Market liquidity increased compared to the previous trading session, with the VN-Index matching volume reaching over 2.23 billion shares, equivalent to a value of more than 60.6 trillion VND; HNX-Index reached more than 203 million shares, equivalent to a value of more than 4.2 trillion VND.

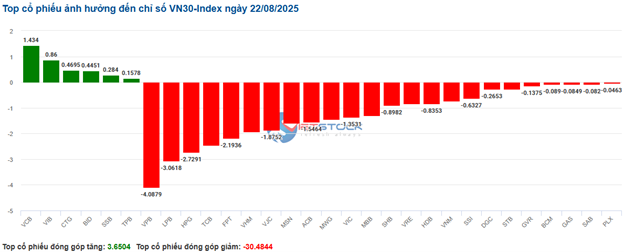

VN-Index opened the afternoon session with strong fluctuations and lasted with the sellers being slightly dominant, causing the index to fail to regain the reference level and closed in a rather pessimistic red. In terms of impact, VPB, TCB, HPG, and GVR were the codes that had the most negative impact on the VN-Index with more than 13.2 points decrease. On the contrary, BID, VCB, MSB, and NAB were the codes that remained green and contributed more than 3.1 points to the overall index.

| Top 10 stocks with the strongest impact on the VN-Index on August 22, 2025 (in points) |

Similarly, the HNX-Index also had a rather pessimistic movement, with the index negatively affected by the codes NVB (-8.79%), HUT (-9.9%), MBS (-6.39%), SHS (-5.64%)…

|

Source: VietstockFinance

|

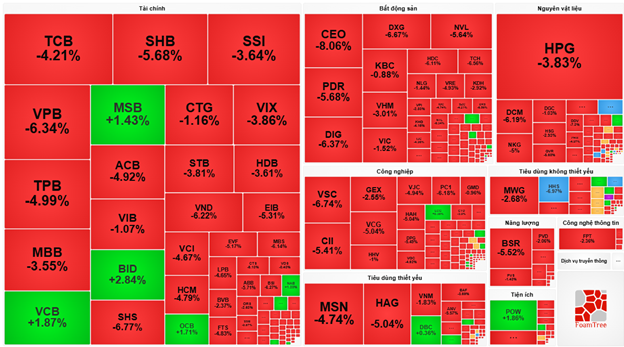

At the close, red dominated all sectors. The energy sector was the group with the sharpest decline in the market, down 4.4%, mainly due to codes BSR (-6.86%), PLX (-2.57%), PVS (-2.29%), and OIL (-4.07%). This was followed by the materials and financial sectors, which fell 3.94% and 2.78%, respectively.

In terms of foreign trading, foreigners continued to sell a net of more than 1,342 billion VND on the HOSE exchange, focusing on codes HPG (1,044.93 billion), VPB (325.72 billion), STB (120.35 billion), and VNM (96.83 billion). On the HNX exchange, foreigners sold a net of more than 50 billion VND, focusing on IDC (27.64 billion), SHS (20.58 billion), MBS (14.58 billion), and PVS (12.38 billion) codes.

| Foreign buying and selling movements |

Morning session: Selling pressure mounts, the market sinks deep into the red

The pressure from large-cap stocks is increasing, making the market’s recovery fragile. The VN-Index temporarily halted at mid-session at the 1,646.06 mark (-2.48%); HNX-Index also fell 3.93% to 273.2 points. Market breadth showed overwhelming selling pressure, with 640 stocks declining and only 144 stocks advancing.

Source: VietstockFinance

|

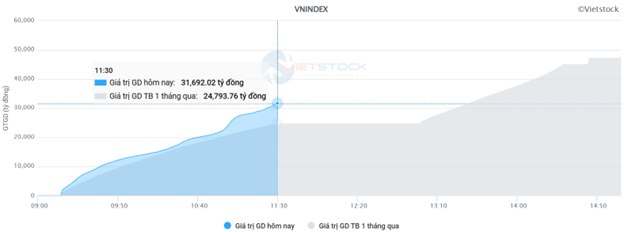

Liquidity increased rapidly towards the end of the morning session with the market’s plunge. Trading value on the HOSE exchange reached nearly 32 trillion VND, up 28% compared to the 1-month average. Similarly, trading on the HNX exchange also increased in the late morning session to more than 2.2 trillion VND.

Source: VietstockFinance

|

A series of large-cap stocks that led the VN-Index in recent days reversed. VPB, VHM, TCB, and HPG are currently the stocks with the most negative impact, taking away a total of 12 points from the VN-Index. Meanwhile, only VCB and BID are making significant efforts to hold on to the green, keeping 4.5 points for the overall index.

The market sank deep into the red, with declines ranging from 1-3.5% in most sectors. Materials and energy temporarily “bottomed out” with a decline of more than 3% as selling pressure dominated across the board. Notable stocks include HPG (-3.83%), DCM (-6.19%), NKG (-5%), HSG (-2.93%), GVR (-5.68%), DPM (-3.66%), PHR (-4.97%), DDV (-7.3%), BFC hitting the floor; BSR (-5.52%), PLX (-1.36%), PVS (-1.43%), PVD (-2.06%), OIL (-3.25%), and PVC (-4.17%).

