I. MARKET DEVELOPMENT OF WARRANTS

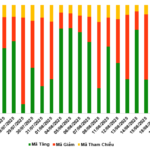

At the close of the trading session on August 18, 2025, the market witnessed 105 advancing codes, 126 declining codes, and 28 unchanged codes.

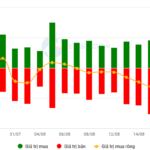

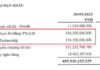

Market breadth over the last 20 sessions. Unit: Percentage

Source: VietstockFinance

In the trading session on August 18, 2025, sellers continued to drive the market, resulting in a decline for most of the warrant codes. Specifically, the large-cap warrants in the declining group were CVHM2502, CSTB2515, CMBB2407, and CVIC2509.

Source: VietstockFinance

The total trading volume in the market during the August 18 session reached 72.65 million CW, a decrease of 20.89%; the trading value reached VND 193.6 billion, a decrease of 14.18% compared to the August 15 session. Among these, CVHM2513 was the code that led the market in terms of volume and value, with a total volume of 3.57 million CW, equivalent to a value of VND 14.41 billion.

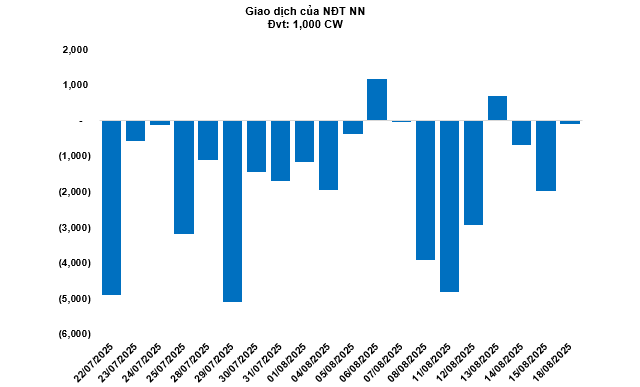

Foreign investors continued to sell net in the August 18 session, with a total net selling volume of 98,500 CW. CSSB2505 and CHPG2512 were the two codes that experienced the highest net selling.

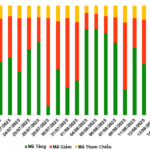

Securities companies SSI, ACBS, HCM, KIS, and VPBankS are currently the organizations with the most warrant codes in the market.

Source: VietstockFinance

II. MARKET STATISTICS

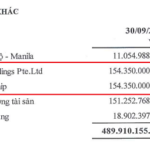

Source: VietstockFinance

III. WARRANT VALUATION

Based on the valuation method suitable for the initial stage as of August 19, 2025, the fair prices of the warrants currently traded in the market are presented as follows:

Source: VietstockFinance

Note: The opportunity cost in the valuation model is adjusted to suit the Vietnamese market. Specifically, the risk-free rate (government bonds) will be replaced by the average deposit interest rate of large banks, with term adjustments suitable for each type of warrant.

According to the above valuation, CVHM2515 and CVIC2505 are currently the two warrant codes with the most attractive valuations.

The higher the effective gearing of a warrant code, the greater the increase/decrease in its price relative to the underlying stock. Currently, CVNM2512 and CVRE2514 are the two warrant codes with the highest effective gearing in the market.

Economics & Market Strategy Analysis Division, Vietstock Consulting Department

– 18:58 18/08/2025

“VN-Index: A Clear Path to Conquer the 1,700-Point Threshold?”

The VN-Index climbed for the fourth consecutive session, closely hugging the upper band of the Bollinger Bands. While trading volume has been volatile in recent sessions, indicating investor sentiment is not yet firmly established, the rally has been largely driven by large-cap stocks. Nonetheless, the MACD indicator continues to trend upward without showing any signs of weakness, suggesting the VN-Index could soon breach the 1,700-point threshold in upcoming sessions.

“VPB Warrants Surge: Unlocking Market Opportunities on August 20, 2025”

The trading session on August 19, 2025, concluded with positive momentum, as the market witnessed a broad-based rally. A total of 144 stocks advanced, while 89 declined, and 26 remained unchanged. Foreign investors turned net buyers, with a net purchase value of 831,100 CW, indicating a resurgence of confidence in the market.

The VN-Index Soars to New Heights: A Thriving Market with Explosive Liquidity

The VN-Index soared to new heights this afternoon (August 12th), reaching a record high of 1,608.22 points. This surge in market liquidity fueled a vibrant and energetic trading atmosphere.

“Covered Call Options Market: Optimism Prevails on August 14, 2025”

The trading session on August 14, 2025, concluded with a mixed performance across the market. Out of all the stocks traded, 200 witnessed an increase in their value, while 44 declined, and 15 remained unchanged. Foreign investors turned net sellers, offloading a net value of 688,700 CW worth of stocks.

Market Mayhem: Navigating the Storm

The VN-Index experienced vigorous tug-of-war action with above-average trading volume. The MACD indicator continues its upward trajectory, providing a buy signal and reinforcing the positive short-term outlook. However, intense fluctuations within the session are likely to persist as the index forges new peaks.