Outpacing the Big 4: VPBank’s Impressive Growth Trajectory

The first half of 2025 witnessed the highest credit growth since the COVID era as the banking sector ramped up lending activities to support the economy in line with the Government’s orientation. According to data from the State Bank of Vietnam (SBV), as of June 30, total credit outstanding in the system had increased by 9.9% compared to the end of 2024 and 19.32% year-on-year.

However, deposit growth showed signs of lagging behind credit expansion. In their July 2025 Monetary Market Report, analysts from MBS Securities Joint Stock Company (MBS) estimated that credit growth was outpacing deposit growth by about 1.3 to 1.5 times. This dynamic has somewhat exerted pressure on interest rates, particularly in private commercial banks, as they strive to attract deposits.

In a recently published banking sector report, FiinGroup assessed that the slower growth in deposits compared to credit has created liquidity tension, prompting banks to seek funding through market sources, impacting funding costs and net interest margins.

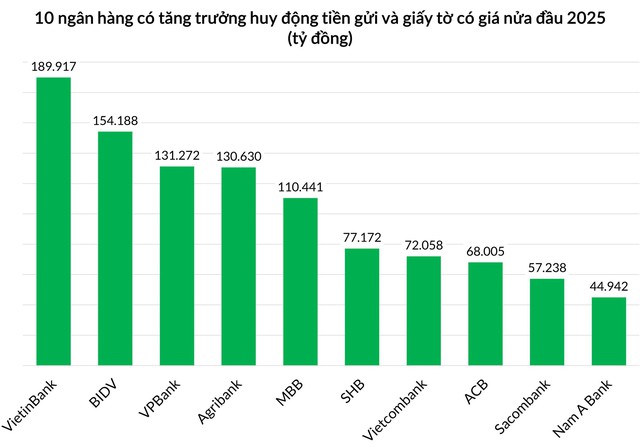

Amidst these challenges, VPBank, a prominent joint-stock commercial bank in Vietnam, stands out for its robust credit growth, underpinned by strong deposit mobilization. In just the first six months of the year, VPBank attracted an additional VND 131,272 billion in customer deposits and securities, the highest among private joint-stock commercial banks and the third highest in the entire system. Moreover, VPBank’s deposit growth outperformed the two giants in the Big 4 group.

This remarkable growth propelled VPBank’s combined customer deposits and securities to nearly VND 684,000 billion, reflecting a nearly 24% increase compared to the beginning of the year. Notably, the bank’s retail deposits witnessed a staggering growth of 27.5%, more than four times the industry average.

VPBank’s deposit growth ranks third in the entire system.

Despite its exceptional deposit growth, VPBank has successfully maintained control over funding costs. Simultaneously, the bank has adhered to prudent ratios, with the loan-to-deposit ratio (LDR) and short-term capital for medium and long-term loans kept at 80.2% and 25.8%, respectively, always within the limits set by the SBV.

For 2025, VPBank aims for ambitious yet balanced growth, targeting a 34% increase in combined customer deposits and securities, a 25% credit growth, and a 23% expansion in total assets. Remarkably, the bank has already accomplished most of its credit and deposit growth targets and is well on track to achieving its total asset goal within the first half of the year.

Unraveling VPBank’s Remarkable Performance

VPBank’s outstanding success in deposit mobilization during the first half of 2025 stems from a well-strategized, flexible, and holistic approach, resulting in broad-based growth across all segments, especially in the individual customer segment.

Beyond its impressive scale, VPBank also excels in the quality of its funding sources. The bank has witnessed a significant increase in non-term deposits (CASA), effectively lowering funding costs, and has successfully attracted long-term international capital, bolstering its safety ratios.

VPBank’s CASA balance surged by nearly 40% in the first half of the year, approaching the VND 100,000 billion mark. According to Mr. Phung Duy Khuong, Vice Chairman and Executive Director in charge of the Southern Region and Head of the Retail Banking Division, this achievement is attributed to the bank’s introduction of the Super Sinh Loi product, the VPBank K-Star Spark in Vietnam mega-concert, and a host of modern and pioneering payment solutions. These initiatives propelled VPBank’s CASA ratio to an impressive 15.8%.

Specifically, the Super Sinh Loi product alone contributed an additional VND 10,000 billion in CASA during the first six months and is projected to bring in another VND 20,000 billion in the latter half of the year. Moreover, the mega-concert not only enhanced VPBank’s brand presence but also directly impacted its business, resulting in nearly 30,000 new Super Sinh Loi accounts and over VND 4,000 billion in CASA.

Additionally, the launch of innovative products such as the Loc Thinh Vuong certificate of deposit further bolstered VPBank’s deposit mobilization efforts, attracting an additional VND 9,000 billion.

VPBank has also diversified its funding sources by securing long-term loans from leading financial institutions. In the first half of the year, the bank successfully raised a record syndicated loan of USD 1.56 billion, arranged and guaranteed by prominent institutions, including SMBC, Standard Chartered Bank, ANZ, and MUFG. In July, VPBank continued to make strides with a syndicated loan of USD 350 million from SMBC, along with development finance institutions like BII, EFA, FINDEV CANADA, and JICA. These international fundraising efforts have fortified VPBank’s long-term capital position, paving the way for future growth.

“VPBank’s Market Capitalization Surpasses $10 Billion for the First Time Following VPBankS IPO News”

In just over a month, VPBank’s stock, VPB, has witnessed a remarkable surge, skyrocketing from over 18,000 to above 34,000 VND per share. This spectacular rally has captured the spotlight in the stock market. Behind this impressive price movement is a confluence of factors: robust half-year financial results, a unique open ecosystem strategy, and, most notably, the highly anticipated IPO of VPBankS.

Credit Growth and the ‘Carrot’ for Select Banks

The rapid growth of credit contrasted with slower capital mobilization has put significant strain on the banking system’s liquidity. In response, the State Bank has intervened by reducing the statutory reserve ratio by 50% for four banks that are recipients of mandatory transfers from four banks under special control.

“AVA Center Inks Deals with Five Major Partners, Embracing New Opportunities”

“Tyson An Phu’s leading developers have partnered with top brands, solidifying AVA Center’s position as the premier All-round City in Northeast Ho Chi Minh City. This modern, integrated urban development promises a new standard of quality and convenience for the region.”

“A Challenging Road Ahead: Tackling Bad Debt”

The latest bad debt situation in the banking industry paints a more optimistic picture, with a significant slowdown in growth, reflecting the banks’ efforts to manage their asset quality. While the industry-wide non-performing loan ratio remains higher than pre-pandemic levels, the trend is heading in the right direction. This indicates that although challenges persist, the banks’ strategies to tackle bad debt are showing signs of success.