According to the latest announcement, August 28th is the upcoming record date for Hanoi Mechanical and Mineral JSC (code: HGM) to finalize the list of shareholders eligible for the first 2025 dividend payment in cash. The payout ratio is set at 45%, meaning that for every share owned, shareholders will receive VND 4,500.

With 12.6 million shares currently in circulation, the company expects to distribute approximately VND 57 billion in dividends. The payment is anticipated to be made starting from September 26th, 2025.

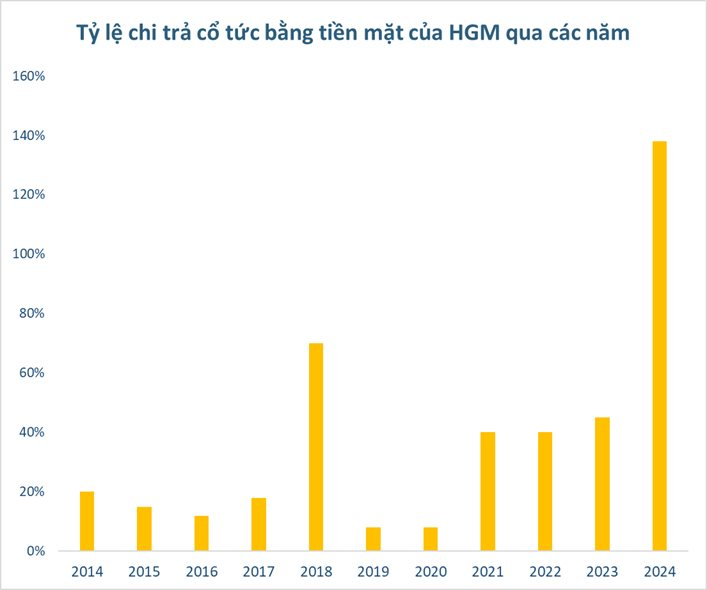

HGM has a consistent track record of paying cash dividends. Since its listing on the HNX in 2009, Hanoi Mechanical and Mineral JSC has never failed to distribute cash dividends to its shareholders. Notably, in 2024, the company surprised investors by distributing an exceptionally high dividend of 138% (VND 13,800/share) across three installments, far surpassing the initial plan of only 15%.

Upon investigation, it is found that Hanoi Mineral JSC’s primary output is Antimony, a strategically important mineral that is in high demand globally, particularly in countries like Canada, the USA, the European Union, and the UK. Antimony is a metal with strategic military applications, such as ammunition and missiles, as well as lead-acid batteries used in automobiles and brake pads due to its heat resistance.

This critical resource is also widely used in high-tech industries as a key component in semiconductors, circuit boards, electrical switches, fluorescent lighting, high-quality transparent glass, and lithium-ion batteries. Familiar products like smartphones, high-definition TVs, modern kitchen appliances, and even automobiles with digital circuits rely on Antimony. With the increasing demand from crucial industries, nations continuously implement various measures to secure their supply of this valuable mineral.

Currently, HGM holds the rights to exploit the Mau Due Antimony mine in Ha Giang province, which consists of three ore bodies. The company is currently mining ore body II, which has a reserve of approximately 372,000 tons of ore with an Antimony grade of nearly 10%. Additionally, with the estimated reserves of ore bodies I and III being similar to ore body II, the company assures an abundant source of ore to meet future production expansion needs.

