In Q2 of 2025, the average pig price in Vietnam showed a slight decrease compared to the previous quarter. However, the price remained within the range of 72,000-75,000 VND/kg. In contrast, during the same period in 2024, the average pig price in the country increased but was only within the range of 64-68,000 VND/kg. Moreover, the price of animal feed raw materials continued its downward trend, with corn and soybean prices in the first six months of the year being about 20% lower than the previous year (according to DDGS data).

|

Pig price movement in Vietnam

|

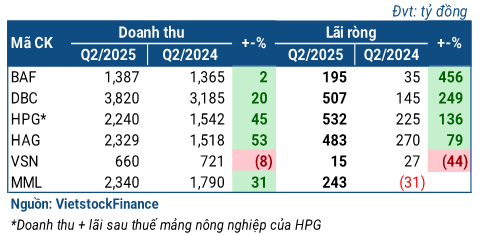

The high pig prices and decreasing feed prices have become a positive “combo” for businesses in the pig farming industry. According to statistics from VietstockFinance, most pig farming enterprises achieved significant growth in Q2.

|

Business results of pig farming companies in Q2/2025

|

Leading the growth in Q2 was BAF Vietnam Agriculture Joint Stock Company (HOSE: BAF). The company achieved nearly 1,400 billion VND in revenue, a 2% increase compared to the same period last year, but with a net profit of 195 billion VND, a 5.6-fold increase. Notably, all revenue came from pig farming activities as the company reduced its low-profit margin agricultural product business. This profit is also a record high for the company since its listing.

| BAF’s business performance |

Following closely was Dabaco Group Joint Stock Company (HOSE: DBC) with more than 3,800 billion VND in revenue (+20%) and a net profit of 507 billion VND, a 3.5-fold increase compared to the previous year. Dabaco attributed this growth to the increase in business activities across various sectors, including animal feed production, concentrated animal farming, and vegetable oil production. The company’s effective vaccination program also helped to successfully control diseases among livestock and poultry. Additionally, a reduction in farming costs contributed to the impressive business results.

| Dabaco’s outstanding performance in Q2 |

The agricultural segment of HPG also witnessed a significant increase in profits, with a post-tax profit of 532 billion VND, more than double that of the previous year. It is worth noting that HPG currently holds a leading market share in chicken eggs in Northern Vietnam and owns a pig herd of nearly 25,000 sows. At the 2025 Annual General Meeting of Shareholders, Chairman Tran Dinh Long revealed that agriculture was the segment with the highest profit margin for Hoa Phat in 2024.

HAG, owned by businessman Bầu Đức, also recorded impressive profits, with a net profit of 483 billion VND, an increase of 79% over the same period last year. However, HAG’s performance was mainly driven by fruit farming, with the pig farming segment contributing only 58 billion VND in revenue, an 82% decrease compared to the previous year. Nevertheless, at the 2025 Annual General Meeting of Shareholders, Bầu Đức revealed that the company has focused on repopulating its pig herds in 2024 and expects to reap the rewards in the coming years.

In the processing segment, Masan MeatLife (UPCoM: MML) successfully reversed its fortunes, achieving a net profit of 243 billion VND, compared to a loss of 31 billion VND in the same period last year. The company attributed this turnaround to the growth of its chilled meat, processed meat, and farm segments, along with optimized production costs.

| MML’s successful turnaround in Q2/2025 |

Vissan Joint Stock Company (UPCoM: VSN) was the only company to report a decrease in profits, with a net profit of 15 billion VND, a 44% decrease compared to the previous year, due to reduced production and higher pig prices during the same period.

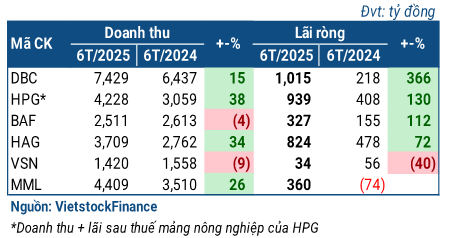

The half-year performance of the pig farming group did not show significant differences from the first quarter. DBC led the growth with a net profit of over 1,000 billion VND, a 4.6-fold increase compared to the previous year. HPG’s agricultural segment recorded a post-tax profit of 939 billion VND, more than double that of the previous year, while BAF achieved a net profit of 327 billion VND, a 2.1-fold increase. It is important to note that in Q1/2024, BAF also benefited from the sale of real estate, contributing over 100 billion VND to their profits.

|

Business results of pig farming companies in the first half of 2025

|

As diseases spread, pig prices are expected to recover soon.

According to BAF, in Q2, the supply of pigs was limited due to an imbalance in the total herd and the foot-and-mouth disease outbreak. Pig prices remained above 72,000 VND/kg and reached 76,000 VND/kg in May 2025. However, with the arrival of the rainy season (the peak season for African Swine Fever – ASF), many farmers rushed to sell their pigs, causing prices to drop to 60,000 – 63,000 VND/kg in July, and currently stabilizing around 60,000 VND/kg. Additionally, consumption has been weaker due to the hot weather and the summer holidays.

Mr. Ngo Cao Cuong, Deputy General Director of BAF, predicted that pig prices would enter a new cycle of increases as supply becomes more limited. In September, when the supply of pigs sold due to disease concerns is depleted and schools reopen, pig prices are expected to maintain their upward trend. “If the disease is not controlled or protective measures are not implemented, pig prices will definitely remain above the 70,000 VND/kg mark this year,” said Mr. Cuong.

This prediction aligns with the analysis of Vietcombank Securities (VCBS), which forecasts a long-term recovery in pig meat prices due to the impact of ASF on supply and slow repopulation rates, as well as increased demand with schools reopening. However, VCBS also believes that pig meat prices will not increase significantly due to the declining index of grain prices. Additionally, the number of imported piglets increased sharply in Q2, which may result in stable herd sizes.

Chau An

– 08:00 23/08/2025

“A Billion-Dollar Nest Egg”: A Generous Company Pays Out 35% Dividends in Cash, Sending Stocks Soaring to Historic Highs

With 67.1 million shares outstanding, the company will have to dish out a hefty 235 billion VND in dividend payments to its shareholders.

The Second Quarter Boom for Industrial Park Businesses

The industrial real estate sector has witnessed a significant surge in land and factory rentals during Q2, resulting in substantial profit growth for numerous businesses. While some companies struggle with declining core revenues, others are reaping the benefits of this increased demand. VCI attributes this positive outlook to the influx of FDI and the expansion of land banks, anticipating continued growth in the industry.

“Real Estate Firms’ Profits Soar: First-Half Yearly Earnings Up 150%”

The Vietnamese real estate market witnessed significant fluctuations and a strong segmentation across segments and regions in the first half of 2025. Amidst these dynamics, listed real estate enterprises surprisingly reported a 50% surge in net profits compared to the same period in 2024, showcasing their resilience and adaptability in a challenging environment.

“VSC Aims to Triple Profit Plans, Targeting Over VND 1,000 Billion”

The Board of Directors of Vietnam Container JSC (HOSE: VSC) has approved a proposal to be presented at an Extraordinary General Meeting of Shareholders, regarding an increase in the company’s pre-tax profit plan for the year 2025.