I. MARKET ANALYSIS OF SECURITIES AS OF AUGUST 19, 2025

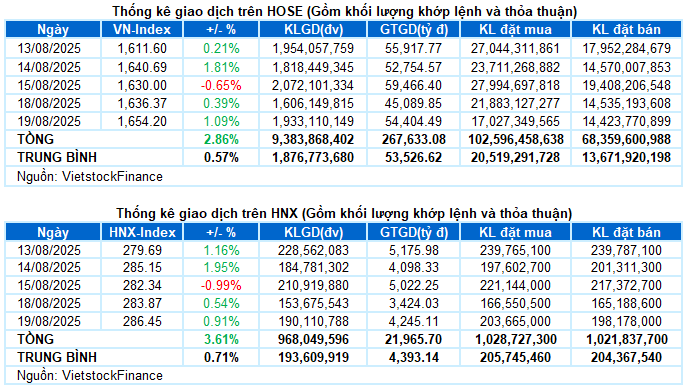

– The main indices continued to gain points during the trading session on August 19. VN-Index increased by 1.09%, reaching 1,654.2 points. HNX-Index also rose by 0.91%, reaching 286.45 points.

– The matching volume on the HOSE floor increased by 18.2%, reaching nearly 1.8 billion units. HNX recorded more than 186 million units, an increase of 22.7% compared to the previous session.

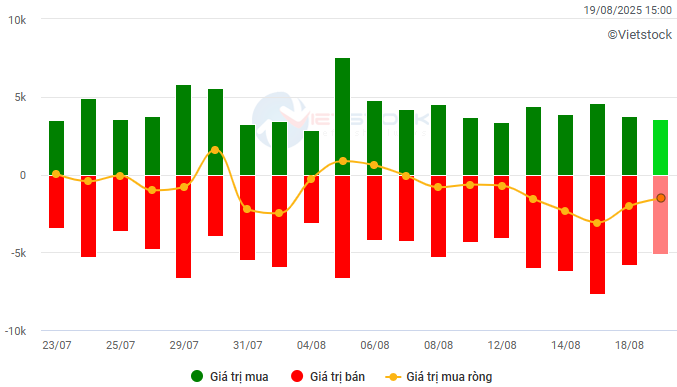

– Foreign investors continued to net sell VND 1.5 thousand billion on the HOSE floor but returned to net buy slightly on the HNX floor with a value of more than VND 13 billion.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

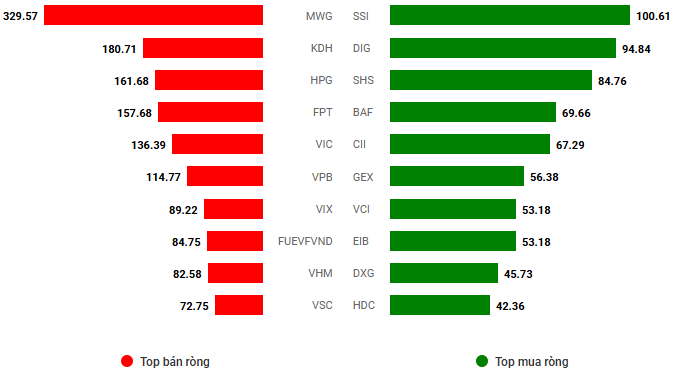

Net trading value by stock code. Unit: VND billion

– The market continued to break strongly in the trading session on August 19. VN-Index quickly conquered the 1,650-point mark after less than half an hour of trading. The spread of gains helped the index trade above this threshold until the early afternoon session. Buying pressure even increased further, pushing the VN-Index up to the 1,665-point mark. Although it could not maintain this high until the end of the session, the VN-Index still closed at 1,654.2 points, up nearly 18 points compared to the previous session.

