Sustainable Raw Milk Supply Strategy

Currently, VNM maintains a strategic partnership with dairy farming households nationwide. The company signs long-term contracts to purchase raw milk, ensuring stable output for farmers while securing a sustainable supply for its production. In this linkage, milk collection stations play a pivotal role, operating under stringent hygiene and food safety standards to guarantee the homogeneity and quality of raw materials.

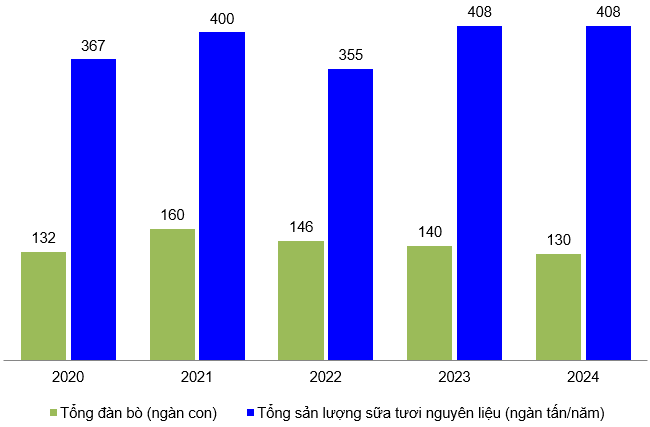

VNM’s Total Cattle Herd and Raw Milk Production for 2020-2024

Source: VNM Annual Report

In 2024, VNM’s total raw milk production reached 408,000 tons, with approximately 181,000 tons (44%) sourced from Vinamilk and Sữa Mộc Châu’s farms and the remaining 227,000 tons (56%) from dairy farming households. Going forward, VNM aims to increase the proportion of raw milk from its self-managed farm systems while gradually reducing purchases from households due to urbanization, which impacts the scale of family dairy farming. Additionally, due to limited land resources for new domestic farms, VNM will focus on improving herd productivity in existing facilities to optimize efficiency and maintain a stable supply.

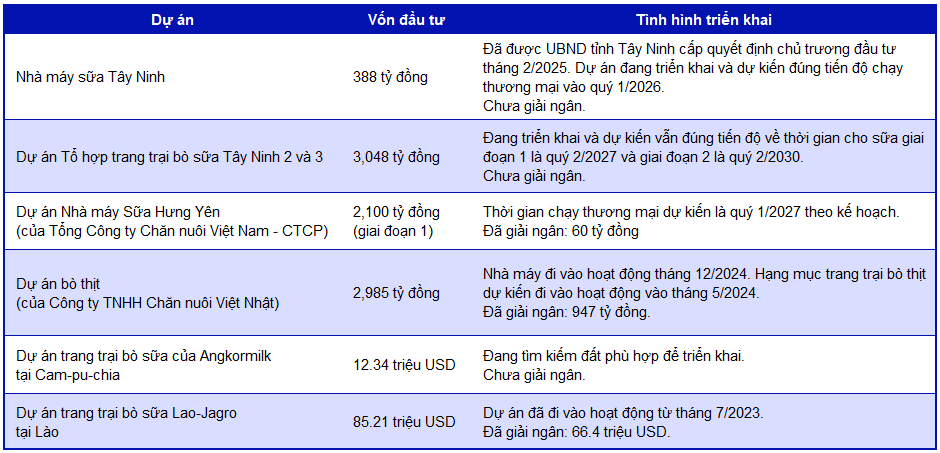

Bolstered by New Projects

VNM is executing a large project portfolio, including domestic factory and farm expansions (in Tay Ninh and Hung Yen) and international investments (in Cambodia and Laos). These ventures will serve as vital sources of raw materials for new product lines in VNM’s future development strategy, solidifying its domestic leadership and expanding its export markets.

Source: VNM

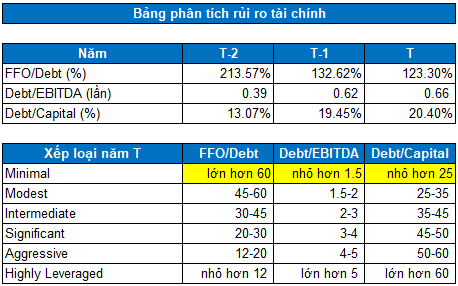

Financial Health

According to Standard & Poor’s criteria, VNM’s financial risk assessment indicators, such as FFO/Debt and Debt/EBITDA, have remained at the Minimal level in recent years. This risk level is the lowest in the financial risk ranking, assuring investors of the company’s financial stability.

Source: VietstockFinance

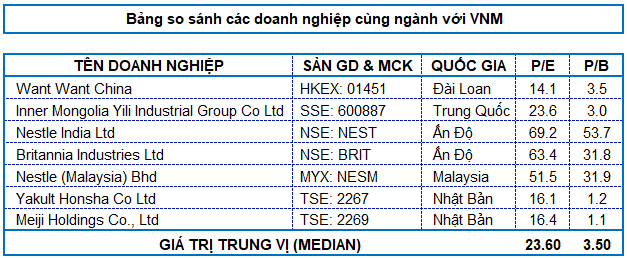

Valuation

As VNM occupies a leading position in Vietnam’s dairy industry, there are no directly comparable stocks listed on the HOSE, HNX, or UPCoM. Therefore, using domestic stocks for relative valuation may not be reasonable or comprehensive.

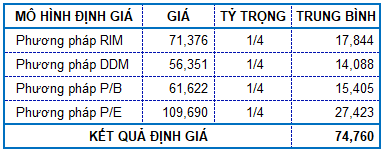

The author employs Market Multiple Models (P/E, P/B) in conjunction with the Residual Income Model (RIM) and DDM (Dividend Discount Model), giving equal weight to each method. The fair value of VNM is determined to be 74,760 VND. Hence, the market price presents an attractive buying opportunity for long-term investment purposes.

Enterprise Analysis Department, Vietstock Consulting

– 10:28 22/08/2025

The Flow of Foreign Capital into Vietnam: A Sustained Trend

“Vietnam presents an attractive investment opportunity with its low valuation, high growth potential, and the shift of capital from developed to emerging markets. The country’s favorable economic landscape makes it a prime destination for investors seeking strong returns and diverse investment options.”

Unlocking the Secrets to Effective Real Estate Investment: A Comprehensive Guide by the Ministry of Construction

The growth rate of credit for real estate across many banks has reached an impressive 20-30%, an astounding threefold increase compared to the overall credit growth rate of the system. The Ministry of Construction suggests that the State Bank should develop a special credit package for reasonably priced housing to further stimulate credit growth.

Build an Emergency Fund to Make Financial Fluctuations Less Frightening

“In the face of unpredictable challenges such as pandemics, economic crises, and waves of layoffs, it is essential to build a financial safety net early on, especially for young families. This safety net serves as a shield, protecting your financial plans and providing resilience in the face of any risks that may come your way.”