“Net Interest Margin Squeeze: Strategies for Vietnam’s Banking Sector”

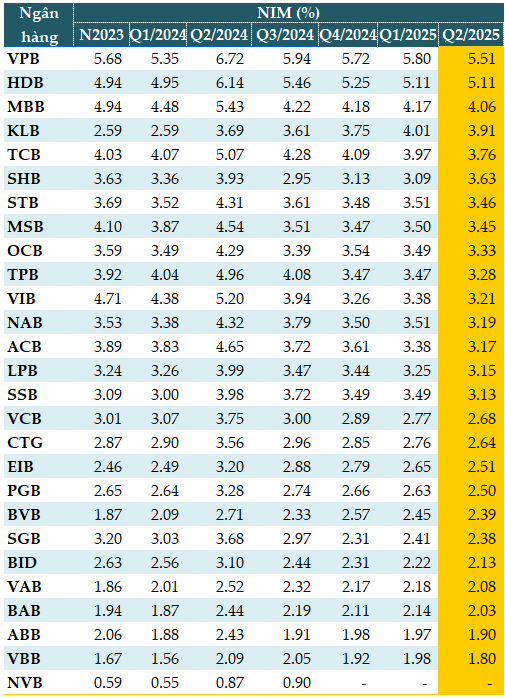

25 out of 27 banks experienced a decline in their Net Interest Margin (NIM) in Q2 of 2025, according to VietstockFinance data. The average NIM for these banks stood at 2.98%, a decrease from the previous quarter’s 3.09%. Notably, 25 out of the 27 banks witnessed a drop in their NIM compared to the preceding quarter.

VPBank boasted the highest NIM, reaching 5.51%, followed by HDBank (HDB) at 5.11%, MB (MBB) at 4.06%, Kienlongbank (KLB) at 3.91%, and Techcombank (TCB) at 3.76%.

|

Q2 2025 NIM for banks

Source: VietstockFinance

|

Mr. Nguyen Quang Huy, CEO of the Faculty of Finance and Banking at Nguyen Trai University, commented that the significant drop in NIM in Q2 compared to Q1 indicates that profit pressure has spread across the banking sector.

NIMs are facing challenges, mainly due to the upward trend in funding costs. Competition in attracting deposits, especially for short-term maturities, has pushed deposit rates higher, directly impacting the funding costs of credit institutions. At the same time, there are signs of a decline in asset yields. Slower credit growth in some key segments, coupled with a preference for low-interest loans to retain existing customers, has resulted in lower-than-expected returns from lending activities.

To address this issue and improve NIMs, Mr. Huy suggested that banks need to implement synchronized solutions on both sides of the balance sheet.

On the asset side, banks should restructure their loan portfolios, focusing on increasing the proportion of higher-margin products while maintaining a robust risk control system to ensure asset quality. Regarding the funding side, cost optimization is imperative. This includes increasing the ratio of non-term deposits (CASA), promoting digital banking services to attract customers, and designing specialized account packages for corporate clients to attract low-cost funds.

Additionally, boosting income from non-interest activities, such as payment services, bancassurance, and foreign exchange, is considered a key strategy to offset the pressure on net interest margins and contribute to the stability and diversification of banks’ revenue streams.

PGS.TS. Nguyen Huu Huan, Senior Lecturer at the University of Economics in Ho Chi Minh City, attributed the NIM decline in Q2 to macroeconomic factors and banks’ internal strategies rather than weak performance. He pointed out that the first factor is the reduction in system liquidity as capital is being diverted to more attractive investment channels like securities and real estate. This compels banks to maintain competitive deposit rates and refrains from significantly reducing them. Meanwhile, lending rates remain unchanged to support the economy, leading to an inevitable squeeze on NIMs.

Reducing Funding Costs

Despite the decline in NIMs during Q2, there is a silver lining as banks are embracing a “race” to reduce operating costs through digital transformation. The adoption of technology optimizes processes and minimizes personnel expenses. The recent wave of job cuts in some banks exemplifies this strategy. Consequently, even with thinner margins, banks’ profits remain robust due to substantial cost savings. This is evident as the banking industry’s profits have not witnessed a decline, although growth rates vary.

Mr. Pham Van Dau, CFO of HDBank, shared that to sustain a robust NIM, HDBank focuses on increasing the CASA ratio. They are actively promoting initiatives to attract payment accounts and digital channel users. As a result, the CASA balance has grown by 56% year-over-year, significantly reducing funding costs. The bank proactively diversifies its funding sources by issuing bonds and attracting international capital through syndicated loans, ensuring stability in funding for lending activities. Additionally, they carefully manage the loan-to-deposit ratio (LDR) to maximize profits from available funds.

In the context of low-interest rates impacting NIMs, Ms. Le Hoang Khanh An, CFO of VPBank, stated that given the competitive landscape in credit growth, VPBank prioritizes maintaining an excellent liquidity position. While interest rates have not increased significantly, funding costs have risen compared to 2024 due to the inclusion of new portfolios with higher interest rates. This will likely lead to a narrower margin compared to the previous year. However, with improved liquidity and the potential for a slight increase in interest rates, NIMs are expected to trend upward.

In SSI Research’s industry update released on July 8, they observed that from 2024 onwards, credit demand has been concentrated in the real estate sector, driven by rising property prices and low mortgage rates. This has intensified competition among banks to secure loans for prime projects, resulting in a strategy of competing through interest rates, which compresses margins. SSI anticipates that this competitive pressure in the real estate segment will persist and continue to affect asset yields in the near future.

However, the focus on public investment and provincial mergers is expected to stimulate economic activity in neighboring areas, potentially expanding credit demand beyond the real estate sector. As credit demand recovers more broadly, there is optimism for a more pronounced recovery in NIMs.

Moreover, SSI expects most home loans to shift to floating rates, improving asset yields, particularly in 2026. Nonetheless, they do not foresee NIMs returning to the high levels seen in 2020-2021, given the intensified and structural nature of the current competitive landscape.

As competitive deposit rates squeeze NIMs and put pressure on net interest income, many banks are actively diversifying into asset management to generate revenue beyond traditional credit activities. According to SSI, this trend is likely to gain traction in the medium term.

– 12:00 21/08/2025

“VPBank’s Deposits Soar in H1 2025: Outpacing Peer Group Growth, Surpassing Two Big4 Banks”

“VPBank stands out amidst a challenging landscape where many banks struggle to keep pace with credit growth, exerting pressure on liquidity. The bank has impressively outperformed several state-owned giants in terms of mobilization, showcasing its prowess in both scale and the quality of its capital sources. VPBank’s remarkable CASA growth and its ability to attract international capital have solidified its position as a leader in the industry.”

Positioning Vietnam in the Global Financial Value Chain

The vision of establishing an international financial center in Vietnam is not merely a distant dream but an evolving reality. This marks the beginning of a new era of extensive and sustainable economic development for the country.

“High Interest Rates on Short-Term Deposits: Implications for Vietnam’s Economy”

The private sector in Vietnam is currently dominated by banking and real estate enterprises. This, according to Dr. Le Xuan Nghia, former Vice Chairman of the National Financial Supervisory Commission, is an inevitable phase of accumulation that many nations have gone through on their path to industrialization and the development of science and technology.