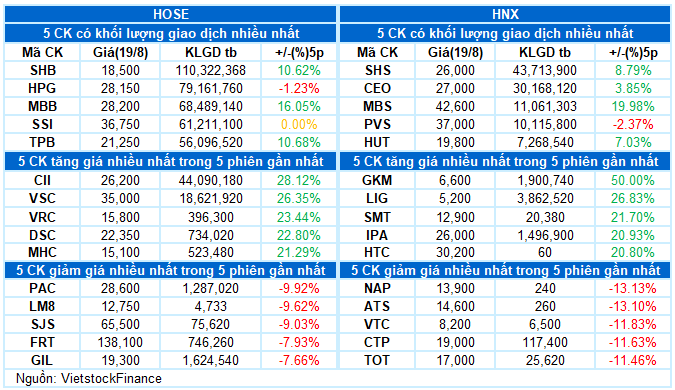

– In terms of impact, banks were the main drivers in today’s session, accounting for 8/10 positions in the top contributing stocks. VPB led with a 4.3-point gain, followed by TCB, LPB, ACB, and HDB, which also brought in a total of nearly 8 points for the VN-Index. Meanwhile, MWG had the most significant negative impact, causing the index to lose 0.7 points.

– VN30-Index broke through 24 points, reaching 1,810.46 points. Buyers dominated with 16 codes increasing, 10 codes decreasing, and 4 codes standing. Of which, VPB topped the list with a brilliant purple color. Following was LPB, up 6.7%, HDB up 6.6%, along with TPB and ACB both up more than 5%. On the downside, MWG was at the bottom with a decrease of 2.9%.

In terms of sectors, the energy sector index continued to lead the market with a gain of 2.47%, but mostly thanks to the brilliant purple color of the largest capitalization stock in the sector, BSR. While most of the remaining stocks were neutral around the reference level.

The most notable highlight was the financial group, with buying pressure showing no signs of cooling despite the impressive recent gains. A series of stocks broke strongly, such as VPB, BSI, DSE, VDS, and DSC, which increased to the maximum daily limit, SSI (+2.65%), VCI (+3.15%), TCB (+3.29%), TPB (+5.46%), ACB (+5.18%), HDB (+6.56%), LPB (+6.73%), SHS (+2.77%), CTG (+2.27%),…

In addition, many codes in other sectors also impressively hit the daily limit, such as DIG, KBC, TIG, SGR, NDN, HPX (real estate); CII, DPG, LCG, HVN, SAM, DRH (industry); BAF, OGC, OCH (essential consumption) or PET, NAG, TTF (non-essential consumption).

On the other hand, the materials sector was at the bottom with a decrease of 0.54% as red spread across large-cap stocks in the sector such as HPG (-0.88%), DGC (-1.16%), DCM (-3.11%), DPM (-1.57%), NTP (-1.72%), PHR (-1.94%), NKG (-1.45%), VCS (-1.36%), and CSV (-1.12%).

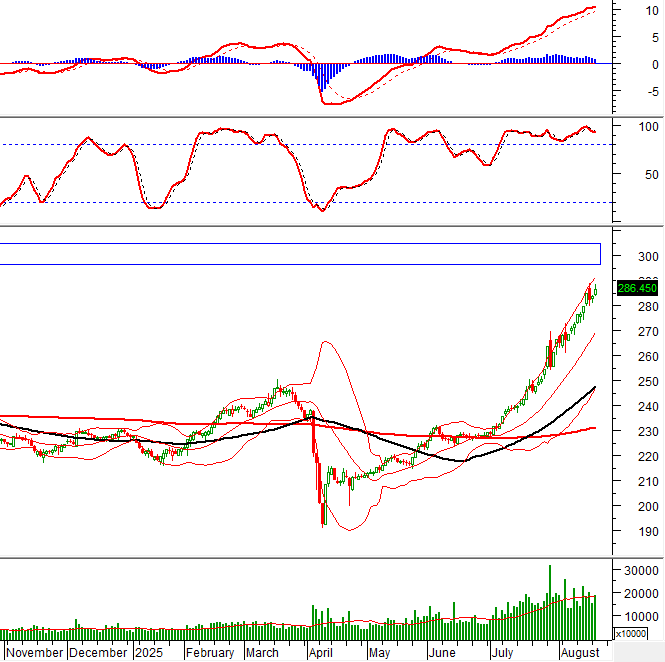

VN-Index continued to set a new peak with trading volume recovering above the 20-session average. The upward trend of the index is still being consolidated as the MACD indicator continues to widen the gap with the Signal line after a buy signal. However, the risk of intra-session volatility in the short term should be noted if the Stochastic Oscillator indicator continues to weaken.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – MACD continues to widen the gap with the Signal line

VN-Index continued to set new highs, with trading volume recovering above the 20-session average. The upward trend of the index is still being consolidated, with the MACD indicator continuing to widen the gap with the Signal line after a buy signal.

