In 2024, SBBS planned to offer 20 million shares at VND 10,000 per share, with a corresponding rights issue ratio of 3:2, and aimed to increase its capital from VND 300 billion to VND 500 billion.

However, by the end of the offering, only 5 million shares were successfully sold, accounting for 25% of the intended 20 million shares. The remaining 15 million shares were canceled.

Notably, Ms. Nguyen Thi Huong Giang, Chairman of SBBS, purchased these 5 million shares, thereby increasing her ownership to nearly 21.1 million shares, equivalent to a continued increase in her holding percentage to 60.19%.

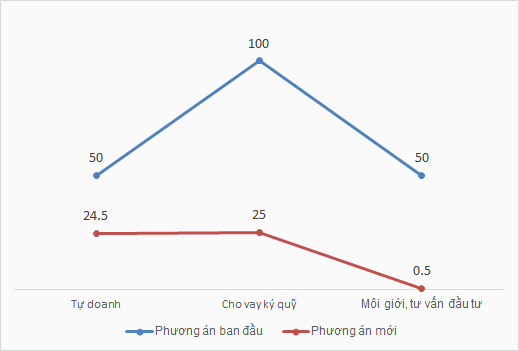

According to the initial plan, the company would allocate VND 50 billion for proprietary trading in securities, VND 100 billion to supplement capital for margin trading, and VND 50 billion to supplement working capital for brokerage, securities investment advisory, and other operating expenses.

With the actual proceeds of VND 50 billion from the share offering, SBBS will allocate VND 24.5 billion for proprietary trading in securities, VND 25 billion for margin lending, and VND 500 million to supplement working capital for brokerage and securities investment advisory services and other operating expenses.

|

SBBS’s capital usage plan

Unit: Billion VND

Source: SBBS

|

The company also provided the following rationale for the change in capital usage regarding the supplementary working capital for brokerage and investment advisory services: The company’s trading platform remains effective after the KRX system became operational, and its other legal business activities have not yet required the use of funds obtained from the share offering to existing shareholders.

SBBS’s Board of Directors has recently appointed an Investment Council comprising Ms. Nguyen Thi Huong Giang, Chairman of the Board, Mr. Pham Minh Tuan, General Director, and Mr. Nguyen Anh Duc, Executive Director of Institutional Brokerage and Investment Advisory. At the same time, the company has approved the principles and investment orientation for proprietary trading in securities. SBBS will prioritize investing in listed securities with high liquidity and healthy financial positions and may consider investing in corporate bonds, government bonds, fund certificates, ETFs, structured products, and futures contracts…

The investment strategy will combine short-term and medium-term investments based on technical and fundamental analysis.

The total value of proprietary trading investments will not exceed the limit for securities proprietary trading activities corresponding to each period. The portfolio structure will be allocated reasonably to limit concentration risk.

In the first half of 2025, SBBS incurred a loss of nearly VND 5.5 billion. This was mainly due to brokerage fees (VND 4.5 billion) and management expenses (VND 5 billion) exceeding revenue (VND 3.8 billion). The company’s main sources of income were from lending activities (interest and receivables of VND 1.2 billion) and securities brokerage (VND 1.3 billion).

| SBBS’s business results |

Yen Chi

– 09:32 21/08/2025

“Lizen Seeks to Raise $100 Million via Equity Offering at a 15% Discount to Expand Global Footprint.”

Lizen is set to offer a strategic investment opportunity with a private placement of 100 million shares, priced at a 15% discount to the market rate. With this move, the company aims to raise 1,000 billion VND to fuel its ambitious growth strategy. The funds will be utilized to retire debt, invest in state-of-the-art equipment, expand its global footprint, and venture into large-scale PPP projects. This proactive approach positions Lizen for significant advancement, as it fortifies its financial standing and seizes opportunities for expansion and innovation.

Valuing the Stock Market: Capital Increases Remain Vital Despite Premium Pricing

The stockbroking industry is riding a wave of success, with the Vietnamese stock market reaching unprecedented heights. While the valuation of stockbroking firms is no longer a bargain, capital increases remain pivotal for companies to compete and ride the wave of market upgrades and digital asset initiatives.

Stock Market Update: Riding the Wave or Missing Out?

Today’s session (August 13th) saw the VN-Index fluctuate around the 1,600-point mark multiple times. The intense back-and-forth movement at this strong resistance level has put investors in a tricky situation: buying now risks buying at the peak, but selling early could mean missing out on potential gains. Experts suggest that if the market undergoes a technical correction until the end of August, it would present an opportunity to enter instead of rushing to buy at higher prices.