VNECO: Stock Triples Amid Financial Crisis (Part 1)

In 2015, Vietnam Electrical Construction Joint Stock Corporation (VNECO, HOSE: VNE) officially ceased to have state capital after SCIC divested its entire 29.6% stake. Around the same time, several institutional investors emerged, including Khai Toan JSC (17.61%), Vietcombank Securities (VCBS, 7.73%), and the foreign fund PYN Elite Fund (which once held 8.58%).

However, these major shareholders subsequently withdrew, making way for a new group of shareholders, notably MalBlue JSC – where Nguyen Anh Tuan serves as Chairman, along with several VNECO leaders who have increased their ownership. This development coincided with the period when VNE stock just escaped its bottom in 2020 and began its recovery trend.

The arrival of Mr. Nguyen Anh Tuan as Chairman from mid-2020 once brought hope to VNECO. With a background in International Accounting, 5 years of experience at Deloitte Vietnam, and 20 years at reputable auditing firms, Mr. Tuan implemented a series of measures to address long-standing debt issues.

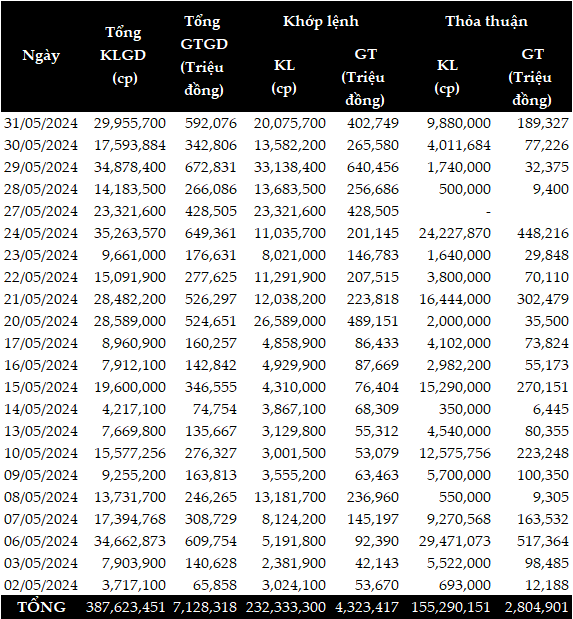

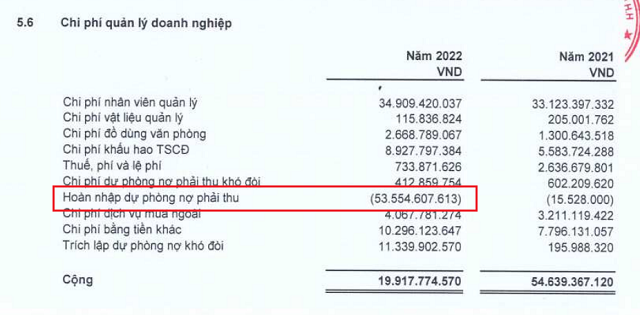

In 2021, VNECO wrote off nearly 100 billion VND of bad debts that had existed for more than 10 years. Notably, in 2022, the transfer of the entire amount of more than 64 billion VND receivable from 3 partners (Electricity Construction Investment JSC, Hoi Xuan, About Source JSC, and Lam Thuan Phat Investment JSC) to ReeNize Trading JSC helped VNECO reverse provisions of nearly 54 billion VND, thereby “narrowly escaping losses”, despite very high interest expenses.

However, these “miracles” are only technical in nature. ReeNize is still the largest customer with nearly 153 billion VND in outstanding receivables as of Q2/2025, and many other debts are turning into bad debts, forcing VNECO to make provisions of 33 billion VND in the period of 2023-2024, contributing to losses.

Mr. Nguyen Anh Tuan became Chairman of VNECO in 2020

|

VNECO reversed nearly 54 billion VND in provisions in 2022, thereby escaping losses. Source: 2022 Audited Consolidated Financial Statements of VNECO

