According to data from CBRE, in the first six months of 2025, Hanoi saw the launch of approximately 11,000 apartments, on par with the same period last year, indicating a stable market. In contrast, Ho Chi Minh City (formerly) had only about 1,400 apartments on offer, a significant drop from the 1,900 units in 2024. Notably, this is also the lowest level in the last decade for the city.

The real estate market in the northern region remained stable in terms of supply, while Ho Chi Minh City saw almost no new projects, especially in the city center.

In terms of pricing, the average apartment price in Ho Chi Minh City increased by nearly 30%, reaching around VND 82 million/sq m. Hanoi also experienced a price hike of approximately 33%, with the average price standing at VND 79 million/sq m. This increase was primarily driven by the focus on high-end and luxury developments in both markets.

For the real estate segment, Hanoi witnessed a 13% increase in land prices, whereas Ho Chi Minh City saw a slight decrease of 3% due to new projects being priced lower than the market average.

According to VietstockFinance, 63 residential real estate businesses listed on the stock exchange (HOSE, HNX, and UPCoM) achieved a combined revenue of over VND 57.1 trillion in the first half of 2025, a 3% decrease compared to the previous year. However, net profit surged by 50%, reaching nearly VND 12 trillion.

Of these, 29 businesses reported higher profits, 16 saw a decline, 2 switched from profit to loss, and 6 made a successful turnaround from loss to profit.

Many businesses witnessed a sudden surge in profits

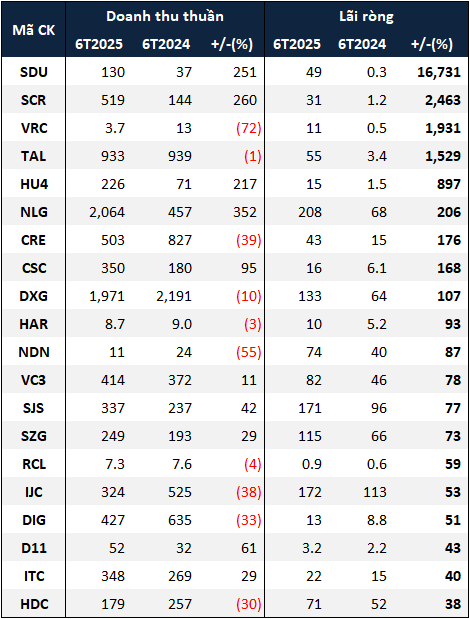

The real estate business with the highest net profit growth in the first half of the year was Song Da Urban Development and Investment JSC (HNX: SDU), with a staggering 168-fold increase to over VND 49 billion. SDU attributed this impressive performance to revenue generated from office leasing, building services, and real estate operations. Additionally, SDU benefited from the reversal of provisions for investments in its subsidiary.

|

Top 20 real estate businesses with increased net profit in the first half of 2025. Unit: Billion VND

Source: VietstockFinance

|

The remaining top performers included Saigon Thuong Tin Real Estate JSC (HOSE: SCR), Real Estate and Investment VRC JSC (HOSE: VRC), and Taseco Real Estate Investment JSC (HOSE: TAL), with net profits increasing by 25.6, 20.3, and 16.3 times, respectively.

SCR’s remarkable results stemmed from significant growth across all segments, including a 2.6-fold surge in leasing services revenue to over VND 141 billion, a 51.6-fold increase in construction revenue to nearly VND 160 billion, and a near tenfold jump in merchandise sales revenue to VND 142 billion. This propelled SCR’s total revenue to VND 519 billion, reflecting a 3.6-fold increase compared to the previous year.

VRC’s performance, on the other hand, was largely driven by an unexpected surge in other income, which reached VND 14 billion (compared to a loss of nearly VND 2 million in the previous year), despite a 93% decline in total revenue to nearly VND 489 million.

