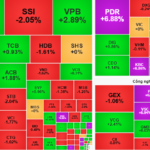

The Vietnamese stock market opened on a positive note on Monday, August 18th. The VN-Index faced corrective pressure and strong volatility but managed to recover well. It ended the session up 6.37 points (+0.39%) at 1,636.37. Foreign trading remained a concern, with net sell-offs totaling VND 2,065 billion across the market.

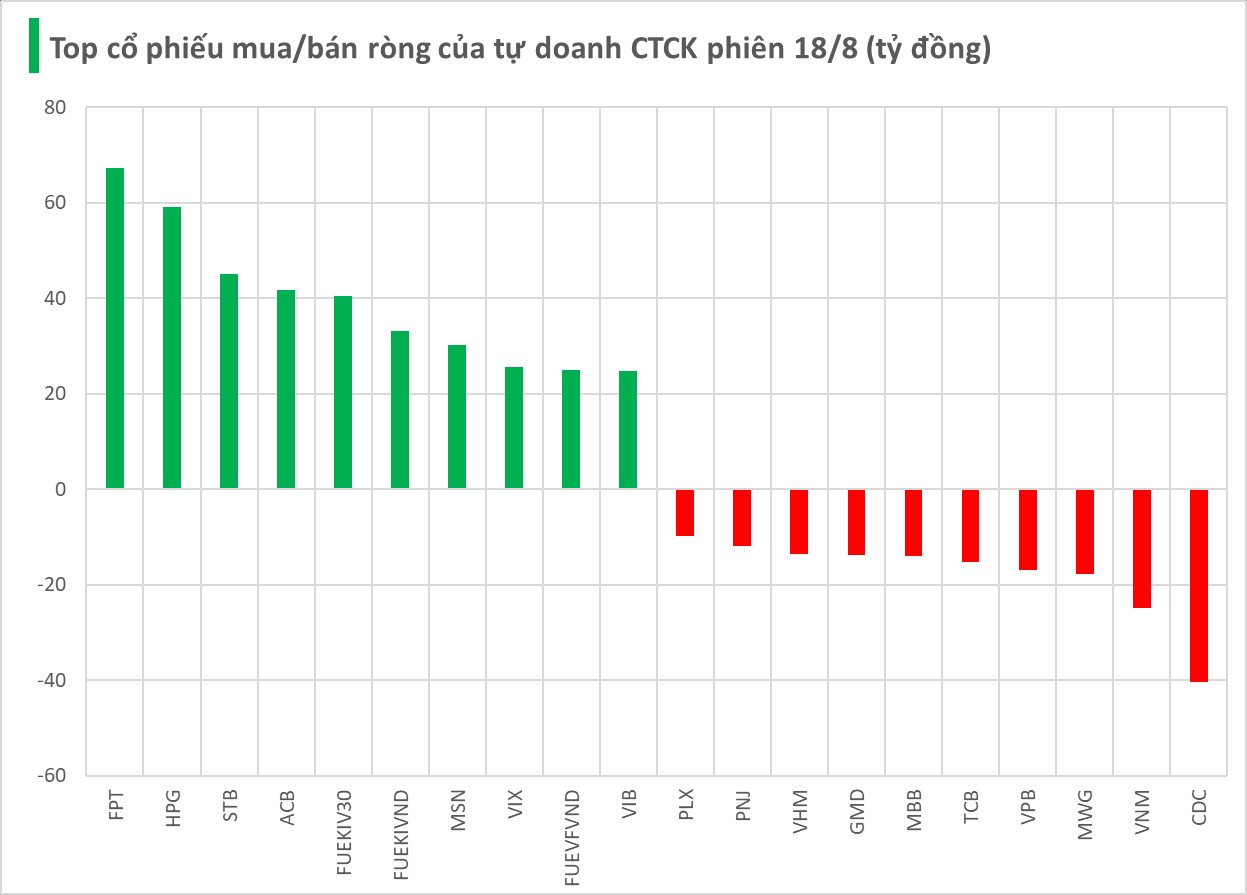

In contrast, securities companies’ proprietary trading continued its buying spree, net buying VND 208 billion on the HoSE alone. FPT Securities led the net buying with a significant VND 67 billion. HPG followed with VND 59 billion, then STB (VND 45 billion), ACB (VND 42 billion), FUEKIV30 (VND 40 billion), FUEKIVND (VND 33 billion), MSN (VND 30 billion), VIX (VND 26 billion), FUEVFVND (VND 25 billion), and VIB (VND 25 billion).

On the other side, CDC saw the heaviest net selling from securities companies, totaling VND 40 billion. This was followed by VNM (VND 25 billion), MWG (VND 18 billion), VPB (VND 17 billion), and TCB (VND 15 billion). Several other stocks also witnessed notable net selling, including MBB (VND 14 billion), GMD (VND 14 billion), VHM (VND 14 billion), PNJ (VND 12 billion), and PLX (VND 10 billion).

