Source: VietstockFinance

|

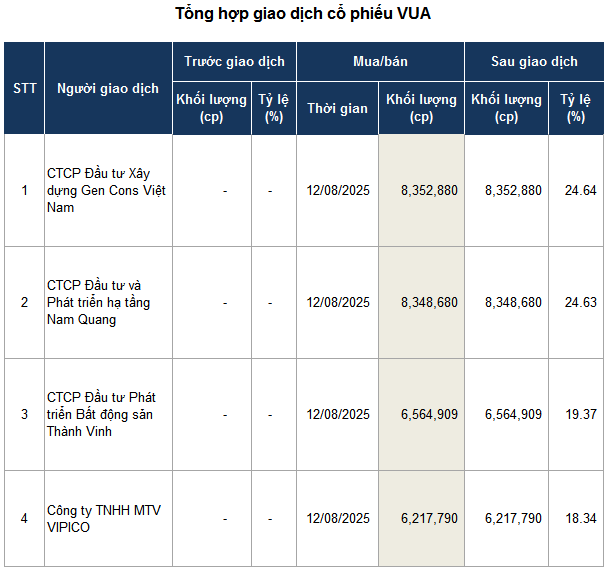

According to the transaction report, none of the four institutions previously held VUA shares. Specifically, from August 12th, Gen Cons Vietnam JSC and Nam Quang Infrastructure Investment and Development JSC became the two largest shareholders, with almost identical ownership ratios of 24.64% (approximately 8.4 million shares) and 24.63% (over 8.3 million shares) respectively. Following them, Real Estate Investment and Development Joint Stock Company holds 19.37% (nearly 6.6 million shares), and VIPICO One-Member Limited Liability Company owns 18.34% (over 6.2 million shares).

| VUA stock price movement from the beginning of 2024 to August 20, 2025 |

|

|

Notably, on August 12th, nearly 32.9 million VUA shares were traded via matching, accounting for 97% of the listed and circulating shares, while no matching transactions occurred. This indicates that the entire block of shares was likely transferred to the new group of shareholders.

The total value of the transaction amounted to approximately VND 461 billion, corresponding to VND 14,024 per share, 6% lower than the closing price on the same trading day. It is estimated that Gen Cons Vietnam and Nam Quang each spent more than VND 117 billion, while Real Estate Investment and Development Joint Stock Company invested about VND 92 billion, and VIPICO expended over VND 87 billion.

Following the deal, Stanley Brothers announced a list of shareholders attending an upcoming extraordinary general meeting in 2025 to approve the dismissal of the current members of the Board of Directors, including Luyen Quang Thang, Nguyen Quang Anh, and Pham Hoang Hai, as well as the Supervisory Board, comprising Do Duc Loc, Dinh Thi Lan Anh, and Le Thi Giang. The meeting will also involve the election of their replacements.

In terms of financial performance, the company posted a net loss of over VND 3.4 billion in the first half of 2025, narrowing from the previous year. Operating revenue reached over VND 4 billion, a 58% decline due to the absence of profit from the sale of financial assets at FVTPL. Operating expenses also decreased to nearly VND 4 billion, but the company remained unprofitable as the revenue could not offset the management expenses.

In the stock market, VUA shares have been stagnant at VND 14,900 per share since August 11th, with no matched transactions taking place on the exchange.

– 13:13 20/08/2025

The Top 10 Urban Giants of Hung Yen: Ecopark and Vinhomes Reign Supreme, With a 5-Month-Old Newcomer Giving Them a Run for Their Money

Hưng Yên is emerging as one of the new “hot spots” on the Northern real estate map. Its strategic location bordering Hanoi, coupled with an ever-improving infrastructure and a wave of investments from both domestic and foreign giants, is transforming the area.

The Return of Cheap Money: Real Estate Enters a New Cycle of Acceleration

The real estate market is witnessing a resurgence, rebounding from a challenging period of high-interest rates, weak liquidity, and cautious investor sentiment. A pivotal factor in this recovery is the return of “cheap money,” a phenomenon that previously fueled the real estate investment boom of 2020-2021.