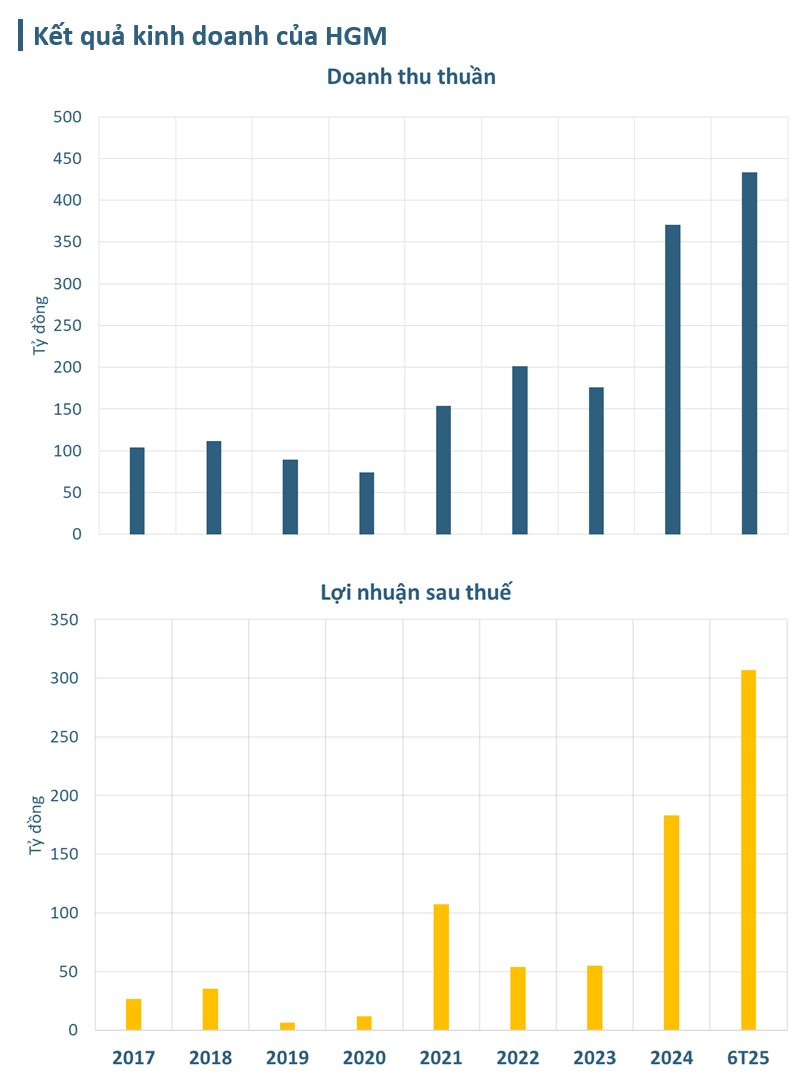

The company’s financial performance in recent years has been impressive. In 2024, HGM achieved record-high revenue and profit, reaching over VND 370 billion and VND 233 billion, respectively, marking increases of 111% and 232% compared to the previous year.

The pretax profit margin stood at 63%, indicating that for every VND 3 of revenue, the company made a profit of VND 2. In comparison to the 2024 plan, Hanoi Mineral JSC surpassed its revenue and profit targets by 105% and 365%, respectively.

In the second quarter of 2025, the company’s net revenue reached VND 280 billion, a threefold increase from the same period last year, attributed to a 276% rise in Antimony prices. Consequently, HGM reported an after-tax profit of VND 205 billion, quadrupling the figure from the previous year.

For the first half of 2025, HGM’s cumulative net revenue was VND 433 billion, and its after-tax profit was VND 307 billion, reflecting increases of 217% and 346%, respectively, compared to the same period in 2024. The export of Antimony metal accounted for over 99% of the company’s total revenue. These outstanding results have enabled the company to surpass its annual targets, achieving 8% and 54% of the revenue and profit goals, respectively, in just the first six months.

In the stock market, HGM is among the most expensive stocks in terms of market price. As of the market close on August 20th, HGM’s share price stood at VND 300,100 per share.

“SZC Announces Plans to Allocate Nearly VND 180 Billion for Dividends in October”

“Sonadezi Chau Duc Joint Stock Company (HOSE: SZC) plans to allocate nearly VND 180 billion to pay dividends for the year 2024. As the major indirect parent company, Industrial Park Development Joint-Stock Company will be the primary beneficiary.”