|

Source: VietstockFinance

|

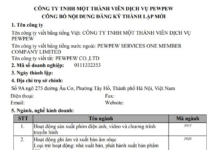

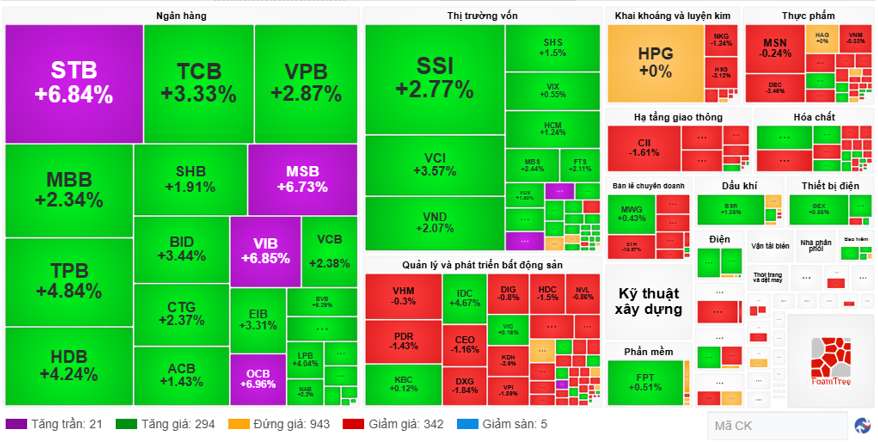

The market closed on August 21 with the VN-Index up 23.64 points to 1,688, while the HNX-Index rose 0.66 points to 284.39. In contrast, the UPCoM-Index fell 0.9 points to 110.58. Total trading value across the market reached nearly VND 56.6 trillion, lower than the recent average. In terms of volume, more than 1.97 billion shares changed hands.

Despite ending the day in positive territory, the market painted a “green on the outside, red on the inside” picture for most of the trading day. A look at the market heat map reveals that funds tended to flow towards banking stocks and several other large-cap stocks.

|

Market Map for August 21

Source: VietstockFinance

|

Specifically, with a 3.74% increase, banking became the second-best performing sector in the market. It’s easy to name the bank stocks that posted impressive gains today, such as VPB up 5.75%, TCB up 2.59%, ACB up 5.18%, HDB up 4.4%, MBB up 1.44%, CTG up 2.37%, BID up 3.93%, LPB up 5.79%, and VCB up 1.9%. Even TPB, STB, MSB, VIB, OCB, and SSB hit the daily limit-up.

The market also saw many other large-cap stocks advancing and providing strong support to the indices, including FPT up 4.09%, SSI up 2.63%, MWG up 2.31%, and VHM and MSN ticking slightly higher.

