Illustrative Image

According to preliminary statistics from the Customs Department, Vietnam’s textile and garment exports in July brought in over $3.9 billion, an increase of 8.7% compared to the previous month. In the first seven months of the year, this ‘gold mine’ industry generated more than $22.5 billion, up 11% from the same period in 2024.

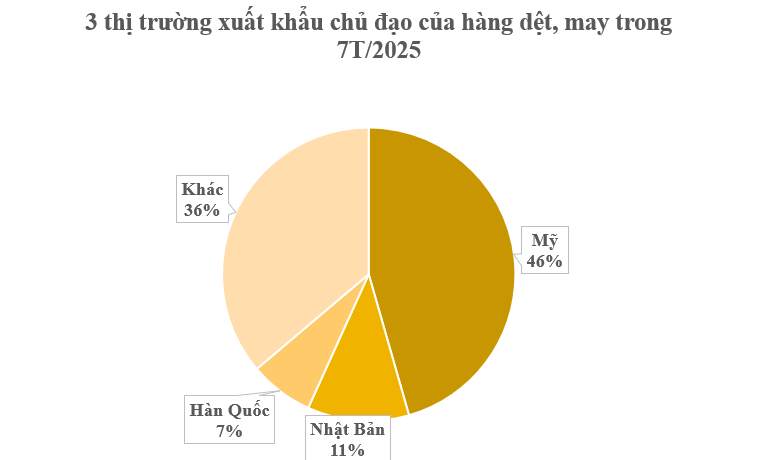

In terms of market breakdown, the United States remains the largest importer of Vietnamese textiles and garments, with a turnover of over $10.2 billion, a significant 15% increase compared to the previous year.

Japan is the second-largest market, contributing over $2.5 billion, a 10% increase compared to the same period in 2024.

South Korea ranks third, with a turnover of over $1.5 billion, although this represents a 2.2% decrease compared to 2024.

In 2024, the Vietnamese textile and garment industry achieved impressive results, reaching approximately $44 billion in exports and an 11% growth rate compared to 2023. With these achievements, Vietnam climbed to second place among the world’s largest textile and garment exporters. One of the main reasons for this success was the industry’s ability to attract orders diverted from Bangladesh.

According to the Vietnam Textile and Apparel Association (VITAS), Vietnamese textiles and garments have expanded their reach to 132 countries and territories (up from 104 in 2024). Notably, Vietnam has even exported high-quality garments to China. In addition to consolidating existing markets, Vietnamese textile and garment enterprises are actively seeking to expand their market share in other large and potential markets.

The fact that Vietnamese textiles and garments are exported to 132 countries and territories underscores the industry’s global prominence. Notably, businesses currently have orders through the end of the year. The aforementioned data highlights the numerous drivers and opportunities to boost textile and garment exports in the remaining months of the year.

To address challenges in the second half of 2025, textile and garment enterprises should focus on investing in the development of domestic raw materials to reduce dependence on imports. This will not only enhance their competitiveness but also ensure compliance with origin requirements in free trade agreements.

Embracing the trend of “green” and sustainable production is also crucial. Recycled and environmentally friendly products are increasingly favored by international consumers, especially in markets like the EU. Businesses should seize this opportunity to differentiate themselves and add value to their products.

Technology is another key factor in increasing labor productivity and reducing production costs. Investing in modern production lines will enable enterprises to meet international standards and improve their long-term competitiveness.

To reach the target of $47-48 billion this year, the industry needs to achieve monthly exports of over $4 billion. Enterprises must effectively leverage the advantages offered by the 17 newly-generation free trade agreements (FTAs) that have come into effect. Additionally, they should devise strategies to adapt to changing circumstances and institutional conditions, given the differing economic and trade perspectives among some major countries.