USD Rates in Vietnam Rise for the Third Consecutive Day

On August 20, the State Bank of Vietnam announced the central exchange rate at 25,263 VND per USD, an increase of 8 VND from the previous day, marking the third consecutive upward adjustment. With a trading margin of ±5%, commercial banks are allowed to quote the USD exchange rate between 24,000 VND and 26,526 VND.

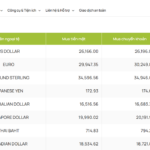

At Vietcombank, the USD was traded at 26,140 VND for buyers and 26,500 VND for sellers, a 10 VND increase from the previous day. Sacombank quoted the USD buying price at 26,150 VND and the selling price at 26,510 VND. Many other banks also made adjustments, pushing the selling price of USD above 26,500 VND – the highest level ever.

In the free market, the greenback was traded around 26,550 VND for buyers and 26,640 VND for sellers. Compared to commercial banks, the black-market rates were only about 100 VND higher per USD. Thus, not only has the SJC gold bar maintained its historical peak of around 124-125 million VND per tael, but the USD in Vietnam has also hit a new record.

Bank and black-market USD rates reach new highs

USD Rate Forecast in Vietnam

According to a report by Yuanta Vietnam, the USD/VND exchange rate rose slightly after a period of stagnation last week, with an increase of 0.11-0.19% in both the banking and free markets. Since the beginning of the year, the rate has increased by about 3.6%, which is considered quite high.

Meanwhile, CSI Vietnam Securities Company (CSI) stated that the VND continued to depreciate despite the cooling of the USD in the international market due to Vietnam’s loose monetary policy to support economic growth. This unit predicts that the VND’s depreciation trend could last until the end of the year, with an increase of about 3-3.5%.

In contrast, Yuanta Vietnam believes that the pressure on the exchange rate will ease due to the weakening of the international USD after a series of less positive US economic data and market expectations of a 0.25 percentage point cut in the Federal Reserve’s interest rate in September. Currently, the USD Index has fallen to 98.3 points, down 4.7% from its peak of over 103 points in April.

Regarding this development, the State Bank of Vietnam has affirmed that if the exchange rate pressure increases further, the bank will consider halting interest rate cuts to stabilize the foreign exchange market and maintain macroeconomic balance.

“Central Bank’s Rate Hike: USD Surges Past VND 26,500 at Banks, Flirting with Regulated Ceiling”

The intense competition in the market has forced banks to refrain from increasing selling prices any further. However, their significant surge in buying rates reveals the persistent pressure of exchange rates.

A Vietnamese Stock Exchange-listed Company Bets Big on Digital Assets, Sending its Stock Price Soaring by Threefold Since the Start of the Year

In an increasingly digital world, investing in digital assets has become a global trend, and Vietnam is no exception. With the recent legalization of digital assets in the country, the popularity of this new investment avenue is only expected to grow.