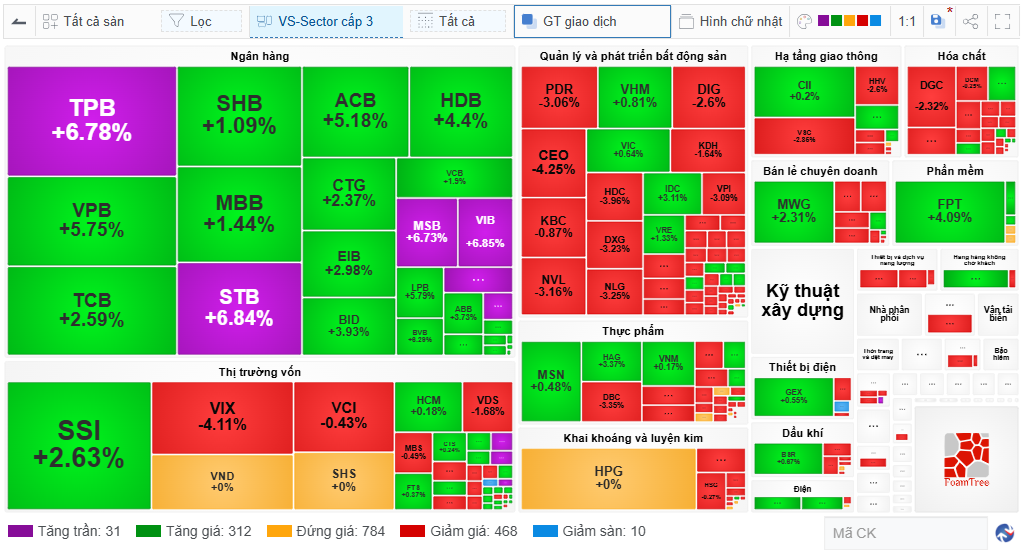

However, the rest of the market painted a gloomier picture, with red dominating most sectors. According to VS-SECTOR, 16 sectors declined, led by hardware and equipment down 2.11%, media and entertainment down 1.45%, telecom services down 1.28%, industrial goods down 1.21%, and personal and household products down 1.05%. Some other sectors with smaller losses but still notable were materials down 0.74%, consumer services down 0.7%, transportation down 0.38%, real estate down 0.13%, and securities down 0.04%.

Among them, securities surprised with a drop at the end of the day, despite a buoyant morning session alongside banks.

|

Most Sectors Declined on August 21

Source: VietstockFinance

|

This market picture became even clearer when looking at the performance by market capitalization. Large Cap rose 1.6%, with VN30-Index, representing the 30 largest stocks in the market, climbing 2.54% to 1,874.91 points. In contrast, Mid Cap fell 0.83% and Small Cap slipped 0.15%. Micro Cap attracted much attention with a strong gain of 5.16%.

Despite the market’s advance to a new high, foreign investors net sold nearly VND 2.5 trillion, marking the 11th consecutive net selling session. The stocks with the largest net selling value were VPB with nearly VND 585 billion, HPG with over VND 343 billion, and CTG with nearly VND 241 billion.

On the buying side, SSI topped with a net buying value of over VND 252 billion, far exceeding the runners-up.

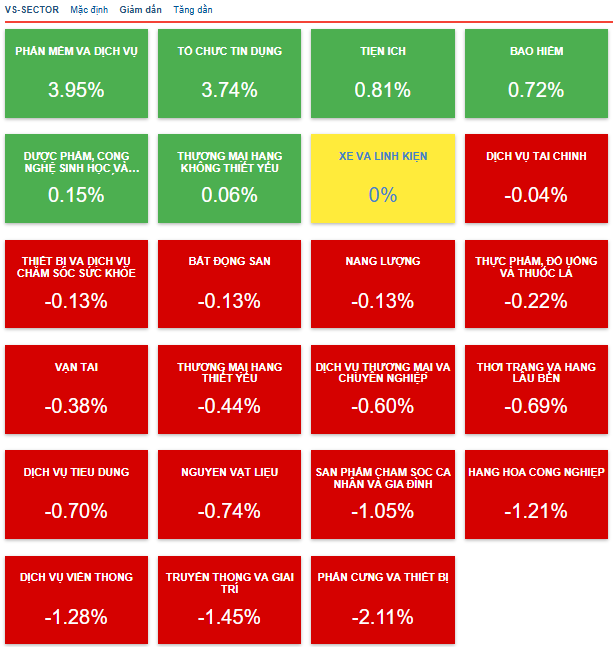

Morning Session: Advancing Despite More Declining Stocks

VN-Index temporarily closed the morning session at 1,683.22, up 18.86 points, while HNX-Index rose 2.42 points to 286.15 and UPCoM-Index gained 1.35 points to 111.03. Despite the gains, the market’s picture showed more declining stocks than advancing ones.

|

Market Advanced but More Declining Stocks

Source: VietstockFinance

|

The market maintained its upward momentum throughout the morning session. However, at the end of the session, there were 333 advancing stocks, lower than 387 declining stocks, while 885 stocks stood still. This indicates that the market’s advance was driven by specific groups of stocks rather than a broad-based rally.

Statistics show that the Large Cap group, up 1.26%, was the main driver of the market in the morning session, mainly thanks to the gains in banking and securities stocks, which rose 3.21% and 1.18%, respectively.

In the banking sector, many stocks hit the daily limit-up, including TPB, STB, MSB, OCB, and VIB, while others posted strong gains, such as TCB, CTG, VPB, HDB, EIB, and BID… In the securities sector, SSI, VND, VCI, MBS, etc., recorded positive gains, with AAS and TVS hitting the daily limit-up. Additionally, some other large-cap stocks also advanced, including HPG and FPT…

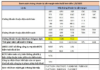

The top 10 stocks influencing the VN-Index reflected this, with VCB contributing nearly 2.6 points, BID nearly 2.2 points, TCB over 2.1 points… In total, the top 10 added nearly 16.7 points to the index, while the bottom 10 took away just over 2.4 points.

