The Ho Chi Minh City Stock Exchange (HoSE) has recently requested explanations from Vietnam Container Shipping Joint Stock Company (Viconship, code: VSC) regarding the consecutive five-session ceiling price increase of VSC shares.

Specifically, HoSE detected that the share price of VSC had reached the ceiling price for five consecutive sessions from August 12, 2025, to August 18, 2025.

Referring to Point 1q, Clause 11, Circular No. 96/2020/TT-BTC on information disclosure in the securities market, and Document No. 2828/UBCK-VP dated May 16, 2022, of the State Securities Commission (SSC) regarding HoSE’s requirement for listed companies to report and disclose information related to the company that affects stock price fluctuations within 24 hours from the time the stock price increases or decreases for five consecutive sessions or more.

Therefore, HoSE proposed that Viconship comply with the above-mentioned regulations on information disclosure.

Illustrative image

Regarding the trading of VSC shares, VietinBank Capital Joint Stock Company recently successfully sold more than 15 million VSC shares in the trading session on August 14, 2025.

After the transaction, the fund reduced its ownership of VSC shares from over 25.5 million shares to 10.5 million shares, equivalent to a decrease in ownership ratio from 6.82% to 2.8%, thereby officially withdrawing from the group of major shareholders of Viconship.

Notably, VietinBank Capital has consecutively sold VSC shares in recent times to reduce ownership at Viconship.

Specifically, on August 12, 2025, VietinBank Capital sold 15 million VSC shares; on July 29, 2025, it sold 10.1 million shares; and on July 25, 2025, it sold 17.5 million VSC shares.

In another development, Viconship recently joined hands with Hai An Shipping and Stevedoring Joint Stock Company (HAH: HAH, HoSE floor) to establish a new enterprise called Hai An Green Shipping Lines Limited Company.

Accordingly, the newly established enterprise is a limited liability company with two or more members, with its head office located on the 3rd floor, Hai An Building, km2 Dinh Vu Road, Dong Hai Ward, Hai Phong City.

The expected charter capital is VND 1,000 billion, in which Hai An Stevedoring contributes VND 400 billion, equivalent to a 40% ownership ratio, and authorizes Mr. Vu Thanh Hai to represent this capital contribution.

Viconship will contribute 60% of the charter capital, equivalent to VND 600 billion, and authorize Mr. Ta Cong Thong – General Director of VSC to represent this capital contribution.

Who is the Secret Company that Just Signed a Deal to Purchase TDC’s Land in Binh Duong Ward?

“TDC and Global Corp have signed an agreement for the transfer of residential properties in Lot E15, part of the TDC Hoa Loi residential project in Binh Duong Ward, Ho Chi Minh City. This seemingly low-key enterprise has caught the attention of many big players in the stock market, with its connections to major power players.”

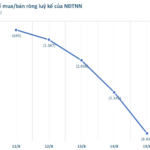

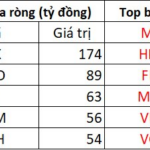

Unlocking Profits: Navigating the VN-Index’s Surge Past the 1,600-Point Milestone

“During the week of August 11–15, 2025, selling pressure from investment funds intensified as the VN-Index rallied for four consecutive sessions, breaching the psychological threshold of 1,600 points and approaching the 1,660 zone. However, the index faced corrective pressures during the week’s final trading session.”