|

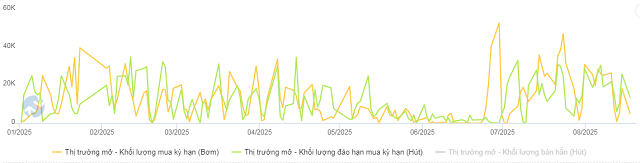

OMO Net Pumping Development since the beginning of 2025. Unit: VND billion

Source: VietstockFinance

|

Specifically, the SBV issued 64,596 billion VND through the term purchase channel with a fixed interest rate of 4%, while the total matured volume on this channel reached 93,621 billion VND. Thus, the SBV net withdrew 29,025 billion VND, bringing the circulating volume in the term purchase channel down to 222,776 billion VND.

|

Development of interbank overnight interest rates since the beginning of 2025. Unit: %/year

Source: VietstockFinance

|

In the interbank market, the overnight rate dropped sharply to 4.49%/year on August 15, 176 basis points lower than the previous week. Trading volume remained stable, maintaining at over VND 505 trillion per day.

|

DXY Development from the beginning of 2025 to August 19, 2025

Source: marketwatch

|

In the international market, the US Dollar Index (DXY) – measuring the strength of the US dollar against six major currencies – fell by 0.43 points compared to the previous week, to 97.84 points.

The greenback continued to weaken mainly due to two reasons: (1) US inflation cooled as July 2025 CPI rose only 0.2% from the previous month (after a 0.3% increase in June), dampening expectations that the Fed will maintain a “hawkish” view; (2) the US-China tariff truce was extended, helping to stabilize global trade and encourage capital flow into stocks and commodities instead of holding USD.

Domestically, Vietcombank’s exchange rate on August 15 was listed at 26,060-26,450 VND/USD (buying – selling), up 50 VND in both directions compared to the previous week.

– 10:24 19/08/2025

“Viet Nam Dong Surges: Bank Rates Surge Past 26,500, Freefalling USD Hits New Lows”

This morning, the US dollar rate surged past 26,500 VND at several banks. Meanwhile, the dollar rate in the free market hit a record high of 26,600 VND on the selling side.

The Central Bank Tightens its Net Injection, Leading to a Significant Drop in Overnight Interbank Interest Rates

“Following a week of aggressive net injections via open market operations, the State Bank of Vietnam (SBV) scaled back its liquidity support to VND 4,958 billion in the week of July 28 to August 4. This development was largely due to substantial maturities in the term lending channel.”