Source: VietstockFinance

|

Other market capitalization groups also recorded impressive gains, with Micro Cap surging 4.13% and Small Cap ticking up 0.07%. In contrast, Mid Cap fell 0.22%.

Market liquidity reached over VND 28.5 trillion, with HOSE accounting for more than VND 26 trillion, a decrease compared to the recent average.

In this context, foreign investors also narrowed their trading compared to previous sessions, buying nearly VND 2 trillion and selling over VND 3.2 trillion, resulting in a net sell of over VND 1.2 trillion. The stocks with the largest net sell value were VPB with over VND 420 billion, CTG with nearly VND 116 billion, and HPG with nearly VND 114 billion.

On the buying side, SSI led with a net buying value of over VND 213 billion, far exceeding the runners-up.

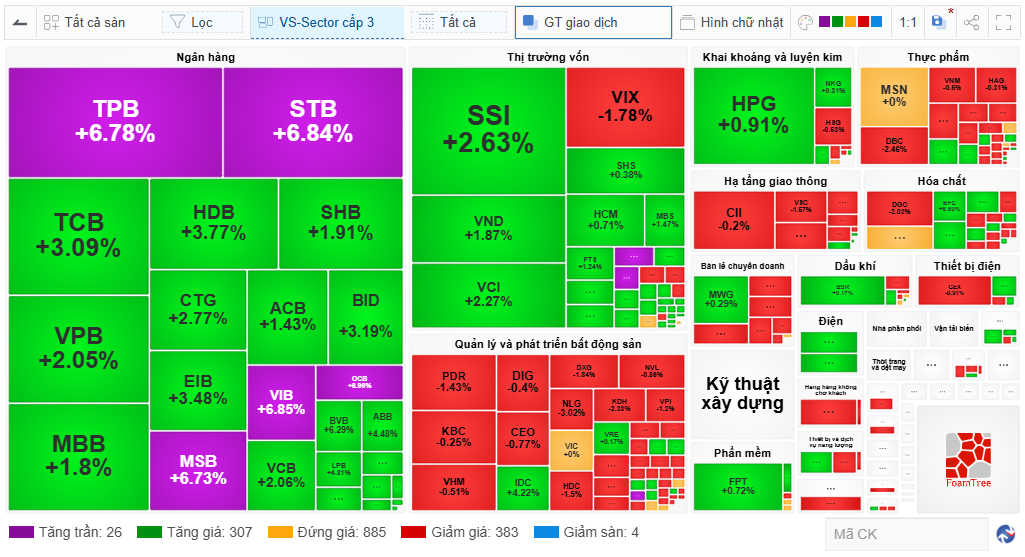

10:40 am: Banking and Securities Lead, VN-Index Surges Over 20 Points

Following the positive momentum from the early morning session, banking and securities stocks continued to advance, driving the market higher. As of 10:30 am, VN-Index climbed 20.31 points to 1,684.67, HNX-Index rose 3.24 points to 286.97, and UPCoM-Index gained 1.42 points to 111.1.

Banking and securities were the top-performing sectors, rising 3.37% and 2.09%, respectively. Given their large market capitalization, this duo significantly “amplified” the market’s gains.

While banking and securities stocks continued to advance, supporting the market’s upward movement, another market pillar, real estate, was painted in red.

Specifically, red dominated most real estate stocks, including VHM down 0.3%, PDR down 1.43%, CEO down 1.16%, HDC down 1.5%, DXG down 1.84%, and KDH down 2.6%…

|

Banking and Securities are the Main Drivers of the Market

Source: VietstockFinance

|

In reality, real estate was just one of the 16 declining sectors, along with food, transportation infrastructure, etc. This number far outweighed the seven advancing sectors.

With a 1.22% gain, VN-Index stood out compared to many other Asian markets. For instance, Shanghai Composite rose 1.04%, Hang Seng increased 0.21%, and All Ordinaries climbed 0.04%. In contrast, Nikkei 225 fell 1.42%, and Singapore Straits Times slipped 0.02%.

