The Ho Chi Minh City Stock Exchange (HOSE) has recently announced a supplementary list of securities ineligible for margin trading.

Specifically, three stocks, DAH – Dong A Hotel Group Joint Stock Company, DHM – Duong Hieu Mineral Trading and Exploitation Joint Stock Company, and SAV – Savimex Economic Cooperation and Import-Export Joint Stock Company, are now barred from margin trading on HoSE due to negative post-tax profits in their reviewed semi-annual financial statements for 2025.

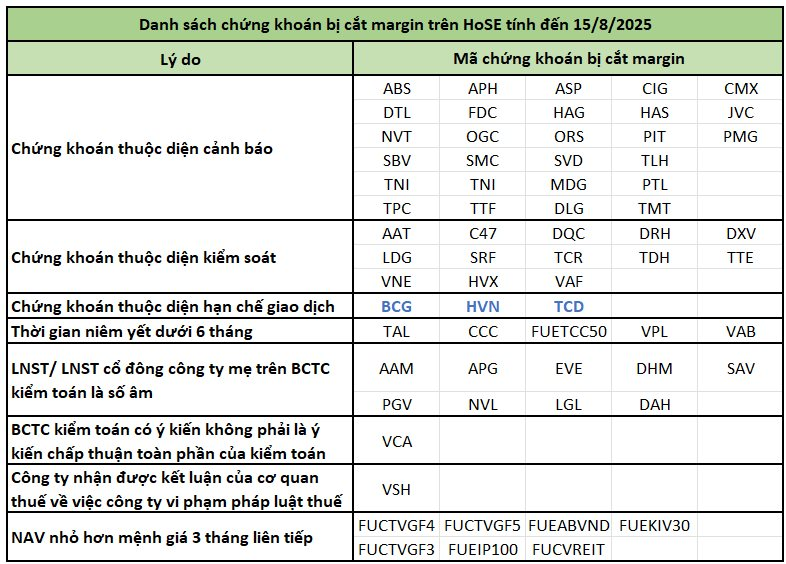

As of August 15, 2025, the number of stocks delisted from margin trading on HoSE stands at 65, including notable names such as HAG, NVL, LDG, BCG, HVN, VPL, and ORS.

HOSE attributed the delistings to various reasons, including securities under warning/control/trading restriction; negative post-tax profits with audited reports bearing opinions from auditing firms; and listing duration of less than six months.

According to regulations, investors are prohibited from utilizing credit limits (financial leverage or margin) provided by securities companies to purchase these 65 stocks categorized as ineligible for margin trading.

The VN50 Growth Index: Unveiling Vietnam’s Top 50 Performing Stocks

The VN50 GROWTH comprises 50 carefully selected constituent stocks from the VNAllshare index. These stocks are meticulously chosen based on specific index screening criteria, ensuring a diverse and robust representation of the market.

Adding TAL Stock to the List of Margin-Ineligible Securities: A Strategic Move by HOSE

The Ho Chi Minh Stock Exchange (HoSE) has announced that it will add the ticker symbol TAL, representing Taseco Real Estate Investment Joint Stock Company, to the list of securities ineligible for margin trading. This decision has been made due to the company’s short listing period of less than six months.

Who is the Woman Behind the 6-Month-Old Enterprise That Just Invested 300 Billion VND in VIB?

Quang Kim Investment and Development JSC, established on May 23, 2024, purchased 17.2 million VIB shares during the November 11 trading session. This substantial acquisition elevated the company’s holdings, along with those of its affiliated shareholder group, to a notable 9.836% stake in the bank’s capital. The legal representative of Quang Kim Investment and Development JSC is Ms. Do Xuan Ha, the sister of Mr. Do Xuan Hoang, who serves as a member of the board of directors of VIB Bank.