|

|

Who are ReeNize Trading and MalBlue? ReeNize Trading JSC was formerly known as MalBlue Education Development JSC, established in 2018 with a capital of 3 billion VND, owned by MalBlue Tourism JSC (later MalBlue JSC) operating in the field of educational support services. In 2021, the company changed its name as mentioned above, increasing its capital to 30 billion VND. The shareholders include Mr. Do Dinh Xam (35%), Mr. Tong Dinh Thang (35%), and Mrs. Nguyen Thi Doan (30%). Mr. Tong Dinh Thang is currently the Head of Investment Division of VNECO, elected in early 2024. ReeNize first appeared in VNECO‘s receivables list in 2021 with 235 billion VND, and then “took over” the entire workload from 3 other partners in 2022, helping VNECO to reverse provisions of 54 billion VND. MalBlue JSC was established in 2016 under the initial name of MalBlue Tourism JSC, with a capital of 2 billion VND. The founding shareholders included Kroize Co., Ltd. holding 50%, Construction Investment and Consulting JSC holding 25%, and Oriental Accounting Services Co., Ltd. holding 25%; Mr. Nguyen Anh Tuan served as Chairman. From 2017 to 2022, the chartered capital increased to nearly 358 billion VND, and the company also changed its name to MalBlue JSC. MalBlue once owned 12.28% of VNECO‘s shares but later reduced its stake to 4.45% at the end of 2023 due to partial compulsory sale, contributing to the sharp decline in VNE stock price in October 2023. |

Selling assets to stay afloat, leaders’ properties auctioned

Financial pressure forced VNECO to sell its real estate properties on Nguyen Dinh Chinh Street (former Phu Nhuan District, Ho Chi Minh City) at a loss (according to the book value) to repay bank debts. The situation became more dire as the company still had obligations in the case of Ms. Hua Thi Phan, related to the amount of 200 billion VND that the court ordered to be returned to Vietnam Construction Bank.

This legal entanglement prevented VNECO from carrying out its plan to raise 500 billion VND for investment in wind power crane equipment and the completion of the My Thuong real estate project in Hue. At the 2020 Annual General Meeting, former Chairman Doan Duc Hong shared: the case had a “significant impact on investment activities due to the inability to borrow capital.”

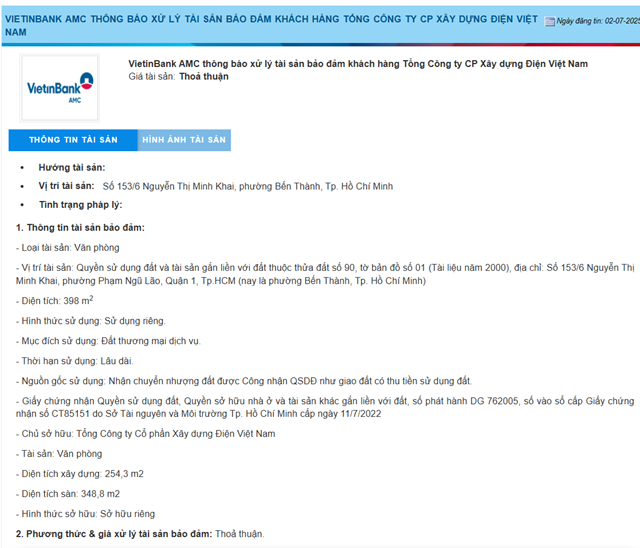

The challenges did not stop there. From mid-2024 to July 2025, VietinBank AMC – the single-member limited liability company for debt management and asset exploitation of Vietnam Industrial and Commercial Bank, consecutively announced the auction of numerous real estate properties of VNECO and related parties. The focal point was the property at 153/6 Nguyen Thi Minh Khai Street (Ben Thanh Ward, Ho Chi Minh City) with an area of nearly 400m2.

VietinBank AMC announced the handling of secured assets regarding the house at 153/6 Nguyen Thi Minh Khai Street, Pham Ngu Lao Ward, District 1 (former), Ho Chi Minh City, owned by VNECO. Source: VietinBank AMC

