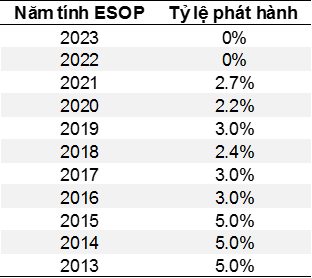

The Vietnamese stock market is experiencing one of its most exuberant phases in history, with a strong upward trend and surging liquidity. The VN-Index has surged by nearly 390 points (+30%) since the beginning of the year, climbing to 1,654 points, the highest closing price ever. The market capitalization of the entire market has also reached a new record, close to VND 9 quadrillion.

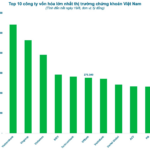

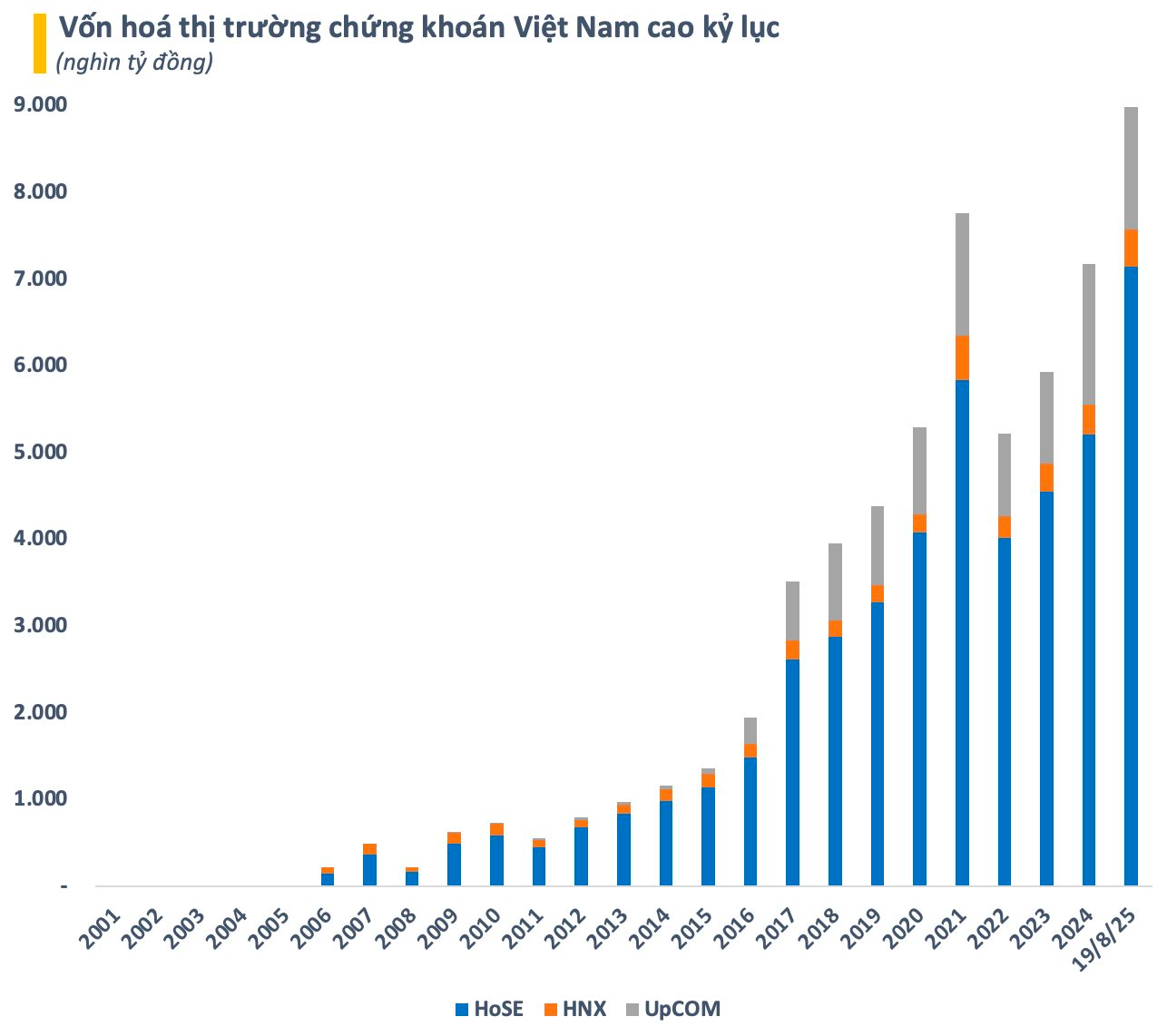

The main driver of the market’s strong performance comes largely from large-cap stocks. As of August 19, there were 23 stocks with a market capitalization of over VND 100 trillion, a record number in history. The total capitalization of this group reached nearly VND 5 quadrillion, accounting for more than half of the value of the entire Vietnamese stock market.

