Vietnam Social Insurance (SI) announced that, according to Decision 166/QD-SI, retirement pensions and September allowances will be paid from September 3rd due to the National Day holiday.

According to SI regulations, retirement pensions and social insurance allowances are directly transferred to personal accounts on the 2nd of every month. In case the 2nd falls on a holiday or a day off, the payment will be made on the following working day.

Retirement pensions and September allowances will be paid from September 3-25, instead of the usual 2nd. Illustrative image.

Monthly retirement pensions and social insurance allowances are paid in two forms. For bank transfers, beneficiaries will receive their money by the 5th of each month at the latest.

For cash payments, the paying agency will make payments from the 2nd to the 10th at fixed payment points, minimum 6 hours/day. If the list has been completed, the payment may end before the 10th.

From September 11-25, payments will continue at the transaction points of the district-level payment service organization. This schedule may vary depending on the actual conditions in each locality.

Thus, the total time for paying September pensions is from September 3 to the end of September 25, according to both cash and transfer forms.

Pensioners should note the regulations on changing the form or place of receipt. If desired, a written request must be sent to the SI agency where the payment is being made. Within 5 working days, this agency must resolve or respond in writing if it cannot be implemented.

In case the beneficiary cannot go directly, he/she can authorize another person in writing with notarized or certified signature, with a maximum validity period of 12 months.

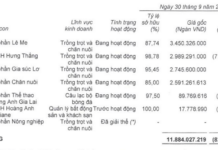

According to Vietnam SI, about 3.4 million people will receive retirement pensions and social insurance allowances in September through bank transfers or cash payments. In addition, beneficiaries will also be paid at home if they are elderly, frail, sick, or unable to receive them directly.

In Hanoi, the city’s SI will pay about VND 4,096 billion to more than 595,000 beneficiaries (over 99.4%) through personal accounts. The agency will also pay more than VND 43.6 billion in cash to over 3,400 other beneficiaries.

How much is the maximum pension from July 1st?

According to the guidance of the Ministry of Home Affairs in Circular No. 12/2025/TT-BNV, detailing a number of articles of the Law on Social Insurance on compulsory social insurance, which took effect from July 1st, the monthly pension level is calculated based on the average salary used as the basis for social insurance payment and the social insurance payment period.

For female laborers, the entitlement is 45% of the average salary for 15 years of social insurance payment, and then for each additional year of payment, an additional 2% is calculated, with a maximum of no more than 75%.

For male laborers, the entitlement is 45% of the average salary for 20 years of social insurance payment, and then for each additional year of payment, an additional 2% is calculated, with a maximum of no more than 75%…

Thus, the highest pension level that employees can currently receive is 75% of the average salary used as the basis for social insurance payment.

What Circumstances Allow Employees to Withdraw Social Insurance Once, Starting July 1st, 2025?

For the long term, new participants will only be eligible for Social Insurance benefits on a one-time basis, under special circumstances. This move aims to encourage more people to remain within the system and reap the benefits of their accumulated contributions to Social Insurance.

Why Not Adjust the Average Wage for Pension Calculation in the Amended Social Insurance Law?

“Calculating the average salary for social insurance contributions is pivotal in determining pension formulas, directly impacting the benefits of participants and the equilibrium of the social insurance fund. This intricate process involves a meticulous consideration of various factors to ensure equitable outcomes for all stakeholders involved.”

“A Proposal to Increase Social Insurance Allowance to 750,000 VND per Month”

According to the Ministry of Labour, Invalids and Social Affairs, 14 provinces and cities have increased social assistance levels beyond the prescribed regulations since the beginning of the year. To keep pace with the upcoming salary reform policies, the Ministry is proposing to raise the monthly allowance standard from 360,000 VND to 500,000 VND or 750,000 VND.