Vietnam’s Strategic Imperative to Achieve Self-Sufficiency in Semiconductor Chip Manufacturing

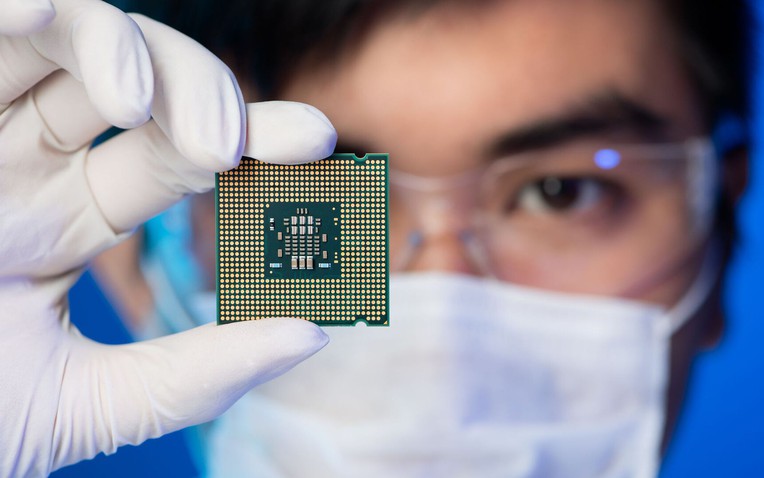

Amidst the backdrop of semiconductors increasingly becoming a pivotal factor in national security and economic development, a scientific seminar titled “Securing Vietnam’s Chip Technology Self-Sufficiency in the National Digital Transformation Process” was held in Hanoi on August 22, outlining a realistic and selective roadmap for Vietnam. Despite being a “latecomer” in the global value chain, Vietnam can strategically position itself to ensure technological autonomy.

Scientific Seminar on “Securing Vietnam’s Chip Technology Self-Sufficiency in the National Digital Transformation”

According to Associate Professor, Dr. Thai Truyen Dai Chan, a member of the CT Group’s Scientific Council, in the current digital age, semiconductor technology is pivotal for all advanced industries. Just as oil was the “lifeblood” of the 20th-century economy, microchips are now likened to the “brain” of the world. Everything from phones, computers, electric vehicles to artificial intelligence, 5G/6G networks, and defense relies on these tiny yet extraordinarily powerful chips.

Therefore, the “chip war” – the competition to dominate semiconductor technology – has become one of the fiercest confrontations among major powers.

Citing the examples of the US, which leads in design and specialized software; Taiwan (TSMC) and South Korea (Samsung) as pioneers in modern chip manufacturing; and China investing hundreds of billions of dollars to reduce its dependence on Western countries, Dr. Chan underscores the commercial and geopolitical nature of this race. Controlling semiconductor technology equates to wielding significant future technological power.

“Failure to master integrated circuits poses immense risks,” he asserted.

Dr. Chan elaborated on three primary risks:

Firstly, economic risks: Any disruption in the global supply chain, such as pandemics or trade tensions, can paralyze multiple manufacturing sectors, directly impacting GDP, employment, and social stability.

Secondly, security and defense risks: All modern military systems, from radar and satellites to UAVs and precision weapons, depend on semiconductor components. Disruption in supply chains can weaken defense capabilities. Moreover, imported circuits may contain “backdoors,” creating illegal access points and threatening national sovereignty. Dependence also hinders technological innovation, as developing AI, IoT, electric vehicles, or next-generation telecommunications infrastructure requires suitable microchips. Overreliance on imports incurs high costs, slows innovation, and leaves countries vulnerable to external manipulation.

For Vietnam, Associate Professor Dr. Chan advocates for a realistic and selective roadmap towards chip self-sufficiency.

“It is challenging for us to directly compete in the ultra-advanced semiconductor segment, which demands tens of billions of dollars in investment and decades of technological foundation. However, we can focus on practical areas that align with domestic demands,” he affirmed.

Associate Professor, Dr. Thai Truyen Dai Chan, delivering his remarks at the seminar.

Unlocking Vietnam’s Semiconductor “Goldmine”

At the seminar, experts unanimously emphasized the imperative of achieving chip self-sufficiency. However, instead of rushing into ultra-advanced technologies, they advocated for a realistic and selective roadmap for Vietnam.

Colonel, Dr. Le Hai Trieu suggested that Vietnam should not initially aim for cutting-edge manufacturing processes like 2nm, 3nm, or 5nm due to the exorbitant investment costs, citing that a 2nm fabrication plant (fab) could cost upwards of $20-30 billion.

Meanwhile, the domestic market’s primary demand lies in simpler applications such as IoT, automotive, and industrial equipment.

Dr. Trieu also pointed out that the chips used in Vietnam’s ID cards and passports employ 40nm technology, a widely used process that will remain relevant for the next 20-25 years.

Associate Professor Dr. Thai Truyen Dai Chan concurred and proposed four potential areas for Vietnam’s engagement, aligning with its capabilities and domestic demands:

Low and medium-power integrated circuits: Targeting IoT, sensors, smart devices, and 6G infrastructure, this field offers a vast market and suits Vietnam’s current capabilities.

Security circuits: Serving e-government, national defense, UAVs, and smart identification, leveraging Vietnam’s strengths in cybersecurity research.

Application-specific integrated circuits (ASIC)/Field-programmable gate arrays (FPGA): Applied in smart transportation, AI at the edge, and defense applications.

Energy and electric vehicle circuits: Such as battery management systems and motor control units, aligning with the country’s green industrial development orientation.

Mr. Tran Kim Chung, Chairman of CT Group.

Mr. Tran Kim Chung, Chairman of CT Group, offered a comprehensive vision: “We need to aim higher, first by mastering core technologies from chip design to manufacturing and commercialization.”

He emphasized creating “Made by Vietnam” products to serve civil, defense, and security needs while also being competitive in the global market, with the ultimate goal of establishing an independent, self-sufficient, and robust semiconductor industry.

“It typically takes about two years to design a standard chip. Then there’s the photolithography process, which can take three to four months. And after that, we have the packaging and testing procedures,” Mr. Chung explained, underscoring the urgency of starting the process as soon as possible.

“If we were to start developing all the necessary chips from scratch, it would take us until 2027 to have them all. Meanwhile, we are making significant strides in digital transformation. So, every hour saved is invaluable,” he added.

Mr. Chung also proposed a collaboration between Hanoi National University and CT Group with security and defense agencies to co-research and develop standardized products based on these chips. With expertise in circuit boards, sensors, and UAVs, the group is poised to meet market demands.

The Ultimate Guide to the Da Nang Mega Project: Unveiling Vietnam’s Soon-to-be Second Tallest Tower

Danang Commences Construction on the Da Nang Downtown Mega-Project, a Nearly VND 80,000 Billion Development on a Prime Riverside Location, Featuring Vietnam’s Second-Tallest Tower.

“Sumitomo and BRG Join Forces to Develop a $4.2 Billion Smart City in Hanoi”

The Japanese conglomerate, Sumitomo Corporation, in collaboration with BRG Group, is set to embark on a monumental journey with the development of a $4.2 billion smart city project outside Vietnam’s capital. This long-awaited initiative underscores the Japanese giant’s unwavering faith in the country’s real estate sector and its potential in the Southeast Asian region.

A Multifaceted Perspective on Land Valuation for the 2024 Land Law Reform

“The topic of land valuation based on “market value” is sparking lively discussions as the 2024 Land Law is being drafted for amendment.”