Silver prices surge at Ancarat Vietnam JSC, reaching 1,470,000 VND/tael (buying price) and 1,508,000 VND/tael (selling price) in Hanoi. Despite a slight 0.2% dip over the past week, investors have enjoyed nearly 41.4% gains year-on-year.

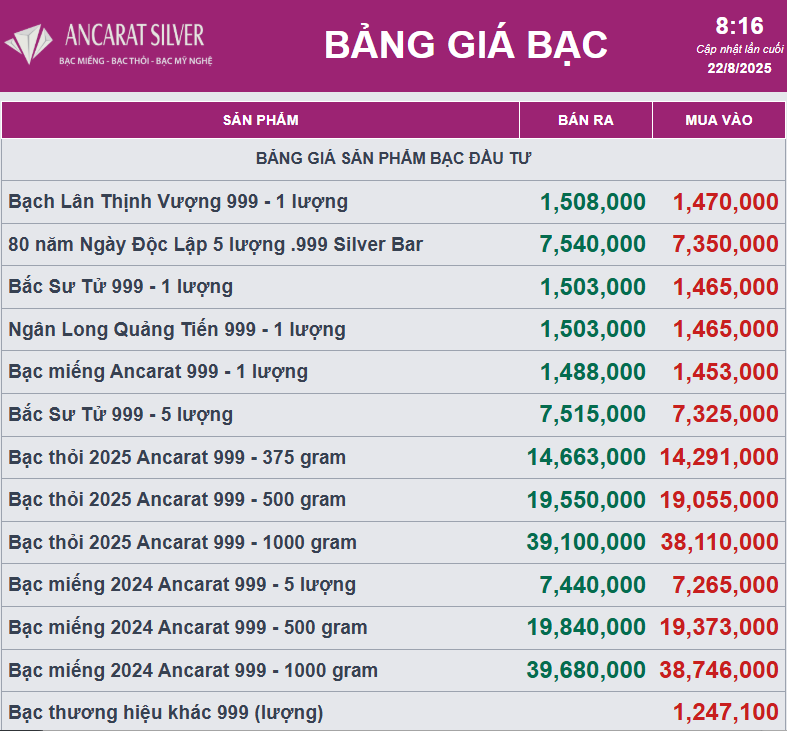

Meanwhile, the price of 999 silver bars stands at 38,110,000 VND/kg (buying) and 39,100,000 VND/kg (selling), as of 8:16 am on August 22nd.

Globally, silver prices climbed to 38.18 USD/ounce, translating to approximately 1,008,000 – 1,013,000 VND/ounce (buying-selling) in the Vietnamese market.

Silver witnessed a strong rally during the August 21st trading session, bouncing off lows near 37.60 USD/ounce as technical buying emerged, reclaiming the crucial 38.10 USD/ounce support level. According to analyst James Hyerczyk, this move mirrored that of gold, as both precious metals are sensitive to currency fluctuations and global geopolitical tensions.

However, silver’s uptrend remains tentative due to cautious market sentiment. Investors are awaiting two pivotal events that could shape short-term price direction: the release of the Fed’s July meeting minutes and Chairman Jerome Powell’s highly anticipated speech at Jackson Hole. Any hints of Fed policy easing could further boost silver and gold, whereas a more cautious stance from the Fed may curb safe-haven inflows. With the US dollar and US bond yields experiencing volatility, the precious metals market is likely to remain volatile until the Fed provides clearer signals on its monetary policy outlook.

Is the US Dollar About to Weaken?

“The U.S. dollar is projected to remain weak in the short and long term, according to UOB Bank. This prognosis takes into account the combined effects of America’s trade policies, the Federal Reserve’s interest rate strategies, and the global trend towards de-dollarization. The perfect storm of these factors paints a clear picture of an impending greenback decline.”