According to the Vietnam Steel Association (VSA), domestic steel consumption increased by 10.2% to over 15.7 million tons in the first half of 2025, as Vietnam ramped up public investment and the real estate market rebounded.

Notably, the domestic consumption of hot-rolled coil (HRC) used in galvanizing enterprises surged to 40%, up from just 15-20% in the same period last year. This increase is partly due to the anti-dumping duties imposed on HRC imports from China and the additional supply from Hoa Phat’s Dung Quat 2 plant.

Hoa Phat shared that HRC consumption has outpaced production, and the company has already sold off its inventory from the previous quarter.

During this period, domestic steel prices remained stable due to high demand and the positive impact of anti-dumping duties. Construction steel prices were unchanged from the same period last year and rose slightly by 1% compared to the previous quarter.

In contrast, total steel exports decreased by 13% to nearly 5.7 million tons due to challenges such as tariff barriers, trade remedies, and geopolitical conflicts.

Construction steel benefits from public investment

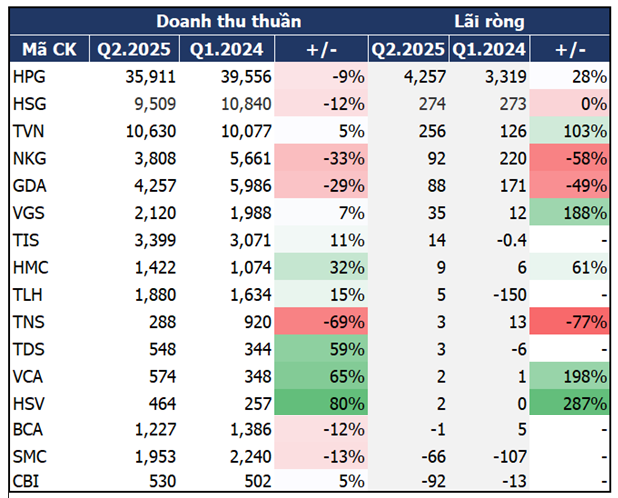

Hoa Phat (HPG) reaffirmed its leading position in the steel industry with impressive business results in Q2 2025. Despite a 9% decrease in net revenue to VND35,911 billion, net profit surged 28% to VND4,257 billion due to improved profit margins and optimized operating costs.

In this period, the “steel king” recorded sales volume of 2.6 million tons of HRC, construction steel, high-quality steel, and steel billets, up 9% from the previous quarter and 18% from the same period last year.

The Hoa Phat Dung Quat 2 steel complex is set to complete its sixth blast furnace in September 2025. Following this expansion, the group’s total steel production capacity is expected to reach 16 million tons per year, including 9 million tons of HRC, fully meeting domestic demand for this product.

Another industry leader, Vietnam Steel Corporation (VNSteel, UPCoM: TVN), also made a breakthrough with a 5% increase in net revenue to VND10,630 billion and a staggering 103% surge in net profit to VND256 billion compared to the same period last year.

Other steel companies also reported positive results. Viet-Duc Steel Pipe Joint Stock Company (HNX: VGS) achieved a 7% increase in revenue to VND2,120 billion and a remarkable 188% jump in net profit to VND35 billion compared to the previous year. Similarly, Gang Thep Thai Nguyen Joint Stock Corporation (UPCoM: TIS) posted a net profit of VND14 billion, a significant improvement from its loss in the same period last year.

Financial performance of steel companies in Q2 2025

Unit: Billion VND

Source: VietstockFinance

|

Export-oriented galvanized steel group faces challenges

In contrast to the positive performance of the domestic-focused steel companies, the export-oriented galvanized steel group faced a gloomy outlook.

Nam Kim Steel Joint Stock Company (HOSE: NKG) witnessed a significant decline in revenue, falling by 33% to VND3,808 billion, which led to a 58% drop in net profit to VND92 billion.

