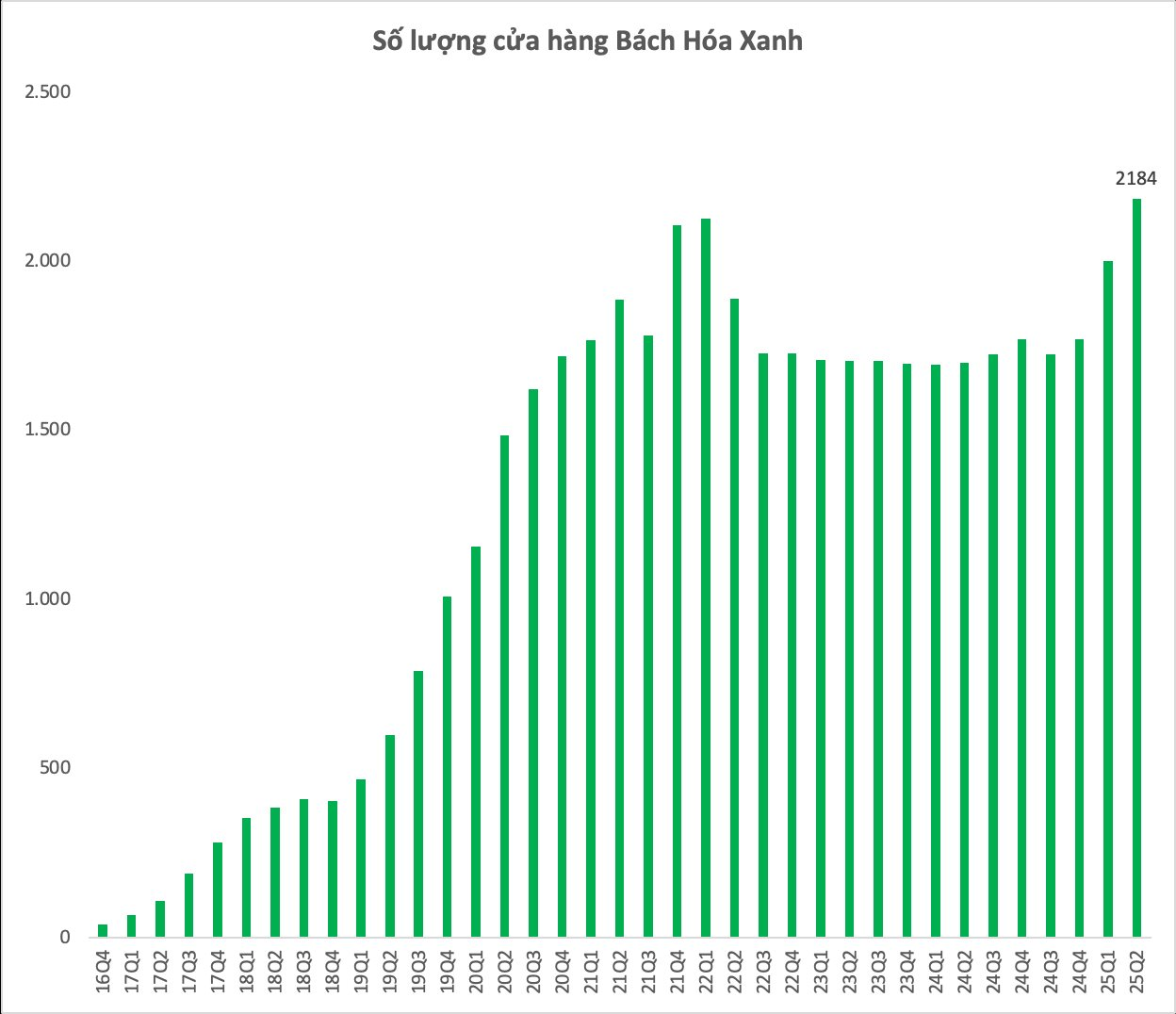

At the Mobile World Investment (MWG) Q2 2025 Investor Meeting, MWG’s CEO, Vu Dang Linh, announced that Bach Hoa Xanh’s profit reached 182 billion VND in Q2 2025, bringing the six-month cumulative profit to 205 billion VND.

With these results, the company is confident in achieving its minimum target of 500 billion VND in profit for 2025 and even expects to surpass 600 billion VND for the full year.

