On August 22, the Ministry of Industry and Trade, in collaboration with the Vietnam Textile and Apparel Association (VITAS) and the Vietnam Leather, Footwear and Handbag Association (LEFASO), organized a conference on “Domestic Market Development for the Textile and Footwear Industries” in Ho Chi Minh City.

The conference took place amid challenges faced by Vietnam’s key export industries due to global economic fluctuations, trade protectionism, and declining demand in major markets such as the US and the European Union.

Shifting Focus After Years of Export Orientation

At the conference, the Domestic Market Management and Development Department shared that various solutions have been implemented to bring Vietnamese goods closer to consumers. Developing the domestic market not only helps businesses reduce their dependence on exports but also offers opportunities for people to access internationally-qualified products at reasonable prices. This approach is seen as a dual strategy – strengthening the domestic market while enhancing competitiveness in the global arena.

In reality, with a population of over 100 million and a growing middle class, the domestic fashion and footwear market is considered an untapped “gold mine.” By 2024, the consumption of textiles is estimated to reach 5-5.5 billion USD, while footwear is expected to reach 1 billion USD, with a promising growth rate in the coming years.

Many exporting textile, leather, and footwear businesses find it difficult to access the domestic market.

Ms. Doan Thi Bich Ngoc, CEO of Canifa Fashion Company, shared: “After nearly 10 years of focusing on exports, we realized that the domestic market is the most important and sustainable destination. Especially after the COVID-19 pandemic and global fluctuations, Vietnamese goods have never received such great attention from the government, ministries, sectors, and consumers.” This is also the reason why Canifa is expanding its retail system and focusing on the “Made in Vietnam” strategy with international quality.

Similarly, Biti’s, a long-established Vietnamese footwear brand, has also chosen the domestic market as its long-term development focus. Mr. Lam Chan Quoc, representing the company, said that from 2010 to the present, Biti’s has established more than 200 self-operated stores, contributing over 70% of domestic revenue. “We don’t have fixed policies but are always flexible, from brand identity to supply chains, to best serve Vietnamese consumers,” Mr. Quoc emphasized.

Great Opportunities but Not Without Challenges

From a management perspective, Mr. Tran Huu Linh, Director of the Domestic Market Management and Development Department, emphasized: “Developing the domestic market helps businesses stabilize their output while enabling people to access reputable and internationally-recognized products.”

According to Mr. Linh, the leading exporters of textiles and footwear, such as China, India, Bangladesh, and Indonesia, have in common strong domestic markets, large populations, and supportive policies. This is a model that Vietnam needs to emulate. “Export powerhouses always prioritize the use of domestic products while simultaneously building their brands and enhancing product quality,” he added.

While the market potential is vast, businesses still face numerous challenges. Firstly, the industry heavily relies on imported raw materials and accessories, making domestic production costs less competitive than cheap imported goods. Additionally, the retail system is fragmented, distribution channels are limited, consumer preferences for foreign products persist, and the prevalence of counterfeit and pirated goods hinder the growth of legitimate businesses.

“The domestic market is extremely competitive. While the export market has transparent rules, the domestic market lacks adequate control, making it difficult for legitimate businesses to operate. Consumers favor cheap prices, and counterfeit and pirated goods are sold at half the price of genuine products, creating unfair competition,” frankly shared by Ms. Phan Thi Thanh Xuan, Vice President and General Secretary of LEFASO.

Furthermore, the lack of a complete supply chain for raw materials and accessories forces businesses to import, sometimes at lower costs than domestic production. This paradox needs to be addressed to enhance self-sufficiency.

According to Ms. Xuan, in the 2023-2026 period, the textile and footwear industries need to focus on addressing two major issues: ensuring raw material self-sufficiency and building strong brands. Simultaneously, there must be a determined effort to bring transparency to the market and stop counterfeit and pirated goods.

“Only with reputable brands can communication and promotion be effective. LEFASO will continue to act as a bridge between the government and businesses, providing advice on standards and quality norms, and strengthening communication to raise consumer awareness. From 2026 onwards, our goal is to have more strong brands each year, capable of meeting domestic demand and reaching international markets,” Ms. Xuan emphasized.

Experts unanimously agreed that refocusing on the domestic market would not only reduce the dependence of the textile and footwear industries on export orders but also contribute to forming a fashion and footwear ecosystem with a strong Vietnamese identity. When businesses pay more attention to the experiences of domestic customers, invest in retail systems, e-commerce, and product designs that cater to local tastes, confidence in Vietnamese goods will increase. It is essential for businesses to understand consumer psychology and establish their brands through quality and service.

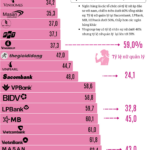

“According to a report by the Ministry of Industry and Trade, the scale of Vietnam’s domestic market currently reaches 6-6.5 billion USD, with clothing accounting for about 5 billion USD and footwear and handbags accounting for about 1.1-1.2 billion USD. The market share is almost evenly split between foreign and domestic brands.”

Building Vietnamese Brands is an Urgent Need

Ms. Nguyen Thi Tuyet Mai, Vice Secretary-General of VITAS, believes that with a scale of 5 billion USD and a population of over 100 million, the domestic market can capture 70-75% of the market share. Successful models such as Viet Tien, May 10, Nha Be, An Phuoc, Canifa, and Yody prove the potential for development in the domestic market. However, to achieve this, it requires the joint efforts of the state, businesses, and associations. “While focusing up to 80% of their capacity on exports, many businesses have somewhat neglected the domestic market, which is full of potential. This ‘gold mine’ needs to be properly exploited through a synchronized strategy: building brands, improving quality, tightening market management, and promoting e-commerce,” expressed Ms. Mai.

“The Billionaire’s Vision: Saigon Marina IFC – A Hub for Financial Institutions, Tech Giants, and Logistics Experts with Over 10,000 Professionals Working Daily.”

“The inauguration of Saigon Marina IFC is a pivotal moment for Ho Chi Minh City’s aspirations to become an international financial hub. This milestone event, witnessed by government leaders, the State Bank of Vietnam, and HDBank, signifies the city’s embrace of a new era of integration, innovation, and global capital attraction.

Mr. Tran Le Nguyen: Kido Harnesses the Power of AI for Round-the-Clock Sales, Transcending the Need for KOLs and KOCs

“The leadership at Kido Group attests to the power of their digital transformation strategies, claiming a remarkable 70% savings in time and costs compared to traditional sales and marketing methods. This forward-thinking company is revolutionizing the industry with its innovative approach, harnessing the potential of technology to streamline processes and achieve unprecedented efficiency.”

From the 20-Year Non-Obsolete ID Chip: The “Gold Mines” of Vietnam’s Semiconductor Industry

The domestic market demands a shift towards simpler chip applications for IoT, automotive, and industrial devices.