I. MARKET DEVELOPMENT OF WARRANTS

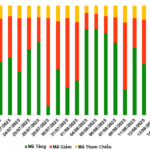

As of the trading session ending on August 19, 2025, the market witnessed 144 advancing codes, 89 declining codes, and 26 reference codes.

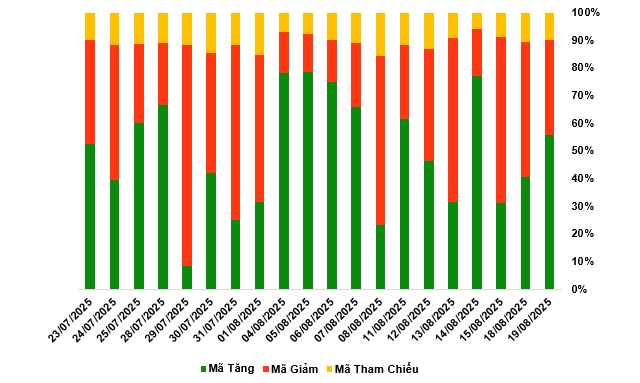

Market breadth over the last 20 sessions. Unit: Percentage

Source: VietstockFinance

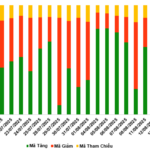

During the trading session on August 19, 2025, buyers returned to lead the market, causing most of the warrant codes to increase in price. Specifically, the large warrant codes in the group that increased in price were CVPB2513, CVIC2502, CVHM2502, and CMBB2511.

Source: VietstockFinance

The total market trading volume in the session of August 19 reached 76.01 million CW, up 4.62%; the trading value reached VND 197.19 billion, up 1.85% compared to the session of August 18. Of which, CHPG2406 was the code leading the market in volume with 2.97 million CW; CVPB2501 led in trading value with VND 17.1 billion.

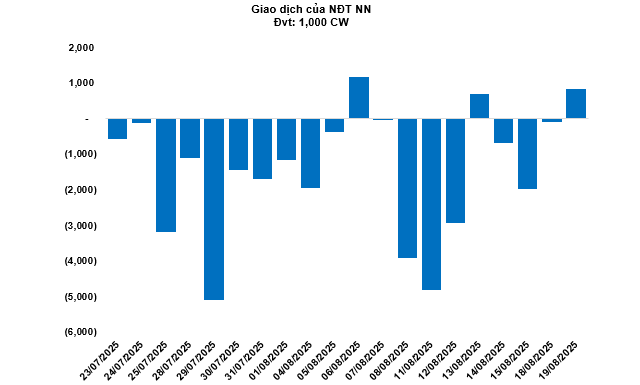

Foreign investors returned to net buy in the session of August 19, with a total net buy value of 831,100 CW. In particular, CSTB2523 and CHPG2514 were the two codes that were net bought the most.

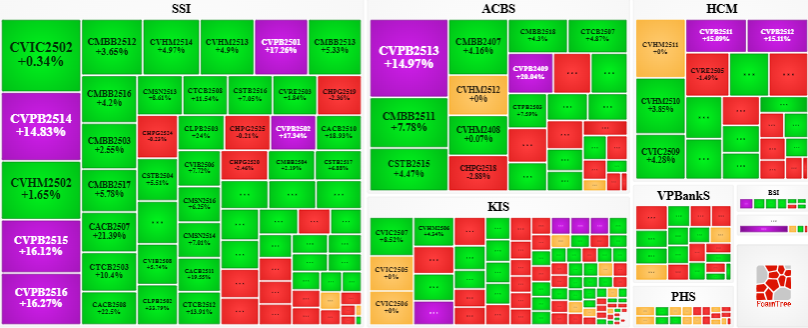

Securities companies SSI, ACBS, HCM, KIS, and VPBank are currently the organizations with the most warrant codes in the market.

Source: VietstockFinance

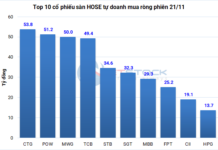

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT VALUATION

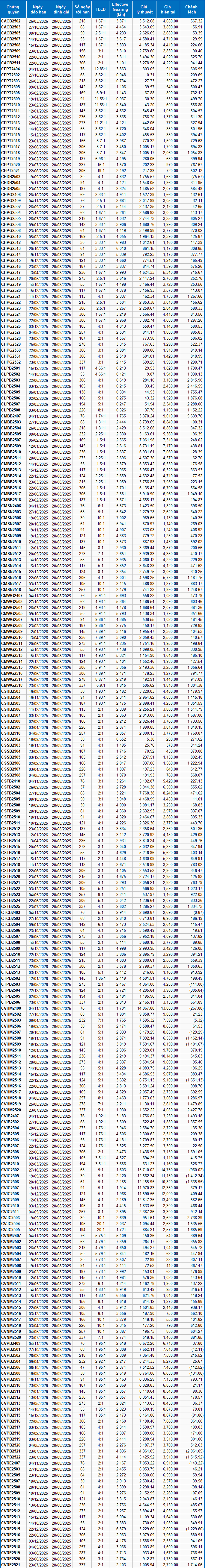

Based on the valuation method suitable for the initial period of August 20, 2025, the reasonable prices of the warrants currently traded in the market are as follows:

Source: VietstockFinance

Note: The opportunity cost in the valuation model is adjusted to suit the Vietnamese market. Specifically, the risk-free bill interest rate (government bills) will be replaced by the average deposit interest rate of large banks with term adjustments suitable for each type of warrant.

According to the above valuation, CVPB2521 and CVHM2515 are currently the two warrant codes with the most attractive valuations.

The higher the effective gearing ratio of the warrant codes, the greater the increase/decrease in price relative to the underlying stock. Currently, CVNM2512 and CVRE2514 are the two warrant codes with the highest effective gearing ratios in the market.

Department of Economic Analysis & Market Strategy, Vietstock Consulting Department

– 18:58 19/08/2025

“Covered Call Options Market: Optimism Prevails on August 14, 2025”

The trading session on August 14, 2025, concluded with a mixed performance across the market. Out of all the stocks traded, 200 witnessed an increase in their value, while 44 declined, and 15 remained unchanged. Foreign investors turned net sellers, offloading a net value of 688,700 CW worth of stocks.

The Stock Market Tug-of-War: Pawn Shop IPO Debuts

The domestic stock market witnessed a tug-of-war during the weekend session (8/8) as large-cap stocks faced corrective pressures. Today, F88’s stock debuted, marking the first time a pawnshop business listed and traded on the stock exchange.

Market Beat: Green Dominance, VN-Index Extends Gains

The trading session concluded with significant gains, as the VN-Index surged by 26.56 points (+1.72%), closing at 1,573.71. Meanwhile, the HNX-Index also witnessed a robust increase of 2.54 points (+0.95%), ending the day at 268.66. The market breadth was strongly positive, with 529 advancing stocks versus 254 declining ones. This bullish sentiment was echoed in the VN30 basket, where 28 stocks climbed while only 2 witnessed losses.