Bright spots in profit come from two main drivers: improved revenue and optimized costs. Mr. Linh shared that while the first half of the year saw slower revenue growth, the pace has picked up significantly in recent times. In addition, costs have been considerably improved, with distribution/transportation center costs reduced from 5% to 3%. Similarly, store operating expenses have been significantly lowered, making the profit stream more evident in the financial reports.

Accelerating expansion: scale at the saturation point could reach tens of thousands of stores

For 2025, MWG aims to open 400 new Bach Hoa Xanh stores. However, as of now, this number has exceeded the plan, with 414 new stores, over 50% of which are in Central Vietnam. From now until the end of the year, the chain is expected to inaugurate an additional 200 stores, bringing the total number of new openings in 2025 to 620.

According to Mr. Linh, 2026 will be a crucial milestone as BHX officially ventures north. Simultaneously, the leader affirmed the goal of opening 1,000 new stores annually. Bach Hoa Xanh has prepared the operational foundation, optimized costs, and validated the model in Central Vietnam, significantly reducing the investment cost for a new store compared to before. This will be a stepping stone to expanding nationwide.

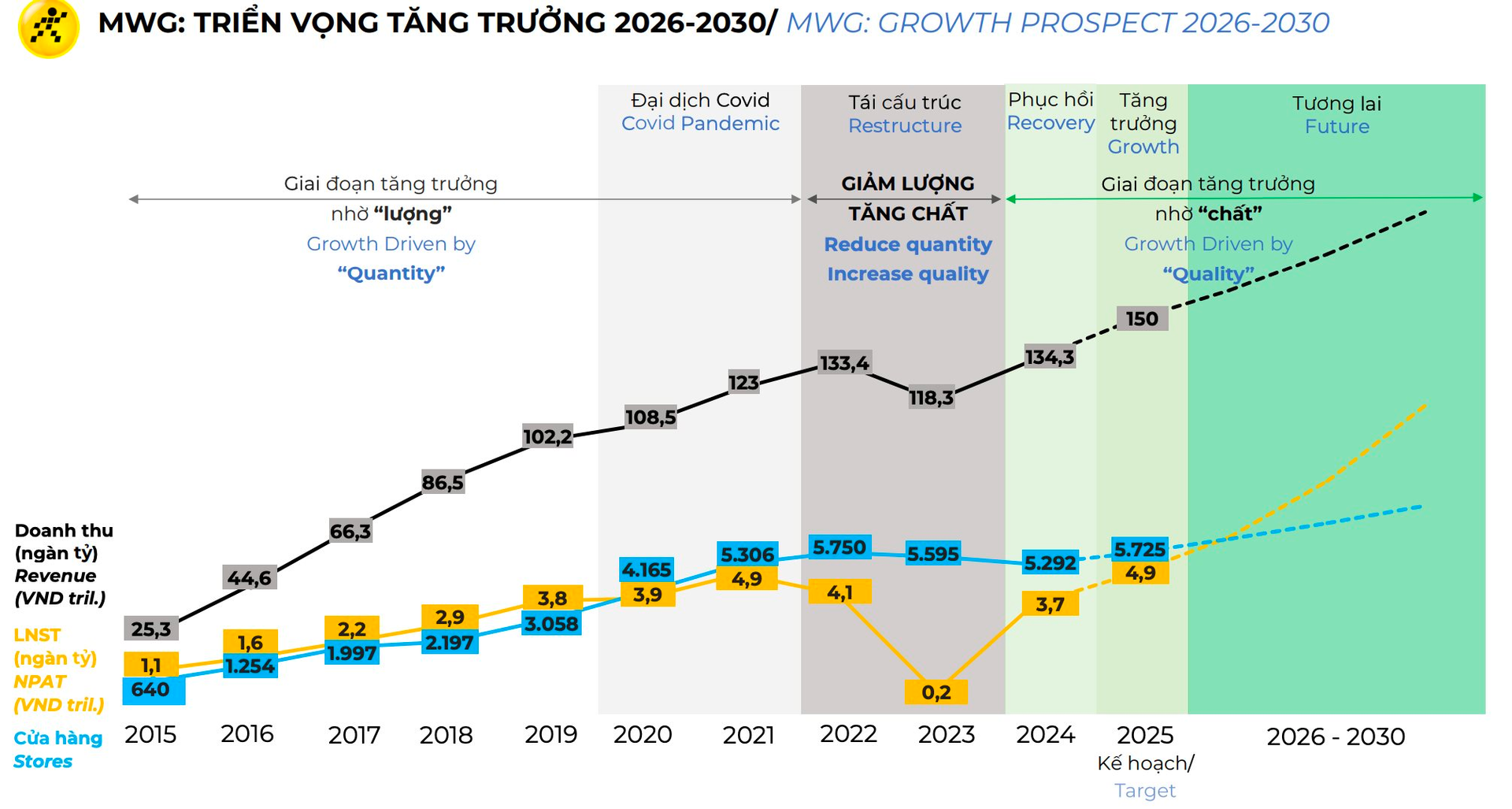

MWG began developing Bach Hoa Xanh in 2015. After nearly a decade, the chain has grown to 2,148 stores nationwide. This number reflects the persistent efforts over the years, but the plan to add 1,000 stores annually from 2026 onwards showcases an ambitious leap. The number of stores can increase almost as quickly as the accumulation of the past decade.

MWG’s CEO predicts that the food and consumer goods market will experience moderate growth in the second half of the year. GDP is expected to grow stronger, driven by factors such as public investment, credit, financial services, securities, and real estate, while consumption is projected to grow by 5-6%.

Mr. Vu Dang Linh reaffirmed the determination to IPO Bach Hoa Xanh in 2028. He stated that the chain aims to rapidly increase revenue to offset accumulated losses quickly and optimize production, warehousing, display, and after-sales services, with a projected profit margin of 4-5%.

Discussing the long-term prospects, MWG’s Chairman of the Board of Directors, Nguyen Duc Tai, shared that a $10 billion revenue target is Bach Hoa Xanh’s vision. However, to achieve this scale, the chain must diversify its store models instead of relying solely on the current 150 sq. m. standard.

“BHX will develop flexible models: stores selling only dry goods, only fresh produce, or mini-stores in apartment basements. The current average revenue is about 2.5-3 billion VND/store/month. To reach the $10 billion mark, BHX can potentially expand to tens of thousands of stores,” Mr. Tai analyzed.

