In the proposal, the Enterprise plans to issue a maximum of 13.4 million shares, equivalent to 20% of the current circulation, raising its charter capital to over VND 803 billion. The proposed offering price is VND 12,000/share, 77% lower than the recent average market price of PTB shares. At this price, Phu Tai could raise over VND 160 billion.

The buyers are existing shareholders as per the record date. The entitlement ratio is 20:1, meaning that for every 20 shares held, shareholders can buy 1 new share. The subscription rights are transferable once during the specified period, while the newly issued shares will not be restricted from trading. The distribution is expected to take place in 2026, after obtaining approval from the State Securities Commission.

If successful, this will be Phu Tai’s first capital increase since the stock dividend payout in 2022.

All proceeds from the capital raise will be used to fund its subsidiaries. Phu Tan Kieu JSC will receive VND 44.5 billion, and Phu Tai Binh Dinh Wood JSC will be allocated over VND 116 billion.

Previously, PTB completed the acquisition of 100% of Phu Tan Kieu, a company based in Gia Lai with a charter capital of VND 4.5 billion. The company’s main business is granite and basalt cutting, one of PTB’s core businesses. Meanwhile, Phu Tai Binh Dinh Wood JSC owns a factory in Phu Cat, Binh Dinh (old address), specializing in the production of wooden handicrafts for export and plywood.

Inside Phu Tai Binh Dinh Wood JSC’s factory – Photo: PTB

|

| PTB’s Charter Capital Increase Process |

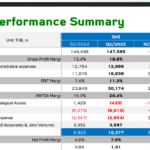

The capital raise plan comes as PTB’s business results show significant improvement. In Q2/2025, revenue reached VND 1,900 billion, up 18% year-on-year, with a net profit of VND 128 billion, a 16% increase.

For the first six months of the year, revenue was VND 3,500 billion, a 16% increase. The profit was VND 241 billion, the highest in the last three years. Revenue from the wood business, PTB’s main segment, increased by 15%, reaching over VND 2,000 billion. The automotive, stone, and real estate segments all showed growth, with real estate bringing in VND 125 billion, 5.4 times higher than the same period last year.

Tu Kinh

– 09:45 19/08/2025

“A Billion-Dollar Nest Egg”: A Generous Company Pays Out 35% Dividends in Cash, Sending Stocks Soaring to Historic Highs

With 67.1 million shares outstanding, the company will have to dish out a hefty 235 billion VND in dividend payments to its shareholders.

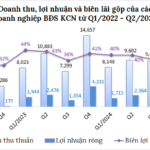

The Second Quarter Boom for Industrial Park Businesses

The industrial real estate sector has witnessed a significant surge in land and factory rentals during Q2, resulting in substantial profit growth for numerous businesses. While some companies struggle with declining core revenues, others are reaping the benefits of this increased demand. VCI attributes this positive outlook to the influx of FDI and the expansion of land banks, anticipating continued growth in the industry.

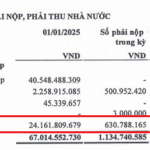

The City of Long Giang: Audit Reveals Tax Issues Once Again

UHY Audit and Consulting Firm revealed that as of June 2025, Long Giang Urban Development and Investment Joint Stock Company (HOSE: LGL) has yet to fulfill its tax obligations declared to the authorities, an issue that has been ongoing since 2020.