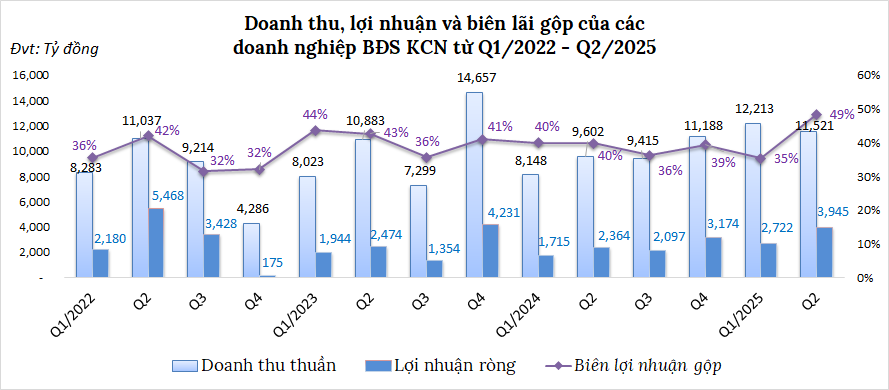

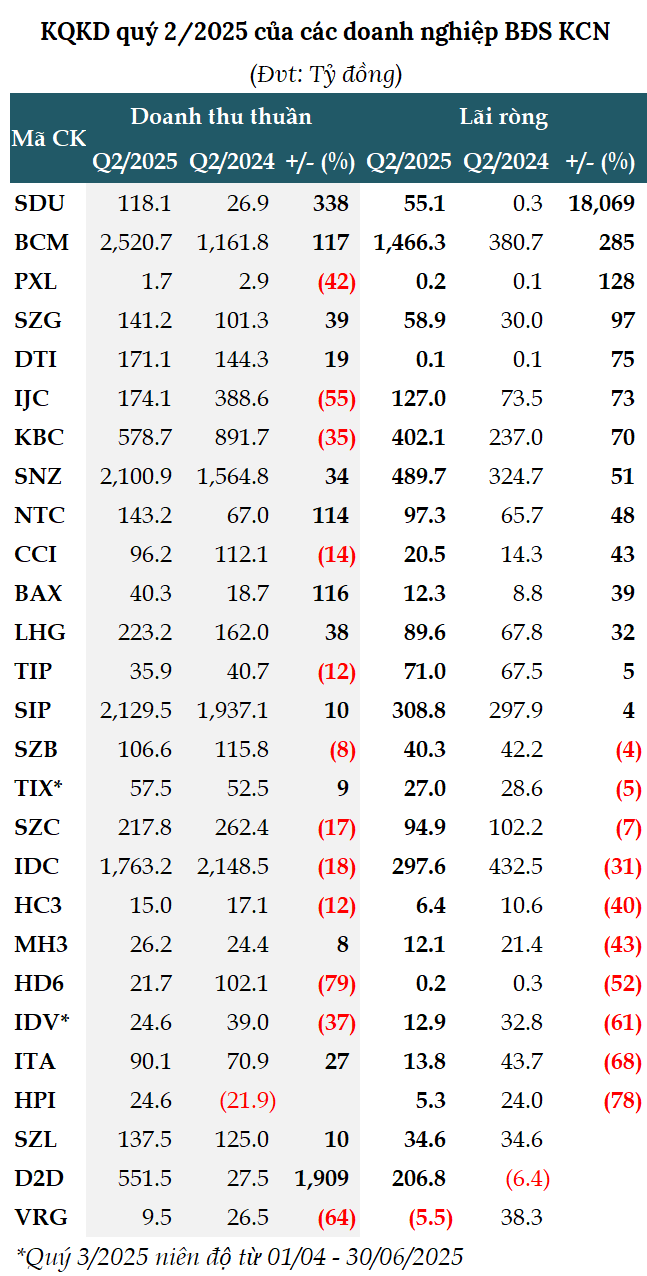

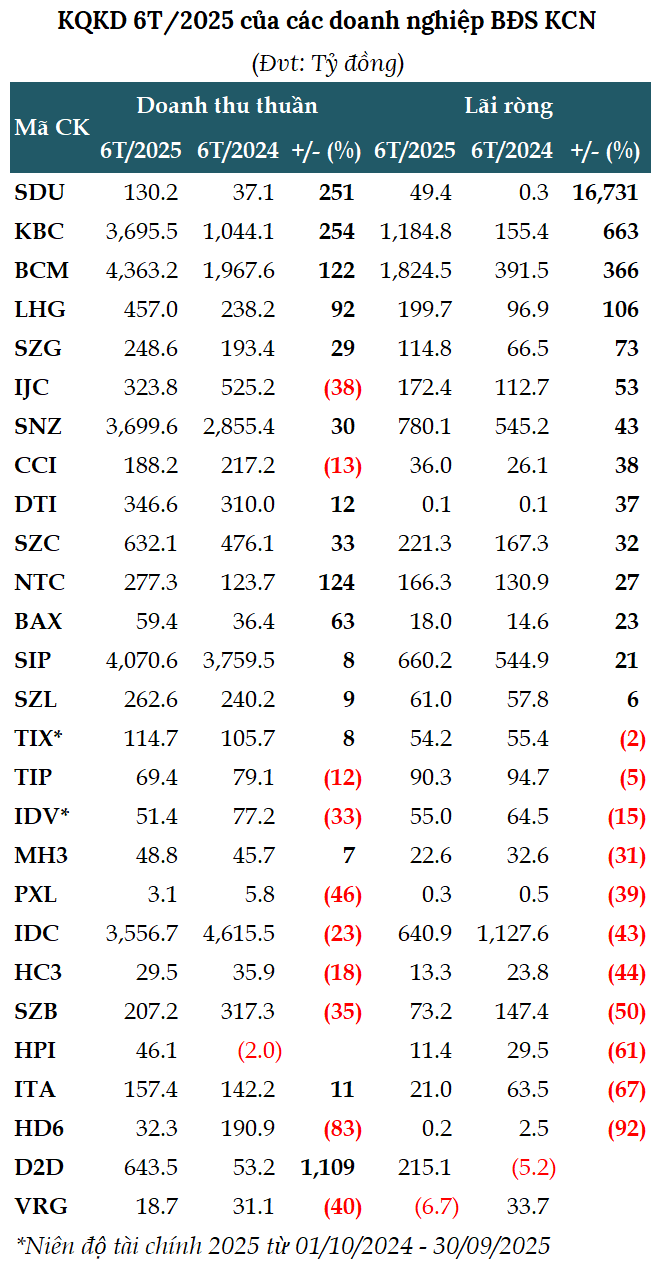

The industrial real estate sector witnessed a remarkable surge in Q2 2025, with both revenue and profits accelerating. Financial reports from 27 companies listed on the stock exchanges (HOSE, HNX, and UPCoM) revealed a combined revenue of over VND 11,500 billion, a 20% increase compared to the previous year. Meanwhile, net profits soared by 67%, reaching over VND 3,900 billion—the highest in the past six quarters. The gross profit margin stood at 49%, the highest in the period from Q1 2022 to Q2 2025.

Source: VietstockFinance

|

Over half of the companies witnessed profit growth, with three businesses witnessing a multifold increase. The most notable performer was Song Da Urban and Industrial Development Investment Joint Stock Company (HNX: SDU), which achieved a record net profit of over VND 55 billion, a staggering 182 times higher than the previous year. This impressive result was attributed