Thăng Long Investment Group Joint Stock Company (coded TIG on HNX) has just announced the resolution of its Board of Directors regarding the transfer of capital contribution at RE-G Real Estate Co., Ltd.

Accordingly, the transfer price will be based on market conditions, ensuring the maximum benefit for the company. The expected time of capital contribution transfer is in the third or fourth quarter of 2025.

The transferee is an investor with a demand for capital contribution transfer, meeting the criteria in terms of price and conditions as prescribed by law.

As introduced on TIG’s website, RE-G Real Estate has a charter capital of 3 million HUF (equivalent to more than 233 million VND), 100% owned by TIG. The enterprise mainly operates in the field of real estate, with its headquarter located in Hungary.

Vườn Vua Resort & Villas project landscape. Source: TIG

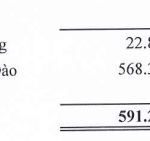

As of June 30, 2025, TIG recorded a commercial advantage at RE-G Real Estate of nearly VND 22.9 billion, a decrease of 5.8% compared to the beginning of the year.

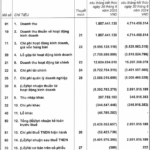

In terms of business results, according to the consolidated financial statements for the second quarter of 2025, TIG’s net revenue reached nearly VND 259.3 billion, a decrease of 16.9% over the same period last year. After deducting the cost of goods sold, gross profit reached VND 23.3 billion, down 54.5%.

In this period, the company recorded a 69% decrease in financial income compared to the same period, to over VND 17.7 billion. On the other hand, financial expenses increased by 8.5% to nearly VND 7.7 billion, and management expenses increased sharply from nearly VND 7 billion to VND 28.5 billion.

As a result, after deducting taxes and other expenses, the company’s net profit was nearly VND 7.4 billion, down 89.5% compared to the net profit of over VND 70.7 billion in the same period last year.

For the first six months of 2025, TIG’s net revenue was over VND 641.5 billion, down 10.7% compared to the same period in 2024. Profit after tax was VND 45.5 billion, down 62.6%.

As of June 30, 2025, TIG’s total assets increased slightly by VND 17.5 billion compared to the beginning of the year, to over VND 4,090.9 billion. Of which, inventory was over VND 477.8 billion, accounting for 11.7% of total assets.

On the other side of the balance sheet, total liabilities were nearly VND 1,958.5 billion, a decrease of VND 20.1 billion compared to the beginning of the year. Of which, loans and finance leases amounted to nearly VND 980.6 billion, accounting for 50.1% of total liabilities.

A Profitable Retreat: TIG Eyes Exit from Hungarian Subsidiary After Q2 Profits Plummet Nearly 90%

The Thang Long Investment Group JSC (HNX: TIG) has announced its decision to divest its entire stake in real estate firm REG in Hungary. This move comes amidst a sharp decline in second-quarter profits, plunging nearly 90% from the previous year’s figures to just over $3.3 million.

“Expanding Horizons: VCAM Fund Management Targets 2 Trillion VND Capital Increase”

The Board of Directors of VCAM, a leading securities investment fund management company, approved the issuance of nearly 5 million new shares to increase its charter capital to VND 200 billion on August 14th. This move underscores VCAM’s strong position and ambitious growth strategy, leveraging its robust owner’s equity to bolster its market presence and expand its investment opportunities.

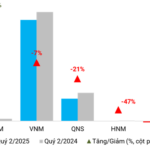

Liquidity Soars, Will Brokerage Sector Boom in Q3?

In the context of a slight dip in liquidity in Q2 2025 compared to the previous year, the ‘zero fee’ policy has intensified the competition among securities companies to capture market share. Understandably, brokerage business performance faced challenges during this period. However, the landscape is predicted to change significantly in Q3.

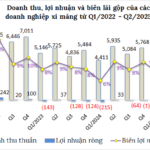

A Sunny Outlook for the Cement Industry: Profits Soar to 12-Quarter High

The cement industry has seen a remarkable turnaround in the second quarter of 2025, with a stunning recovery in profits. The sector reported a whopping 216 billion dong in earnings, a nearly three-year high and a massive 6.4 times increase compared to the same period last year. This impressive performance marks a significant shift for the industry, with many businesses turning their fortunes around and moving from losses to impressive gains.