TAL, a newcomer to the HOSE exchange, reported impressive results ahead of its official listing on August 1st. While revenue remained stagnant and cost of goods sold decreased by 13%, net profit soared, reflecting the success of the company’s strategic product restructuring, cost-control measures, and preparations for the upcoming commercialization phase in the latter half of the year.

Vinhomes remains the industry leader in profitability

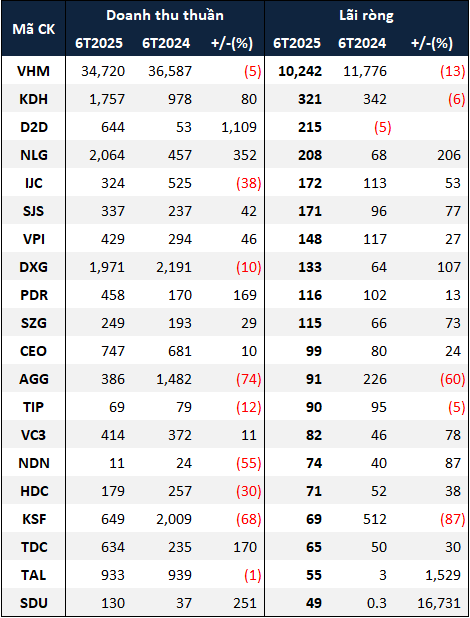

Vinhomes JSC (HOSE: VHM) maintained its top position in the industry, recording a net profit of over VND 10.2 trillion in the first half. VHM attributed these results to their adherence to set plans and the successful execution of project development strategies.

The company’s total sales reached VND 67.5 trillion, marking a 31% increase and underscoring the robust market demand and the effectiveness of their sales strategies in this new growth cycle. As of the end of June, unrecorded sales stood at VND 138.2 trillion.

|

Top 20 real estate businesses with the highest net profit in the first half of 2025. Unit: Billion VND

Source: VietstockFinance

|

Following VHM, Nha Khang Dien JSC (HOSE: KDH) ranked second with a net profit of nearly VND 321 billion. While their net revenue increased by 80% due to real estate transfers, a significant rise in both the cost of goods sold and financial and selling expenses caused a 6% decline in net profit.

Dat Xanh Group JSC (HOSE: DXG) experienced a 10% drop in revenue but posted a net profit of VND 133 billion, doubling their performance from the previous year. The decrease in revenue was mainly attributed to a 34% decline in real estate transfers, amounting to over VND 1 trillion. Although revenue from brokerage activities increased by nearly 58% to almost VND 751 billion, it was insufficient to drive overall revenue growth. A notable positive was the reduction in financial and selling expenses, the two largest cost categories, which resulted in a substantial increase in net profit.

Nam Long Investment Corporation (HOSE: NLG) recorded a four-and-a-half-fold surge in net revenue and a threefold increase in net profit compared to the previous year, reaching nearly VND 2.1 trillion and VND 208 billion, respectively. This marked the highest six-month net profit achieved by NLG since 2021.

These impressive results were driven by revenue generated from key project deliveries, including Akari City (VND 788 billion), Can Tho II Central Lake (VND 930 billion), and Southgate (VND 105 billion)…

Phat Dat Real Estate Development Corporation (HOSE: PDR) also attracted attention by divesting its entire 94% stake in Ngo May Real Estate Investment JSC – the developer of the Q1 Tower project – to Quy Nhon 68 Investment Co., Ltd. for VND 435 billion.

Novaland stops selling below cost but continues to incur losses

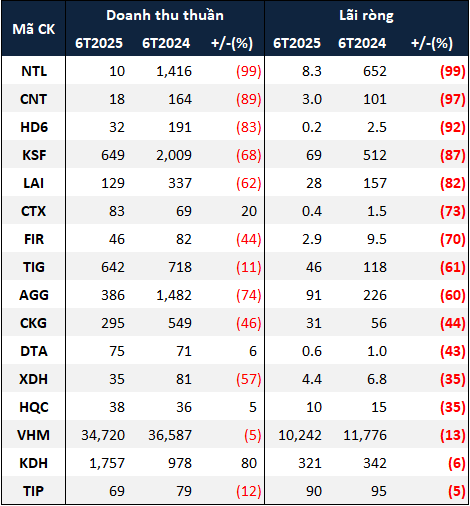

While many businesses reported positive results, several others experienced declines in profitability during the first half of the year.

