In a recent meeting with NDT, where Mr. Nguyen Duc Tai, Chairman of The Gioi Di Dong Joint Stock Company (MWG), discussed the company’s quarterly financial results, he provided insights into the group’s IPO plans for its subsidiaries, including The Gioi Di Dong, Dien May Xanh, and Bach Hoa Xanh.

Mr. Tai shared that, from the outset, The Gioi Di Dong was not intended to be limited to the mobile phone business. The company’s vision was to establish itself as a retail conglomerate, with mobile phones as the initial focus due to their ease of management and the ability to stockpile without incurring spoilage costs. Additionally, the warranty services associated with mobile phones were relatively straightforward.

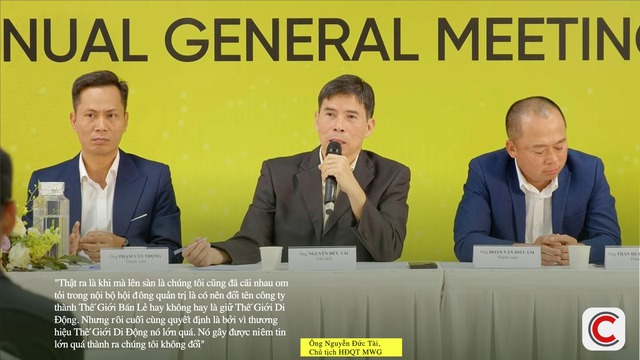

Mr. Tai revealed that there were internal debates within the board of directors about whether to change the company’s name to The Gioi Ban Le to better reflect its expanded scope. However, they ultimately decided to retain the well-established and trusted brand name of The Gioi Di Dong.

He added that the decision to pursue IPOs for the subsidiaries was not a spur-of-the-moment idea but rather a strategic move that had been contemplated for years.

Explaining the rationale behind separate IPOs for each subsidiary, Mr. Tai highlighted the significant differences between the product categories. For instance, there is a distinct contrast between electronics like televisions and consumer goods like fish, despite similarities in operational aspects.

He emphasized that IPOs would empower each chain by providing independent leadership and dedicated teams focused on their respective areas of expertise. Currently, the chains are led by two different CEOs, each with their specialized teams, and the IPOs are intended to maximize this sense of autonomy and accountability.

According to Mr. Tai, the IPO process also signifies a rebirth for The Gioi Di Dong and Dien May Xanh, marking a new phase of vigorous growth driven by quality rather than just quantity. He believes that this evolution will make the business even more exciting than it was during its initial expansion.

Mr. Tai acknowledged the varying perspectives of investors, with some preferring to invest solely in The Gioi Di Dong due to its market leadership, while others see greater potential in Bach Hoa Xanh, given the massive $50-60 billion consumer goods market. He noted that many investors had expressed a desire to invest directly in the individual chains rather than through the parent company.

He further elaborated on the benefits of separate IPOs, stating that it would foster a stronger sense of determination and motivation among the leadership and thousands of employees. By keeping the chains separate, the collective strength of the group would be maximized, and this is a key consideration for the management team, which will be further discussed in upcoming board meetings.

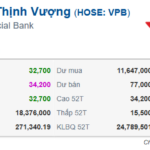

Is VPBank Ready for an IPO?

On August 18th, the Board of Directors of VPBank Securities Joint Stock Company (VPBankS) passed a resolution to seek shareholder approval via written consent. According to multiple sources, the securities firm is preparing to submit an IPO proposal as soon as the fourth quarter of 2025.