However, the risk of intra-session volatility in the short term should be noted if the Stochastic Oscillator indicator continues to weaken.

HNX-Index – Setting a new 52-week high

HNX-Index narrowed its gains towards the end of the session but still set a new 52-week high.

The upward trend of the index is being consolidated as the MACD indicator remains positive after giving a buy signal since the beginning of July 2025. If this is maintained, the index could target the old peak of August 2022 (equivalent to the 295-305-point region) in the coming time.

Analysis of Money Flow

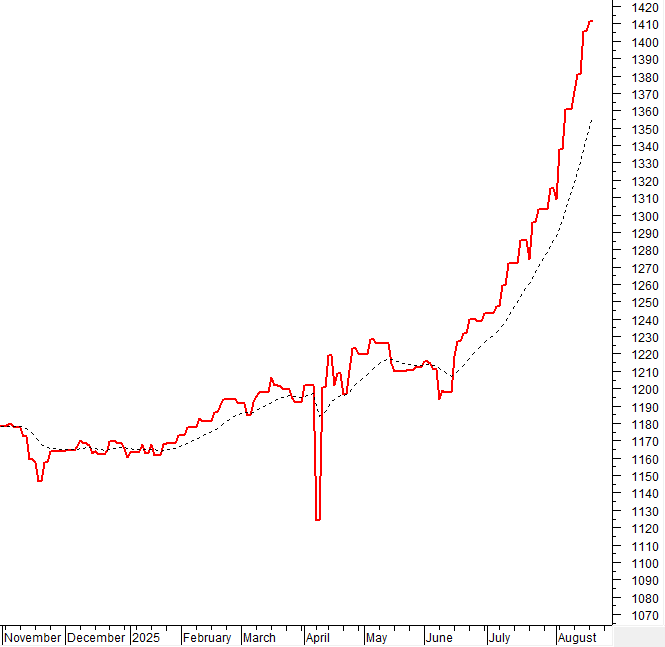

Movement of smart money flow: The Negative Volume Index indicator of VN-Index is currently above the EMA 20 days. If this status continues in the next session, the risk of an unexpected drop (thrust down) will be limited.

Foreign capital flow movement: Foreign investors continued to net sell in the trading session on August 19, 2025. If foreign investors maintain this action in the coming sessions, the situation will become more pessimistic.

III. MARKET STATISTICS AS OF AUGUST 19, 2025

Department of Economic and Market Strategy Analysis, Vietstock Consulting

– 17:05 19/08/2025

Market Pulse for August 22: Pessimism Prevails as Foreign Investors Heavily Sell Off HPG

The market closed with notable losses, as the VN-Index dipped by 42.53 points (-2.52%), settling at 1,645.47. Likewise, the HNX-Index witnessed a decline of 11.91 points (-4.19%), ending the day at 272.48. The overall market breadth was dominated by decliners, with 647 stocks trading lower against 180 gainers. This bearish sentiment was echoed in the VN30 basket, where 26 stocks closed in the red versus just 4 in the green.

Stock Market Wrap-up: A Peak Pause

The VN-Index struggled during the week’s final session as intense profit-taking pressure drowned the market. This development mirrors late July 2025, when the rally stalled after an extended uptrend. The upcoming trading sessions will be pivotal in determining whether the market is taking a breather before resuming its ascent or transitioning into a more distinct corrective phase.

The King of Stocks Reigns Supreme: What Do the Experts Say?

The surge in bank stock prices is not a fleeting phenomenon but a result of a confluence of factors: robust business fundamentals, conducive monetary and legal policies, market reforms, and a stable macroeconomic environment. However, the differentiation will become more pronounced, and only banks with strong governance, cheap capital advantages, a thriving digital ecosystem, and a robust asset structure will sustain their allure.

The Stock Market’s Stealthy Strategists: In-House Traders Unveil their Tactics with a $9 Million Shopping Spree on August 18th.

The proprietary securities firms continued their net buying streak on the HoSE, with a total value of 208 billion VND. The focus was on the leading technology stock, which saw a significant boost in trading volume and value. This strategic move by the proprietary firms showcases their confidence in the tech sector’s potential and strengthens their position in the market.