to their office leasing, building services, and real estate development businesses. For the first six months, their net profit exceeded VND 49 billion, marking a 168-fold increase.

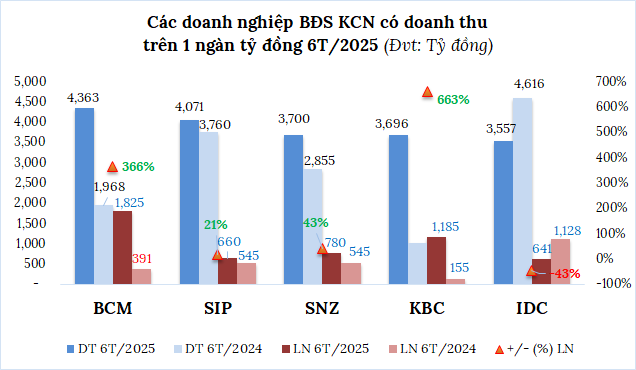

Becamex IDC, or the Industrial Development and Construction Corporation (HOSE: BCM), experienced a significant boost in profits, with a net profit of nearly VND 1,500 billion in Q2, quadrupling the figure from the same period last year. This was largely due to the robust growth in industrial real estate revenue and reduced expenses. For the first six months, Becamex IDC’s net profit surpassed VND 1,800 billion, 4.7 times higher than the previous year, achieving 74% of their annual plan.

Sonadezi Giang Dien (UPCoM: SZG) also benefited from a 90% surge in factory leasing revenue, resulting in a quarterly net profit of nearly VND 59 billion, an increase of 97%. For the first half of the year, the company’s net profit reached VND 115 billion, a 73% increase, accomplishing 67% of their target.