Opening: “King” Stocks Surge

Vietnam’s stock market opened the session on August 21 with a positive tone, led by banking stocks. As of 9:30 am, VN-Index gained 12.47 points to 1,676.83, HNX-Index rose 2.95 points to 286.68, and UPCoM-Index ticked up 0.87 points to 110.55. The total trading value across the market reached nearly VND 5.2 trillion.

There were 306 advancing stocks, including 17 stocks hitting the daily limit-up, outnumbering 213 declining stocks, of which four hit the daily limit-down. The remaining 1,086 stocks stood still.

By sector, banking was the top performer, rising 2.64%. Many “king” stocks posted strong gains, including VCB up 2.22%, VPB up 3.97%, TCB up 2.22%, BID up 3.44%, CTG up 1.78%, and LPB up 3.83%… Meanwhile, VIB, MSB, and OCB hit the daily limit-up.

The second-best performing sector was energy, up 1.56%, driven mainly by BSR‘s 3.37% gain.

Securities stocks also performed impressively, climbing 1.2%. Notably, SSI rose 2.35%, VIX gained 1.37%, VND advanced 1.66%, FTS increased 2.24%, VDS surged 4.2%, and TVS hit the daily limit-up.

The situation in Vietnam contrasted with that of Wall Street overnight, where the S&P 500 and Nasdaq Composite continued to fall under pressure from the sharp decline in technology stocks. Investors also considered the mixed earnings results from the retail sector and the recently released minutes of the Federal Reserve’s (Fed) meeting.

At the close of the trading session on August 20, the S&P 500 fell 0.24% to 6,395.78, while the Nasdaq Composite lost 0.67% to 21,172.86. Wednesday’s session marked the fourth consecutive decline for the S&P 500 and the second straight loss for the Nasdaq Composite. Meanwhile, the Dow Jones edged up 16.04 points (equivalent to 0.04%) to 44,938.31.

– 15:55 21/08/2025

“VN-Index: A Clear Path to Conquer the 1,700-Point Threshold?”

The VN-Index climbed for the fourth consecutive session, closely hugging the upper band of the Bollinger Bands. While trading volume has been volatile in recent sessions, indicating investor sentiment is not yet firmly established, the rally has been largely driven by large-cap stocks. Nonetheless, the MACD indicator continues to trend upward without showing any signs of weakness, suggesting the VN-Index could soon breach the 1,700-point threshold in upcoming sessions.

“Vietstock Daily 20/08/2025: Sustaining the Uptrend”

The VN-Index reached new heights, with trading volume recovering above the 20-session average. The upward trend of the index remains robust as the MACD indicator continues to widen the gap with the signal line, providing a strong buy signal. However, investors should be cautious of potential short-term volatility if the Stochastic Oscillator indicator continues to weaken.

Market Pulse for August 22: Pessimism Prevails as Foreign Investors Heavily Sell Off HPG

The market closed with notable losses, as the VN-Index dipped by 42.53 points (-2.52%), settling at 1,645.47. Likewise, the HNX-Index witnessed a decline of 11.91 points (-4.19%), ending the day at 272.48. The overall market breadth was dominated by decliners, with 647 stocks trading lower against 180 gainers. This bearish sentiment was echoed in the VN30 basket, where 26 stocks closed in the red versus just 4 in the green.

Stock Market Wrap-up: A Peak Pause

The VN-Index struggled during the week’s final session as intense profit-taking pressure drowned the market. This development mirrors late July 2025, when the rally stalled after an extended uptrend. The upcoming trading sessions will be pivotal in determining whether the market is taking a breather before resuming its ascent or transitioning into a more distinct corrective phase.

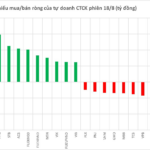

The Stock Market’s Stealthy Strategists: In-House Traders Unveil their Tactics with a $9 Million Shopping Spree on August 18th.

The proprietary securities firms continued their net buying streak on the HoSE, with a total value of 208 billion VND. The focus was on the leading technology stock, which saw a significant boost in trading volume and value. This strategic move by the proprietary firms showcases their confidence in the tech sector’s potential and strengthens their position in the market.