Similarly, Dong A Steel Joint Stock Company reported a nearly 50% decrease in net profit to VND88 billion due to anti-dumping measures in its export markets.

Hoa Sen Group (HSG), however, maintained relative stability with a 12% decrease in revenue to VND9,509 billion and a net profit of VND274 billion, almost unchanged from the previous year. This resilience can be attributed to their strategic focus on the domestic market.

Among steel trading companies, while Thep Tien Len (HOSE: TLH) and Kim Khi TP.HCM (HOSE: HMC) improved their net profits, Dau Tu Thuong Mai SMC (HOSE: SMC) continued to incur heavy losses of VND66 billion due to the lack of improvement in their core business and the need to make additional provisions for bad debts.

Positive outlook for the second half of 2025

The Vietnam Steel Association (VSA) forecasts a strong recovery in the domestic market in the second half of 2025, despite the typically rainy start to Q3 and the slow improvement in the real estate sector. VSA remains optimistic about stable iron and steel consumption, with construction steel prices expected to range between VND14-15 million per ton.

MBS Securities believes that with Vietnam’s economic growth target of 8% in 2025 and the expected double-digit growth in the 2026-2030 period, the demand for steel in construction and manufacturing is likely to continue its stable upward trajectory.

“Strong consumption will continue to drive domestic steel prices in the second half of 2025,” said MBS analysts.

Vu Hao

– 11:53 19/08/2025

The Grand Opening and Launch of Saigon Marina International Financial Centre Tower

On the morning of August 19, 2025, the grand opening and inauguration of the Saigon Marina International Financial Centre (Saigon Marina IFC) took place at 02 Ton Duc Thang, Saigon Ward, Ho Chi Minh City. The event was graced by the presence of esteemed leaders from the Communist Party of Vietnam, the Government, and the People’s Committee of Ho Chi Minh City, along with representatives from various central ministries and sectors. The ceremony was also attended by dignitaries from foreign consulates and international organizations, as well as high-ranking executives from numerous domestic and international corporations, financial institutions, and businesses.

The New Industrial Revolution: Unveiling the Northwest Hoa Xa Industrial Park – The Epicenter of Investment in North Central Vietnam

On August 19, 2025, the groundbreaking ceremony for the Tay Bac Ho Xa Industrial Park Infrastructure Investment and Business Project (Tay Bac Ho Xa Industrial Park) took place in Vinh Linh district, Quang Tri province. This event marked a significant turning point in the province’s journey towards sustainable industrial development post-merger.

“AEON Mall’s Grand Opening in the Mekong Delta: A Shopping Paradise in Tan An City”

AEON Mall is thrilled to announce the opening of its very first shopping center in the Mekong Delta region, AEON Tan An. Slated to open its doors in September 2025, AEON Tan An promises to be a premier shopping and lifestyle destination for locals and visitors alike. With a diverse range of retail and entertainment options, this new mall is set to revolutionize the way people in the vibrant Mekong Delta experience modern amenities and leisure activities.

The Resolution to Surpass: Vietnam’s Transport Sector Aims to Shatter Records with the Early Completion of the 23-Trillion VND Highway Project.

The Dong Dang – Tra Linh Expressway, a monumental infrastructure project, spans an impressive 121 kilometers in length and is developed in two phases with a total investment of nearly VND 23,000 billion. Phase 1, measuring 93.35 kilometers, broke ground on January 1, 2024, marking the beginning of a transformative journey for the region’s connectivity and prosperity.

“Sabeco’s Bold Move: Aiming for a 32% Increase in Cu Chi Brewery’s Capacity to 350 Million Liters Annually, Unfazed by Repeated Denials Since 2019.”

The Sabeco Cu Chi brewery has yet to operate at full capacity; it produced 179.2 million liters in 2023, a number that dipped to 166.7 million liters in 2024. However, there are plans to increase production to 211 million liters in 2025, which is still shy of its full capacity of 264 million liters annually.