In a financial statement sent to the State Securities Commission of Vietnam and the Ho Chi Minh City Stock Exchange, Hoang Anh Gia Lai Joint Stock Company (HAG) explained the fluctuations in their business results and the emphasis of the auditor’s opinion on their reviewed consolidated financial statements for the first half of 2025. The auditing firm was Ernst & Young Vietnam.

According to the reviewed financial statements for the first six months of 2025, in the section requiring emphasis, Ernst & Young Vietnam noted that as of June 30, 2025, HAGL’s short-term debt exceeded its short-term assets by over VND 2,700 billion (short-term assets of VND 10,948 billion and short-term debt of VND 13,715 billion).

The company also violated certain commitments regarding bond contracts and failed to repay principal and overdue bond interest. These conditions indicate the existence of material uncertainty that may cast significant doubt on the entity’s ability to continue as a going concern.

In response to this opinion, HAGL explained that as of the date of the reviewed consolidated financial statements for the first half of 2025, the company had prepared a business plan for the next 12 months. Accordingly, cash flow is expected to be generated from the partial liquidation of financial investments and the disposal of assets and recovery of loans from partners.

Cash flow will also come from business operations and financial activities related to private bond issuances and loans from commercial banks under current credit agreements. This is in addition to obtaining approval for a debt restructuring plan with lenders.

The company is also in the process of working with lenders to adjust the terms that have been violated. Simultaneously, they are seeking shareholder approval through written consent to convert a portion of loans and payables into equity.

According to HAGL, in 2025, the business operations from banana and durian exports continued to generate significant cash flow. Therefore, the company’s management proceeded with the preparation of the consolidated financial statements for the first half of 2025 based on the going concern assumption.

Also, according to the explanation, HAGL reported that in the first half of 2025, gross profit increased by VND 470 billion, mainly due to increased fruit business operations compared to the previous year.

The loss from financial activities increased by VND 82 billion, mainly due to increased provisions for investments in Hoang Anh Gia Lai International Agriculture Joint Stock Company, as well as higher interest expenses compared to the same period last year.

Other losses increased by VND 6 billion, mainly due to the disposal of a few inefficient assets by the Group in 2025.