Additionally, one of Bach Hoa Xanh’s strategic directions in the coming time is to expand its online presence. Currently, online revenue accounts for approximately 5% of total revenue. BHX’s significant advantage is its extensive store network, enabling swift processing of online orders and reduced delivery time.

“We aim to increase the proportion of online revenue from 5% to 10% in the coming period. The combination of online and offline channels will be BHX’s key competitive advantage in the next phase,” Mr. Tai shared.

Specifically, Bach Hoa Xanh is determined to enter a phase of robust growth with three strategic focuses. First is to boost revenue growth by accelerating the expansion of both offline and online channels and increasing sales in existing stores.

Second, ensure product quality and safety by strengthening collaboration with reputable suppliers committed to maintaining quality, food safety, and stable production standards.

Third, improve profits by increasing revenue, continuing to optimize operations to the finest detail, and implementing a “Familyship” culture with suppliers to optimize costs and enhance efficiency for both BHX and its partners.

Business Performance in Other Chains

In the mobile phone and electronics segments, The Gioi Di Dong and Dien May Xanh have maintained stable growth rates of around 15% year-over-year. The company aims to sustain this growth momentum in the coming months, closely adhering to the 15-16% full-year plan.

Regarding the Era Blue joint venture in Indonesia, Mr. Linh shared that the plan is to reach 150 stores by the end of 2025. Initially, the company focused solely on Jakarta, but it has now expanded to other regions, totaling 124 stores. Once the model proves effective, Era Blue will continue to be scaled. As MWG holds a 45% stake, the profit is accounted for accordingly and will be reflected in the enterprise value during the electronics segment’s IPO, although it won’t be consolidated into revenue.

In the pharmaceutical segment, An Khang is still in the process of daily improvements. This chain is currently operating at a loss, but the deficit has gradually decreased month over month, indicating positive signals.

Meanwhile, the AVAKids chain has been profitable since Q1/2024. In the first half of 2025, it recorded approximately 13 billion VND in profit, and the results of recent months have been consolidated. MWG’s CEO stated that AVAKids plans to open several new stores and combine offline and online models to boost sales.

“VSC Aims to Triple Profit Plans, Targeting Over VND 1,000 Billion”

The Board of Directors of Vietnam Container JSC (HOSE: VSC) has approved a proposal to be presented at an Extraordinary General Meeting of Shareholders, regarding an increase in the company’s pre-tax profit plan for the year 2025.