Key sectors such as real estate and finance have not shown more positive signals. In fact, many stocks have started to approach their floor prices, such as CEO, DXG, TCH, DIG, NVL, SCR; VPB, SHB, SHS, VND, MBS,…

Source: VietstockFinance

|

In terms of foreign trading, selling pressure continued to dominate with a net sell value of nearly 1.4 trillion VND on all three exchanges. Notably, HPG was sold off compared to the rest with more than 755 billion VND. Since the beginning of the third quarter of 2025, this stock has also been prominent on this list with a cumulative net sell value of nearly 3 trillion VND, second only to FPT (over 5 trillion VND).

| Top 10 stocks with the strongest foreign buying and selling in the morning session of August 22, 2025 |

10:30 AM: Buyers lack determination, VN-Index continues to struggle

The breadth continued to lean towards the red, although buying demand appeared, but sellers still had the upper hand, causing the main indices to fail to regain the reference level. As of 10:30, the VN-Index fell 19.09 points, trading around 1,668 points. The HNX-Index fell 6.79 points, trading around 277 points.

Stocks in the VN30 basket are performing with a slightly dominant red color, and only a few codes remain positive. Specifically, VPB, LPB, HPG, and TCB took away 4.08 points, 3.06 points, 2.72 points, and 2.46 points from the index, respectively. In contrast, VCB, VIB, CTG, and BID were the few bank codes that maintained buying demand and contributed more than 3.2 points to the VN30-Index.

Source: VietstockFinance

|

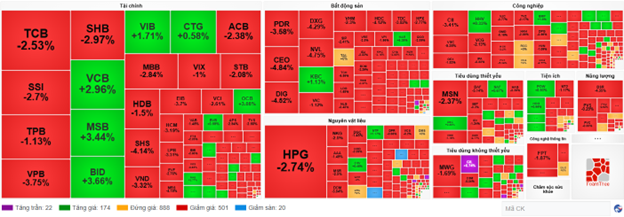

Red dominated most sectors, creating a rather bleak picture. The information technology and energy sectors were under strong selling pressure, falling 1.77% and 1.67%, respectively. Specifically, FPT fell 1.67%, CMG fell 2.88%, ELC fell 2.91%, BSR fell 4.01%, PLX fell 0.81%, and OIL fell 1.63%.

In addition, the two large-cap sectors of finance and real estate continued to face strong selling pressure and negatively affected the overall market. In particular, red appeared in bank codes such as VPB down 4.27%, TCB down 2.41%, MBB down 2.48%, ACB down 2.38%, and in large real estate codes such as VHM down 1.8%, VIC down 0.72%, BCM down 2.15%, and VRE down 2.47%.

Compared to the beginning of the session, buyers and sellers struggled, with more than 880 codes standing still and sellers slightly dominating with 501 codes falling (20 floor codes) while 174 codes rose (22 ceiling codes).

Source: VietstockFinance

|

Opening: Declines across the board, VN-Index loses points at the opening bell

The market opened the morning session in a negative atmosphere, with red dominating most sectors. In particular, the VN30 index had the most negative impact as most of the stocks in this group fell.

A series of large-cap VN30 stocks fell sharply, such as LPB, FPT, VIC, VHM, TCB… Only a few codes such as VIB, STB, and VCB remained slightly positive.

The real estate sector was the group that put the most pressure on the overall market, with the number of red codes dominating. Specifically, VIC fell 1.28%, VHM fell 2%, VRE fell 1.64%, and KDH fell 0.84%.

In addition, the information technology sector was no less pessimistic. This was mainly due to the decline of leading stocks such as FPT (-1.67%), CMG (-1.44%), ELC (-0.67%)… Some small-cap stocks with negative impacts also affected the sector’s index, such as POT (-8.68%) and SBD (-1.28%).

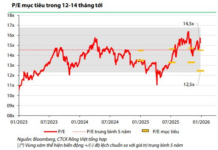

Stock Market Wrap-up: A Peak Pause

The VN-Index struggled during the week’s final session as intense profit-taking pressure drowned the market. This development mirrors late July 2025, when the rally stalled after an extended uptrend. The upcoming trading sessions will be pivotal in determining whether the market is taking a breather before resuming its ascent or transitioning into a more distinct corrective phase.

The King of Stocks Reigns Supreme: What Do the Experts Say?

The surge in bank stock prices is not a fleeting phenomenon but a result of a confluence of factors: robust business fundamentals, conducive monetary and legal policies, market reforms, and a stable macroeconomic environment. However, the differentiation will become more pronounced, and only banks with strong governance, cheap capital advantages, a thriving digital ecosystem, and a robust asset structure will sustain their allure.

“If I Had Invested in Stocks Instead of Playing it Safe, I Could’ve Afforded That Car”

While bank savings accounts offer a meager 5-6% annual interest rate, the stock market presents a tantalizing opportunity for superior returns. This has prompted many to reconsider their once “safe” choice.

“NCB’s Solution to Large-Scale Travel Agencies’ Liquidity Issues”

“National Commercial Joint Stock Bank (NCB) has unveiled a range of tailored credit solutions exclusively for large enterprises in the securities and entertainment tourism industries. These innovative financial offerings are designed to empower businesses with enhanced cash flow management, bolstered competitive advantage, and the ability to seize emerging growth opportunities.”

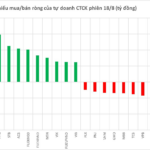

The Stock Market’s Stealthy Strategists: In-House Traders Unveil their Tactics with a $9 Million Shopping Spree on August 18th.

The proprietary securities firms continued their net buying streak on the HoSE, with a total value of 208 billion VND. The focus was on the leading technology stock, which saw a significant boost in trading volume and value. This strategic move by the proprietary firms showcases their confidence in the tech sector’s potential and strengthens their position in the market.