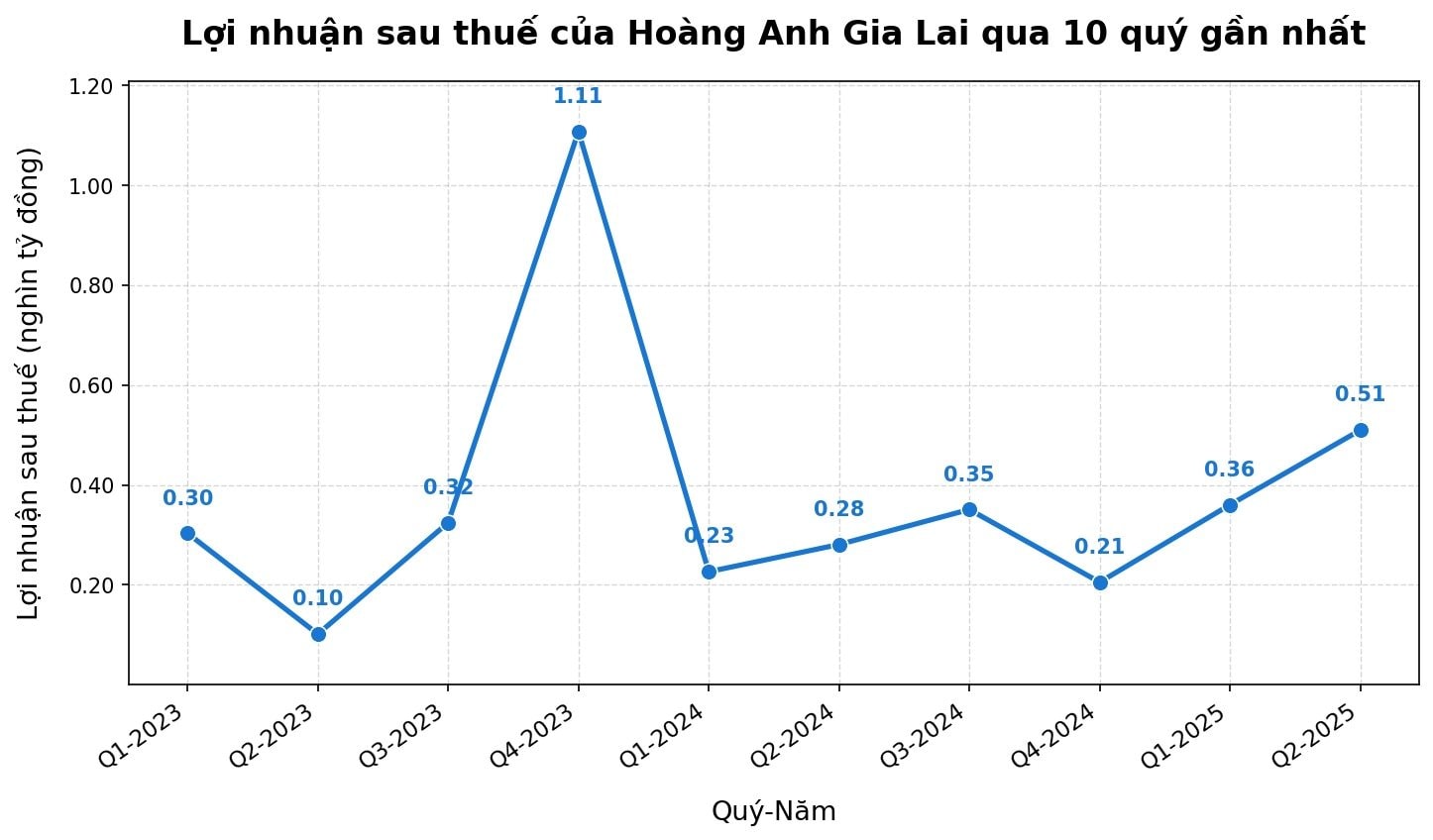

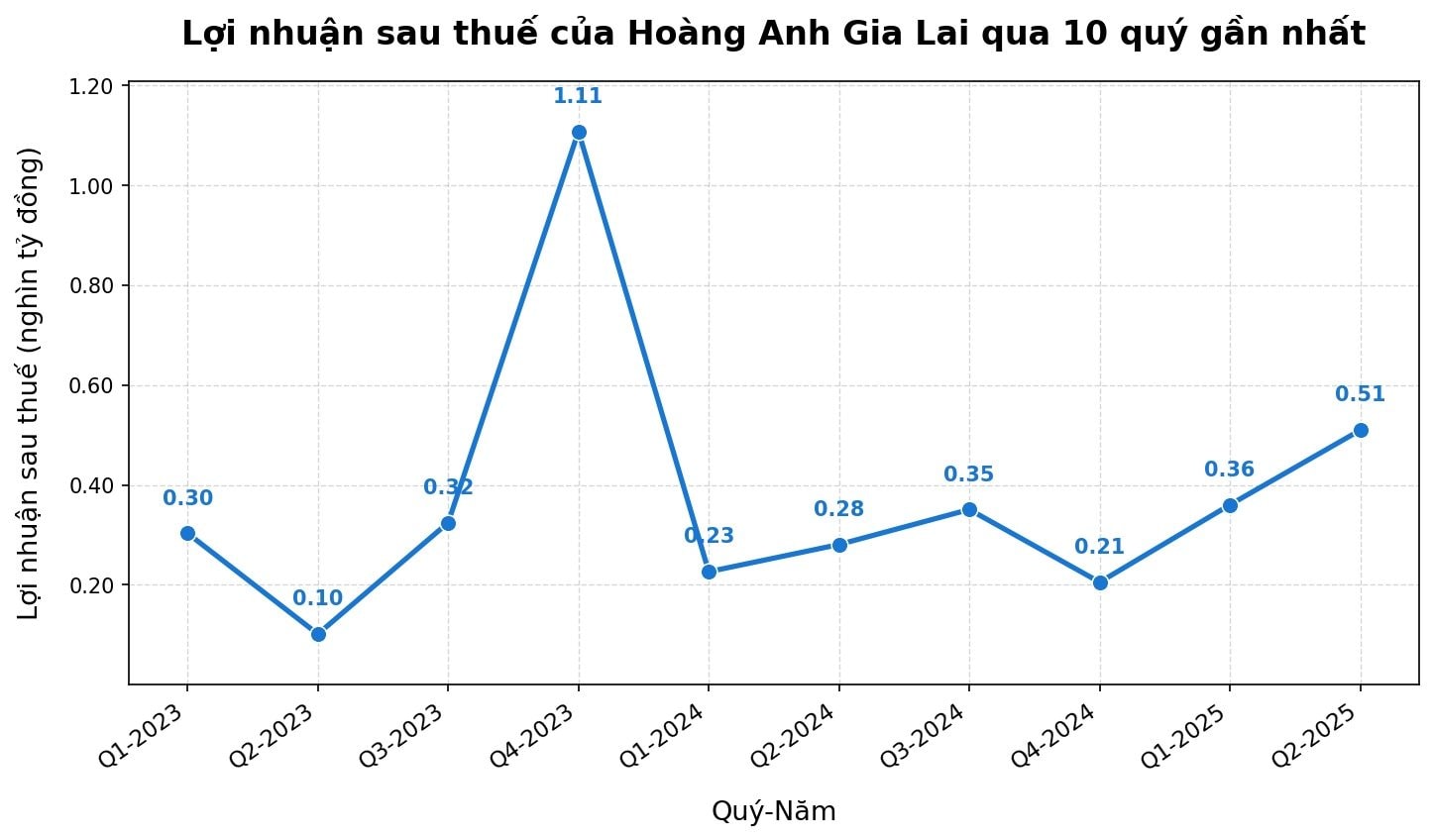

In the first six months of 2025, Hoang Anh Gia Lai recorded VND 3,709 billion in net revenue and VND 824 billion in after-tax profit, an increase of 34% and 73%, respectively, compared to the same period in 2024.

This result helped Hoang Anh Gia Lai achieve VND 400 billion in undistributed post-tax profits as of June 30, 2025. This is the first time since Q4 2020 that the company, known as “Bầu Đức,” has escaped from cumulative losses.

As of June 30, 2025, HAGL’s total assets exceeded VND 26,000 billion, an increase of over VND 3,700 billion from the beginning of the year, mainly due to short-term receivables of nearly VND 9,900 billion and loans to related parties of over VND 3,700 billion.

Payables also increased to VND 15,600 billion, including financial borrowings of over VND 9,300 billion.

The bond debt held by BIDV decreased significantly from VND 3,105 billion at the end of 2024 to VND 1,099 billion after the transfer of VND 2,000 billion in principal and over VND 2,000 billion in bond interest to a new group of investors.

This debt was subsequently converted by HAGL, with VND 2,000 billion in principal becoming long-term debt and over VND 2,000 billion in interest becoming other payables, all from Huong Viet Investment Joint Stock Company and five individuals.