|

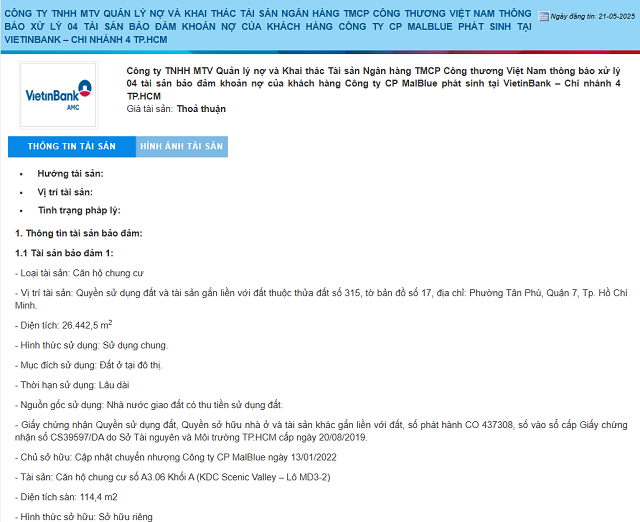

Many VNECO leaders and their relatives were also affected, including Chief Accountant Pham Do Minh Triet (also the nephew of Vice Chairman Pham Phu Mai) whose house in Da Nang was auctioned; Chairman Nguyen Anh Tuan lost a 122m2 land lot in Di An, Binh Duong (former); Mr. Nguyen Manh Tuyen, the younger brother of Mr. Tuan, also had his property in Di An handled; in addition, there was the property of former Member of the Board of Supervisors of VNECO, Ms. Nguyen Thi Hoang Oanh.

These assets of the above individuals were mortgaged for ReeNize’s loan at VietinBank – Branch 4 (Ho Chi Minh City) and have been auctioned multiple times without success.

Announcement of handling secured assets of ReeNize Trading JSC’s loan on VietinBank AMC‘s website. Source: VietinBank AMC

|

MalBlue JSC, where Mr. Nguyen Anh Tuan used to be Chairman and a major shareholder of VNECO, also had a series of assets auctioned by VietinBank AMC. Source: VietinBank AMC

|

Fined for reporting false profits

In late June 2025, the State Securities Commission of Vietnam fined VNECO 320 million VND for violations of information disclosure, including 175 million VND for inaccurate disclosure. Notably, the Q4/2023 financial statement recorded a profit of 1.3 billion VND, but the audit confirmed an actual loss of more than 28.5 billion VND, a difference of nearly 30 billion VND.

VNECO also reported inaccurately about its governance situation, stating that there were no transactions with insiders, while the 2023-2024 consolidated financial statements recorded transactions with key members and related parties.

Another noteworthy point is that VNECO‘s Chairman, Mr. Nguyen Anh Tuan, used to be the Deputy General Director of CPA Vietnam Auditing Corporation. This is also the auditing unit of VNECO‘s 2023-2024 financial statements.

Not only VNECO, but its subsidiary, Electricity Construction VNECO 8 JSC (HNX: VE8), has also been forced to delist due to consecutive losses for 3 years, with total accumulated losses exceeding the paid-up charter capital and negative equity in the 2024 audited financial statements. Similar to its parent company, VNECO 8 also requested to postpone the 2025 Annual General Meeting until September this year.

|

VNECO and the amount of 200 billion VND in the Hua Thi Phan case VNECO was identified as a party with rights and obligations related to the Hua Thi Phan case, due to its involvement with a 200 billion VND amount received from defendant Ngo Kim Hue – who was concluded to be an “extended arm” of Ms. Phan. In 2007, VNECO signed a cooperation investment contract with Ms. Hue to implement a complex project on a land area of more than 80,000m2 in Binh Chanh District, Ho Chi Minh City. According to the agreement, Ms. Hue contributed capital in the form of land use rights, while VNECO advanced 310 billion VND (from bond issuance and bank loans), equivalent to 90% of the land value. However, Ms. Hue failed to complete the land title transfer procedures as committed, so the contract was terminated in 2010. The two parties signed a liquidation agreement, and Ms. Hue fully repaid 400 billion VND (including principal and interest) to VNECO from 2010 to 2011. Eight years later, when the Hua Thi Phan case was brought to trial, the court determined that the 310 billion VND amount was actually received and used by defendant Phan, while Ms. Hue only played an intermediary role. Despite the contract having been liquidated, the Ho Chi Minh City High People’s Court still ruled that VNECO must refund 200 billion VND to Vietnam Construction Bank – where Ms. Phan had embezzled thousands of billions of dong. Over the years, VNECO has lodged complaints with competent authorities, arguing that there is no basis to annul a civil transaction that has been completed for 8 years. This amount of money has also been used by the Company for key electricity projects such as Vinh Tan – Song May, Phu My – Song May, and Duyen Hai – Tra Vinh… and has been approved annually by the State Audit Office. In early 2022, the Executioner of the People’s Court of Da Nang City decided to postpone the execution against VNECO regarding the Company’s obligation to refund more than 200 billion VND to Vietnam Construction Bank. VNECO stated that it is in the process of making the necessary arrangements to request the competent authority to resolve the case through the Supervisory Procedure. |