According to statistics from VietstockFinance, 19 seafood companies listed on HOSE, HNX, and UPCoM reported a combined revenue of over VND 16.4 trillion, a 12% increase compared to the same period in 2024. The industry’s net profit soared by 167% to VND 1.2 trillion, with the tra fish group taking the lead.

A series of new milestones for the tra fish group

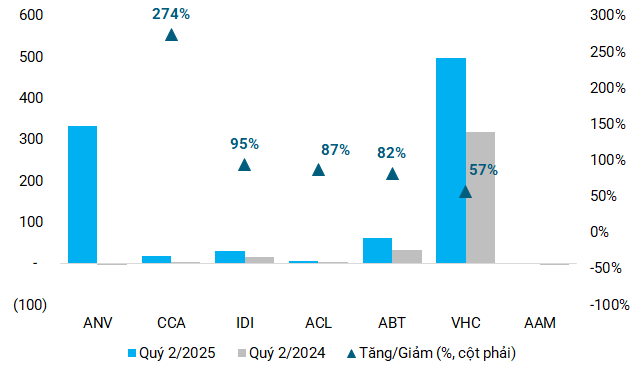

The most notable performer was Nam Viet (HOSE: ANV), with a revenue of VND 1.7 trillion, a 45% increase, and a record-breaking net profit of VND 333 billion, turning around from a loss. Higher selling prices and increased sales volume pushed the gross profit margin from 12% to 28%, a rare achievement in the industry.

Vinh Hoan (HOSE: VHC) maintained its revenue at approximately VND 3.2 trillion, almost unchanged from the previous year, but its net profit surged to VND 499 billion due to reduced production costs and higher sales volume. The gross profit margin improved from 14% to 20%.

Multi-National Investment and Development – IDI (HOSE: IDI) achieved a revenue of VND 2 trillion, the highest in three years, and a net profit of VND 30 billion, a 95% increase.

In the smaller-scale group, Cuu Long An Giang (HOSE: ACL) reported a profit of VND 6 billion, the highest in 11 quarters. Can Tho Seafood Import and Export (UPCoM: CCA) recorded a record revenue of VND 479 billion, a 49% increase, and a profit of VND 18 billion, the highest since Q2 2022. Ben Tre Seafood Export (HOSE: ABT) achieved a record profit of VND 61 billion due to a significant improvement in gross profit margin. Mekong Seafood (HOSE: AAM) turned around from a loss to a profit of VND 1.1 billion.

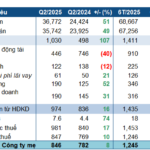

|

Many tra fish exporters reported strong business results (in VND trillion)

Source: Author’s compilation

|

Shrimp sector gains momentum from US “single-running” orders

Although the tra fish group was the main focus, the shrimp sector also benefited significantly from the US postponement of retaliatory tariffs.

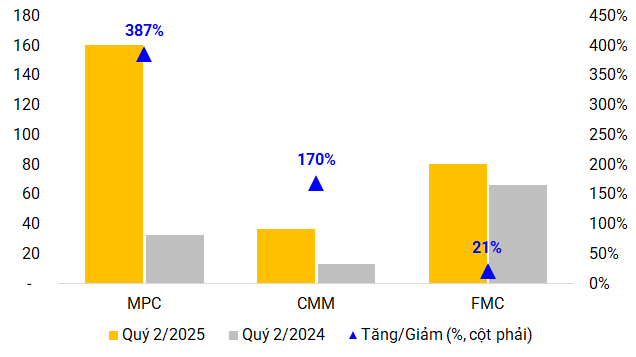

The most prominent performer was Minh Phu Seafood Corporation (UPCoM: MPC), with a net profit of VND 161 billion, nearly five times higher than the same period and the highest in ten quarters, despite a slight decrease in revenue to VND 3.6 trillion. This result was achieved by increasing the proportion of value-added products and improving profit margins.

Sao Ta Food Joint Stock Company (HOSE: FMC) reported a revenue of VND 1.9 trillion, 1.5 times higher than the same period, and a net profit increase of 21% to VND 80 billion, thanks to increased shipments and efficient new farming techniques.

