## HVA Stock Price Surges for the Second Time in 2025

| The HVA stock price has surged for the second time in 2025, as seen in the chart below: |

Prior to this significant surge, HVA sent an explanation to the Hanoi Stock Exchange (HNX), asserting that the stock price fluctuation was due to market supply and demand, not internal factors. The company stated that its business operations remain stable, and it is currently restructuring its investments and deploying blockchain technology projects in line with the government’s encouragement of digital development.

Notably, on August 20, a large transaction of 800,000 shares, equivalent to 5.8% of HVA’s capital, was agreed upon between Metacare Medical Technology Joint Stock Company and Mr. Tran Quang Chien at a price of VND 21,500 per share, totaling VND 17.2 billion. Following this deal, Mr. Chien owns 7.33% of HVA, while Metacare reduced its ownership to 9.58%.

Simultaneously, the company announced the nomination of Mr. Chien to the Board of Directors, likely to be elected at the upcoming extraordinary general meeting on September 13 in Can Tho City. He will replace Mr. Nguyen Chi Cong, who has recently stepped down.

Born in 1991, Mr. Tran Quang Chien is a prominent figure in the field of financial technology. He founded CyStack and developed the ONUS platform, which garnered over five million users before being acquired by Vemanti Group (USA) in 2025. He also co-founded ONUSChain and is currently the CEO of ONUS Labs. HVA anticipates that Mr. Chien’s involvement will enhance their technological capabilities and expand their digital ecosystem to serve tens of millions of users.

Mr. Tran Quang Chien is expected to boost HVA’s investment capabilities in the blockchain field – Photo: HVA

|

In addition to Mr. Chien and Metacare, HVA’s major shareholders include JADE LABS PTE. LTD holding 24.29%, Chairman of the Board of Directors, Mr. Vuong Le Vinh Nhan, with 15.71%, and LiveTrade Joint Stock Company with 12.8%.

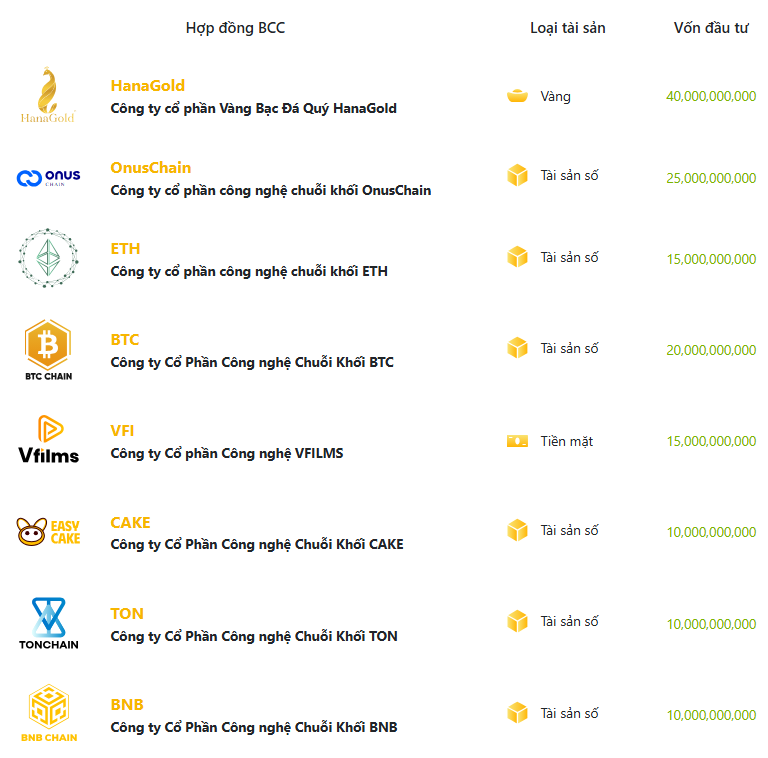

Regarding business operations, in the first half of 2025, HVA recorded a remarkable surge in revenue, reaching over VND 40 billion, compared to VND 469 million in the same period last year. The company also achieved a profit after tax of VND 3.3 billion, the highest in recent years. The majority of the revenue came from services provided to OnusChain, amounting to nearly VND 25 billion.

At the end of the second quarter, the company recognized receivables of VND 146 billion, accounting for more than 90% of total assets, related to units associated with the blockchain field. Notably, its investment in Hanagold Gemstone Joint Stock Company exceeded VND 40 billion.

HVA invests in a series of units operating in the blockchain field. Source: HVA

|

Tu Kinh

– 17:39 22/08/2025

“Financial Institutions Embrace the Digital Asset Revolution”

The legalization of digital assets marks a pivotal moment in Vietnam’s legal history. While the regulatory framework is still a work in progress, the investment appetite from financial institutions is palpable, with many proactively laying the groundwork to enter the fray when the proverbial green light shines.

The Tech Industry Petitions to Exclude Technical Operations from the Scope of Crypto Asset Management

On June 2nd, Endeavor Vietnam JSC, representing a consortium of tech enterprises including ZenX (Ninety Eight), Web3 Vietnam, Oraichain Labs, Athena Studio, and Sky Mavis, submitted a proposal to the government and relevant authorities. The proposal suggests excluding pure technology development and technical service provision activities from the scope of the pilot resolution for the cryptocurrency market in Vietnam.

Unleashing VIB’s Fintech DNA: Engineering the Super Quartet – a Personalized Financial Ecosystem

“Vietnam is among the fastest-growing digital payment markets in the region. According to the State Bank of Vietnam, the value of cashless transactions in 2024 was 26 times the GDP, with 87% of the adult population having access to financial services. With this backdrop, superficial improvements are not enough to create a sustainable competitive advantage.”

International Finance Center: It’s Not About the Number of Buildings or Hectares

Are there any other adjustments you would like to make?

“In a competitive business landscape, Vietnamese enterprises recognize the paramount importance of embracing an open policy. Leading economists emphasize that while tax incentives are necessary, they are not sufficient for fostering a thriving business environment. The key lies in creating a transformative ecosystem with flexible mechanisms that nurture the growth of innovative financial and technological models.”