In the north, the Urban Development and Construction Corporation of Kinh Bac (HOSE: KBC) demonstrated strong performance, with a net profit of VND 402 billion, reflecting a 67% increase. This growth was driven by their impressive performance in the land leasing segment. For the first six months, their net profit after tax amounted to VND 1,248 billion, 6.4 times higher than the previous year. However, the company has only achieved 39% of its annual plan.

Source: VietStockFinance

|

Several other companies also reported positive net profit results, including Sonadezi (UPCoM: SNZ), which achieved a record-high profit of nearly VND 490 billion, a 51% increase, fulfilling 92% of their plan. Nam Tan Uyen (UPCoM: NTC) followed closely with a net profit of over VND 97 billion, a 48% increase, achieving 59% of their target. Long Hau Corporation (HOSE: LHG) also impressed with a net profit of nearly VND 90 billion, a 32% increase, surpassing their plan by 27%.

Notably, the Industrial Urban Development Corporation No. 2 (HOSE: D2D) showcased an unprecedented performance, with a revenue of nearly VND 552 billion, over 20 times higher than the previous year. Their net profit broke records, surpassing the annual plan. D2D attributed this exceptional performance primarily to land transfer revenue in Chau Duc Industrial Park.

Source: VietStockFinance

|

The common thread among the companies that experienced growth was the significant increase in revenue from land and factory leasing or the transfer of industrial real estate.

On the other hand, some businesses faced challenges due to declines in their core business operations. For instance, Tan Tao Investment and Industry Corporation (UPCoM: ITA) concluded Q2 with a 68% decrease in net profit, amounting to nearly VND 14 billion, despite a 27% increase in revenue to over VND 90 billion. For the first six months, their net profit stood at VND 21 billion, a 67% decrease, achieving only 9% of their plan.

IDICO (HNX: IDC) witnessed a 31% decline in profit, amounting to nearly VND 298 billion, due to a significant drop in revenue from industrial infrastructure leasing. For the first half of the year, IDICO’s net profit was nearly VND 641 billion, a 43% decrease, accomplishing 40% of their annual target.

Source: VietstockFinance

|

FDI and Rubber Land Bank as Catalysts

As of the end of June, several companies held substantial amounts of advance payments from land and factory lessees, creating significant reserves for their long-term strategies. SIP led the pack with over VND 13,100 billion, accounting for 47% of their total assets and an 8% increase from the beginning of the year. IDC ranked second with over VND 6,400 billion, a 6% increase, representing 33% of their capital.

Vietcap Securities (HOSE: VCI) assessed that the significant reduction in tariffs on Vietnamese goods by the US bolstered Vietnam’s competitive position. This advantage is further strengthened by a network of FTAs, low labor costs, a young workforce, and improved infrastructure.

However, not all FDI inflows into Vietnam are destined for the US market. Northern industrial parks may face higher risks due to their reliance on electronics exports to the US, whereas the diverse industry structure and FDI targeting the domestic market in the south help mitigate the impact of external shocks.

VCI forecasts an 8% increase in the total area of leased industrial land in 2025, followed by 12% and 17% increases in 2026 and 2027, respectively. This growth is supported by an expected additional supply of 6,000 hectares of industrial land in the medium term.

In addition to companies with robust sales, those with large rubber land banks are also poised to benefit as many localities plan to convert this land into industrial parks. In the period from 2024 to the first half of 2025, the Vietnam Rubber Group Joint Stock Company (HOSE: GVR) received approval for approximately 2,100 hectares of new industrial land and is awaiting approval for an additional 5,800 hectares in Dong Nai, Ba Ria-Vung Tau, Binh Phuoc, and Binh Duong.

Phuoc Hoa Rubber Joint Stock Company (HOSE: PHR) intends to develop an additional six industrial parks spanning 2,700 hectares and eight small and medium industrial clusters covering 575 hectares. PHR will act as the primary investor or collaborate with partners to implement these projects.

With the dual advantage of FDI inflows and new land resources in the coming years, the industrial real estate sector is expected to maintain its strong growth trajectory in the foreseeable future.

Thanh Tu

– 12:00 19/08/2025

“Real Estate Firms’ Profits Soar: First-Half Yearly Earnings Up 150%”

The Vietnamese real estate market witnessed significant fluctuations and a strong segmentation across segments and regions in the first half of 2025. Amidst these dynamics, listed real estate enterprises surprisingly reported a 50% surge in net profits compared to the same period in 2024, showcasing their resilience and adaptability in a challenging environment.

The Rising Star of Vietnam’s Economy: Outpacing Thailand?

“The Nation” highlights Vietnam’s emergence as Asia’s new manufacturing powerhouse, attributing it to the country’s impressive pace of reform and growth. While Thailand, slow to innovate, risks falling behind its dynamic neighbor. The article emphasizes Vietnam’s rapid ascent and the potential consequences for the region’s economic landscape.