Camimex (UPCoM: CMM) recorded a net profit of VND 37 billion, a 170% increase and the highest in 12 quarters. CMM’s revenue was also slightly lower than the record high in Q4 last year. Kien Hung (HNX: KHS) reported a profit of VND 13 billion, 2.2 times higher.

|

MPC and CMM’s profits surge from a low base in Q2/2024 (in VND trillion)

Source: Author’s compilation

|

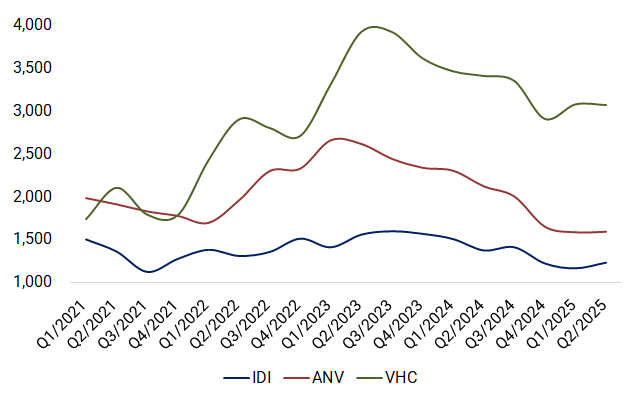

Tra fish inventories remain low

While revenue remained high, inventories of many tra fish companies continued to be at low levels, reflecting the industry’s positive signals to some extent.

At the end of Q2, ANV had inventories of nearly VND 1.6 trillion, a continuous decrease since the beginning of 2023. VHC and IDI also recorded significantly lower inventories compared to the same period, at over VND 3 trillion and VND 1.23 trillion, respectively.

In contrast, the shrimp sector witnessed increasing inventories. MPC raised its inventory to VND 4.2 trillion after lowering it to VND 3.4 trillion in Q1 – the lowest in four years. Compared to the same period, this figure still showed a significant decrease from VND 5.7 trillion.

Notably, FMC reversed the trend with a sharp increase to nearly VND 1.3 trillion, double the beginning of the year. CMM continued to increase its inventory, ending Q2 at VND 1.8 trillion, 1.5 times higher than in Q2/2024.

|

Tra fish exporters’ inventories remain low compared to a year ago (in VND trillion)

Source: Author’s compilation

|

Slowing down after a period of rapid growth?

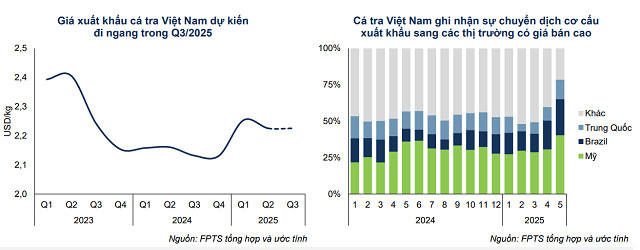

FPTS Securities (FPT Securities) believes that Q3/2025 will be a slowdown for both tra fish and shrimp. The main reason is not due to weak demand but because businesses rushed to import goods before the US imposed tariffs. Major importers will be more cautious, which could slow down the pace of order allocation.

For tra fish, export turnover is expected to decrease by about 3% compared to the same period. The Chinese market is likely to see weaker consumption, while the US market remains stable as some demand has been “pulled forward” from the previous quarter.

Nevertheless, the tariff advantage continues to help Vietnamese tra fish maintain its market share in the US and expand into high-price markets such as Brazil.

FPTS forecasts that the export price of Vietnamese tra fish will cool down in Q3/2025 but remain higher than the same period last year. Source: FPTS

|

Regarding raw material prices, tra fish prices are expected to decrease by about 5% compared to Q2 due to the harvest season. On the cost side, there are signs of declining soybean meal prices – a major component of feed – which will help reduce input pressure and support profit margins.

FPTS expects that VHC ’s business results in Q3 will be similar to the same period last year, as US customers become more cautious and it is challenging to maintain high export prices.

For shrimp, export turnover may slightly decrease compared to Q3/2024 as US demand cools down after the stockpiling phase. However, the high level of localization and lower tax rates compared to competitors such as India and Indonesia are expected to help major companies like FMC and MPC maintain profitability.

– 10:24 22/08/2025

A Profitable Second Quarter: BSR Surpasses Annual Targets

The upward trajectory of crude oil prices compared to the downward trend in the same period last year has resulted in a positive impact on the performance of Binh Son Refining and Petrochemical Joint Stock Company (HOSE: BSR). This quarter, the company witnessed a significant growth in its business, surpassing its annual profit plan just within the first six months.

Market Beat July 31st: Holding the 1,500-Point Mark Triumphantly

The VN-Index faced significant challenges during the morning session, with constant struggles and adjustments, suggesting a deep decline at the closing bell. However, a remarkable turnaround took place in the afternoon session, as the market staged a strong recovery, recouping much of the lost ground. The index ultimately closed at 1,502.52, limiting the damage to a modest 5.11-point loss.

The Market Beat – 02/01: VN-Index Starts the Year on a Positive Note Despite Lackluster Liquidity

The market witnessed a rebound in the afternoon session, with the VN-Index recovering from 1,264 to 1,269.71. Meanwhile, the HNX-Index also gained 0.26 points to reach 227.69, while the UPCoM-Index dipped slightly by 0.01 points to 95.05. Overall, the liquidity of the three exchanges was relatively low, slightly exceeding 12 trillion VND.