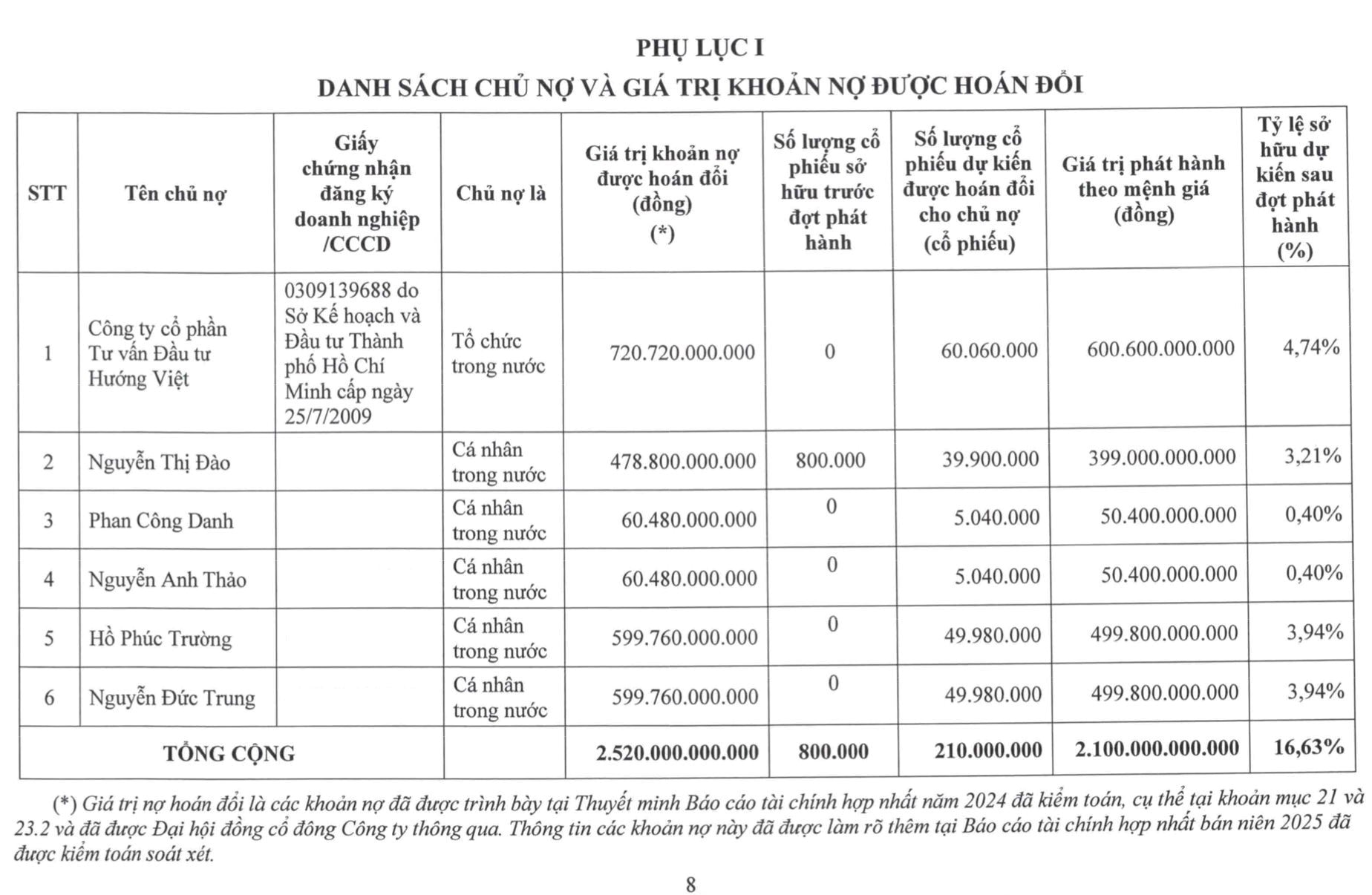

Simultaneously, HAGL is seeking shareholder approval for a plan to issue 210 million shares to convert VND 2,520 billion in bond debt, with a conversion rate of VND 12,000 of debt for 1 share. The six creditors who will receive shares include Huong Viet and the aforementioned five individuals.

“NCB’s Solution to Large-Scale Travel Agencies’ Liquidity Issues”

“National Commercial Joint Stock Bank (NCB) has unveiled a range of tailored credit solutions exclusively for large enterprises in the securities and entertainment tourism industries. These innovative financial offerings are designed to empower businesses with enhanced cash flow management, bolstered competitive advantage, and the ability to seize emerging growth opportunities.”

“Tailored Financial Solutions for Tourism, Entertainment, and Securities Giants: NCB’s Promise”

“National Commercial Joint Stock Bank (NCB) has unveiled a range of tailored credit solutions exclusively for large enterprises in the securities and entertainment tourism industries. These innovative financial offerings are designed to empower businesses with enhanced cash flow management, enabling them to boost their competitive edge and seize emerging growth opportunities.”

A Tale of Contrasting Fortunes: The Intriguing Story of “Bầu” Đức and His Son

“Amidst a flurry of trading activity, Doan Nguyen Duc, Chairman of Hoang Anh Gia Lai Joint Stock Company, registered to sell 25 million HAG shares. In a fascinating turn of events, his son, Doan Hoang Nam, stepped in and registered to purchase 27 million shares through either matched orders or negotiated deals. This intriguing development has sparked interest among investors and market observers alike.”

The Ultimate Urban Lifestyle: Hoang Huy New City Leads the Way in Experiential Living and Consumer Trends

“The term ‘Culture Industry’ is no longer a mere macroeconomic concept. When viewed through the lens of ‘Festival Economics’, it unveils a treasure trove of opportunities for forward-thinking commercial real estate ventures. Hoang Huy New City in Hai Phong, Vietnam, is a trailblazer in this regard, pioneering a sustainable and profitable model that others are sure to emulate.”