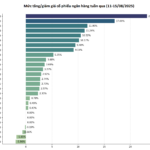

The VN-Index is Projected to Reach 1,750 Points: Top 10 Potential Opportunities to Ride the Year-End Rally

The names on this list predominantly belong to the banking, securities, and real estate industries, among others.

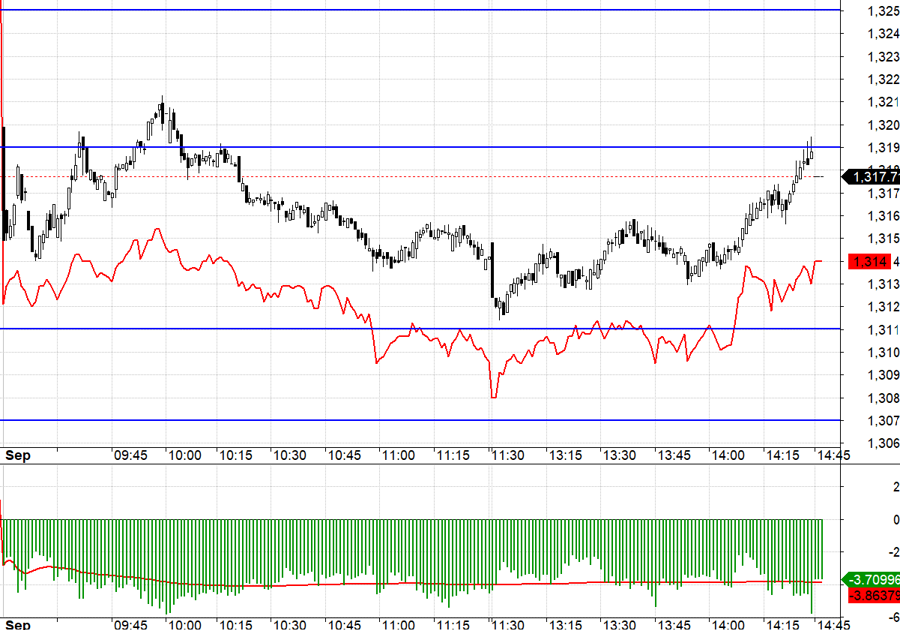

Stock Market Update: Mid and Small-Cap Stocks to Attract Investors’ Interest

The August 18th session concluded with a robust buying spree as investors sought to take advantage of discounted stock prices. For the upcoming August 19th trading day, we anticipate a shift in focus towards mid and small-cap stocks, presenting a strategic opportunity for savvy investors to diversify their portfolios and potentially capitalize on the momentum of these dynamic segments of the market.

“A Billion-Dollar Nest Egg”: A Generous Company Pays Out 35% Dividends in Cash, Sending Stocks Soaring to Historic Highs

With 67.1 million shares outstanding, the company will have to dish out a hefty 235 billion VND in dividend payments to its shareholders.