Source: VietstockFinance

|

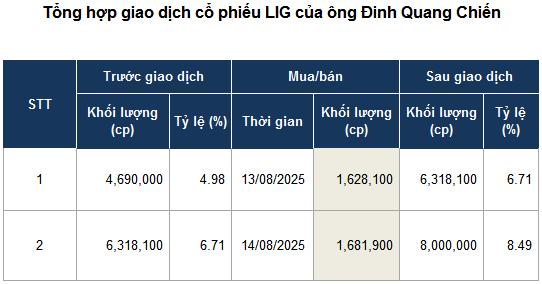

On August 13, Mr. Chien officially became a major shareholder by purchasing over 1.6 million shares, increasing his ownership from 4.98% to 6.71% (equivalent to over 6.3 million shares).

Just a day later, on August 14, Mr. Chien’s ownership in LIG further increased to 8.49% (equivalent to 8 million shares) through the purchase of an additional nearly 1.7 million shares.

Notably, during the two days that Mr. Chien reported changes in ownership, LIG stock also recorded a consecutive three-session ceiling increase (from August 13-15). It is estimated that Mr. Chien spent approximately VND 15.5 billion to become the sole major shareholder of LIG.

| LIG stock price movement from the beginning of 2021 to the session on August 21, 2025 |

In the stock market, despite a strong upward trend in the first half of August and reaching a nearly two-year high, LIG stock is still far from its peak at the end of 2021, with a decrease of more than 74%.

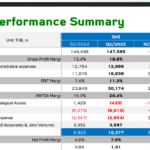

| LIG’s business results over the years |

The current market price of LIG stock is still below par value. This reflects the company’s declining business performance since it achieved record profits in 2021.

| LIG’s business results for the first 6 months over the years |

In the first six months of 2025, LIG‘s business results showed improvement with a net profit of nearly VND 2 billion, reversing the loss of nearly VND 1 billion in the same period last year. However, with a revenue of nearly VND 2,227 billion and a profit of only about VND 2 billion, the company is facing significant pressure from cost prices.

– 13:28 21/08/2025

“Agri-Giant C.P. Vietnam Takes a Hit: Revenue Down 21% Post Sick Pig Scandal”

Charoen Pokphand Foods (C.P. Foods), a leading Thai conglomerate, witnessed a slight dip in its global revenue for Q2 2025, with Vietnam being the primary contributor to this decline.

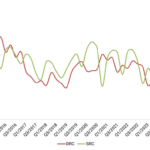

Profits Plummet for Tire Manufacturing Group

The second quarter of 2025 witnessed a distinct dichotomy within the rubber industry, with a clear divide between product manufacturers and latex harvesters. While rubber tappers thrived amidst sustained high latex prices, tire manufacturers faced significant challenges due to soaring raw material costs, resulting in their lowest gross profit margins in a decade.