This decision takes effect immediately upon the company’s receipt of approval from the State Securities Commission regarding the change in legal representative.

“TDC Aims to Garner $30 Million from the Transfer of Lot E15 in the Hoa Loi Residential Area”

On July 21, 2025, Becamex TDC, a leading real estate company listed on the Ho Chi Minh Stock Exchange (HOSE: TDC), and Global Corp proudly announced the signing of a term sheet for the transfer of residential properties in Lot E15, located within the TDC Hoa Loi residential project in Binh Duong Ward, Ho Chi Minh City.