Urban Development and Investment Corporation of Tu Liem (HOSE: NTL) witnessed the sharpest drop, with a 99% plunge in net profit, resulting in a meager profit of just over VND 8 billion. This was due to a significant shortfall in the real estate business segment, causing net revenue to fall below the cost of goods sold and resulting in a gross loss of nearly VND 4 billion. According to NTL, real estate projects during this period were still in the process of finalizing legal procedures and could not be recognized as revenue. Consequently, NTL’s revenue for the first half primarily came from financial activities such as interest income and investment in securities.

|

16 real estate businesses with decreased net profit in the first half of 2025. Unit: Billion VND

Source: VietstockFinance

|

Sunshine Group Joint Stock Company (HNX: KSF) also experienced a significant decline, with an 87% drop in net profit to VND 69 billion. Similar to NTL, KSF‘s net revenue plummeted by 68% to just VND 649 billion due to the impact of real estate transfers, and other business activities were insufficient to compensate.

These results come as KSF prepares to issue 600 million common shares to make a public offer to acquire all outstanding shares of Sunshine Homes (UPCoM: SSH).

In the first half of the year, SSH incurred a net loss of up to VND 243 billion. This was mainly due to a 62% drop in net revenue, and the cost of goods sold decreased by a smaller margin due to final settlements with several main contractors. Additionally, financial expenses increased due to the impact of subsidiary companies.

|

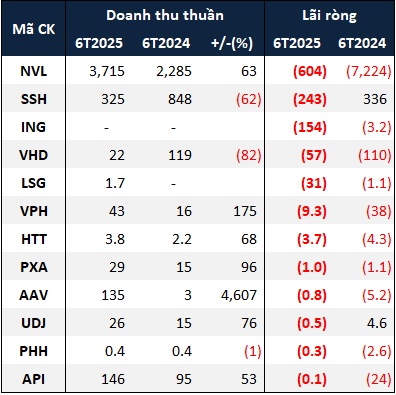

12 loss-making real estate businesses in the first half of 2025. Unit: Billion VND

Source: VietstockFinance

|

In terms of losses, Nova Group – Investment and Construction Joint Stock Company (HOSE: NVL) once again topped the list with a net loss of VND 604 billion in the first half. On a positive note, their revenue from real estate transfers reached nearly VND 3.4 trillion, an 81% increase, thanks to deliveries at projects such as NovaWorld Phan Thiet, NovaWorld Ho Tram, Aqua City, Sunrise Riverside, and Palm City…