In terms of structure, among the 23 stocks with a market capitalization of over VND 100 trillion, only two are from UPCoM: Viettel Global (VGI) and ACV, while HNX has no representatives. The remaining 21 stocks on the HoSE are leading names in key sectors such as banking, real estate, industrial production, technology, and retail.

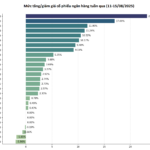

Notably, bank stocks continue to dominate in terms of both quantity and weight in the 100,000 billion club, with 10 names, including Vietcombank, BIDV, VietinBank, Techcombank, VPBank, MB, ACB, LPBank, HDBank, and Sacombank. Bank stocks, especially private ones, have surged with double-digit percentage gains in a short period.

Yellow represents the banking group

Overall, the banking group is offering several attractive investment themes. Firstly, there’s the story related to credit growth targets. In Official Dispatch No. 128/CD-TTg dated August 6, 2025, the Prime Minister requested the State Bank of Vietnam (SBV) to urgently develop a roadmap and pilot the removal of credit growth targets, with implementation from 2026.

Next is the topic related to the statutory reserve requirement. On August 12, the SBV Governor issued Circular 23 amending Circular 30, allowing credit institutions that receive the mandatory transfer of a bank under special control to reduce their statutory reserve requirement by 50% according to the approved mandatory transfer scheme. At the same time, entities participating in the management, operation, and financial support of the bank under special control will also be eligible for similar treatment.

Previously, four banks officially received the mandatory transfer of four weak banks. Vietcombank acquired CBBank, which was renamed VCBNeo digital bank. HDBank took over DongABank, transforming it into Vikki Bank. MB acquired Oceanbank, rebranding it as MBV. And GPBank was transferred to VPBank.

Another investment theme that has been attracting attention recently is the trend of banks IPO-ing their securities subsidiaries. Most recently, VPBank Securities is planning an IPO in Q4 this year. Earlier, TCBS started accepting registrations for its IPO shares from August 19, following shareholder approval, and is expected to be listed on the stock exchange by the end of this year.

The New Game in Blockchain and Digital Assets

In addition to the above themes, the banking group is also attracting attention with a new and potentially lucrative game in the blockchain and digital asset space.

Notably, MB recently signed an MoU with Dunamu, the operator of South Korea’s Upbit cryptocurrency exchange, on August 12, 2025. This agreement focuses on technology and infrastructure sharing and expertise to develop digital asset solutions in Vietnam. Dunamu is expected to support the development of a domestic cryptocurrency exchange, provide advice on legal frameworks, investor protection mechanisms, and international standards such as FATF.

Techcombank is also embracing this trend. The bank’s chairman, Mr. Ho Hung Anh, affirmed that engaging in areas such as blockchain and building a digital asset exchange is an inevitable trend in the bank’s digital transformation strategy. He emphasized, “With the opportunities presented and if permitted by law, TCB naturally wants to participate and contribute to the development and ownership of these technology platforms.”

Previously, at the National Forum on Vietnamese Digital Technology Enterprises earlier this year, Ms. Nguyen Thi Phuong Thao, Vice Chairman of HDBank, proposed investing in research and development to master blockchain technology. She shared that they had formulated an action plan with three key tasks: investing heavily in blockchain; collaborating with domestic and foreign partners to enhance capabilities and accelerate digital transformation; and providing incentives by encouraging employees and partners to join this mission.

Overall, digital assets are a global investment trend, and Vietnam is no exception. The National Assembly officially passed the Law on Digital Technology Industry in June last year, marking the first time that the concepts of digital assets and tokenized assets were incorporated into law. The International Financial Center being developed in Danang is an integral part of building the digital asset market.

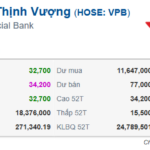

“VPBank’s Market Capitalization Surpasses $10 Billion for the First Time Following VPBankS IPO News”

In just over a month, VPBank’s stock, VPB, has witnessed a remarkable surge, skyrocketing from over 18,000 to above 34,000 VND per share. This spectacular rally has captured the spotlight in the stock market. Behind this impressive price movement is a confluence of factors: robust half-year financial results, a unique open ecosystem strategy, and, most notably, the highly anticipated IPO of VPBankS.

Thailand Embraces Crypto Payments for Tourists, Vietnam Eyes Billion-Dollar Opportunity

Thailand’s move to allow tourists to exchange cryptocurrency for baht for payments is a significant step towards integrating digital assets into the travel industry. This development presents an opportunity for Vietnam, with its evolving legal framework, to emerge as a regional hub for digital assets.

“Financial Institutions Embrace the Digital Asset Revolution”

The legalization of digital assets marks a pivotal moment in Vietnam’s legal history. While the regulatory framework is still a work in progress, the investment appetite from financial institutions is palpable, with many proactively laying the groundwork to enter the fray when the proverbial green light shines.