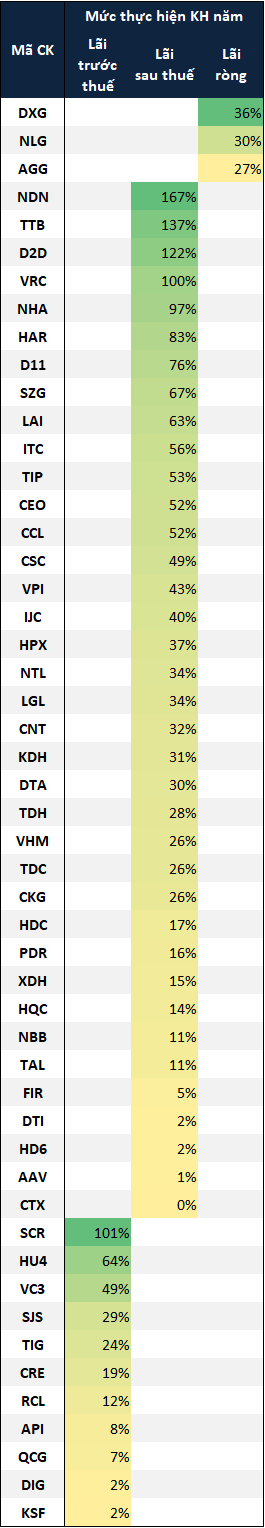

5 businesses surpass annual plan

With exceptional performance, 5 businesses exceeded their full-year 2025 profit targets after just six months: Da Nang House JSC (HNX: NDN), TTBGroup (UPCoM: TTB), Industrial Urban Development No. 2 JSC (HOSE: D2D), SCR, and VRC.

NDN’s growth in the first half can be attributed to the favorable conditions in the stock market. The company benefited from the reversal of provisions for a decrease in the value of traded securities, amounting to nearly VND 52 billion. Consequently, net profit reached over VND 74 billion, an 87% increase, despite a nearly halved net revenue compared to the previous year.

|

Performance against 2025 plans for select real estate businesses

Source: VietstockFinance

|

For the second half of 2025 and early 2026, CBRE forecasts that the total supply of apartments and houses in Hanoi could reach 33,000-35,000 units. The market is expected to maintain its stability until 2028. However, the absorption rate is projected to decline due to higher prices and increased options for buyers.

The western region of Hanoi continues to be a hub for many projects, although large-scale developments are concentrated in the eastern region, benefiting from a series of bridge connections between the two banks.

In the southern region, if we consider only Ho Chi Minh City (formerly), the supply of apartments in the 2025-2027 period will be very limited, ranging from 10,000 to 15,000 units. However, if we include neighboring markets, the supply in the southern region shows a slight increase and is expected to become more vibrant in the coming period.

Regarding pricing, the upward trend in satellite cities has caught up with the pace of Ho Chi Minh City, especially in Long An, where the presence of large-scale projects and rapid implementation have resulted in higher price increases compared to other markets.

– 12:00 18/08/2025

No Fare Hikes or Overcrowding: Inter-Provincial Buses Maintain Regular Operations for September 2nd Holiday

The upcoming 2/9 holiday will not see any surge pricing for bus fares in Hanoi, and all bus companies have pledged not to overload their vehicles with passengers. In Ho Chi Minh City, some bus companies have requested a price increase of up to 40% compared to regular days to offset the cost of returning empty buses. However, this surge pricing will only be in effect for a maximum of two peak days.

The Economic Powerhouse: Generating the Nation’s Highest Revenue Post-Provincial Merger

The initial figures from the 34 merged provinces and cities paint an intriguing picture of fiscal revenue trends. Ho Chi Minh City, bolstered by the inclusion of Binh Duong and Ba Ria-Vung Tau, has surged ahead to become the nation’s top earner, boasting an impressive revenue of over VND 465 trillion. Notably, a significant spike in land-related revenues has provided a substantial boost to the city’s coffers, presenting both opportunities and challenges in terms of market stability and efficient resource utilization.

The Capital’s First Double-Decker Train: A New Experience with Limited Daily Trips and Onboard Entertainment

“Vietnam Railways introduces a new era of travel with the launch of the ‘5-door carriage’ train and a state-of-the-art biometric ticketing system. Step aboard and experience a seamless journey like no other.

The new train boasts a modern design, featuring five spacious doors per carriage, transforming the travel experience with enhanced convenience and comfort. Passengers can now board and alight with ease, ensuring a swift and efficient journey.

Coupled with the advanced biometric ticketing system, Vietnam Railways offers a secure and personalized travel experience. This cutting-edge technology revolutionizes the way tickets are managed, providing a seamless and contactless journey from booking to boarding.

With this innovative step forward, Vietnam Railways continues to raise the bar in transportation, offering a truly modern and sophisticated travel experience.”