At the “Elevating Vietnamese Enterprises” event held on May 8, 2025, the International Bank (VIB) introduced the VIB Business solution package – a comprehensive digital financial ecosystem for small and medium-sized enterprises (SMEs). This is a concrete step to materialize the spirit of Resolution 68, including solutions from unblocking capital, optimizing cash flow, to supporting digital transformation, helping enterprises save time, cost, and improve governance efficiency and competitiveness.

Group of solutions to unlock capital – Faster and more flexible access to capital

Capital has always been one of the top concerns for SME businesses. Closely following the practical needs of enterprises, VIB provides short-term unsecured loans of up to VND 1 billion through the VIB Business Card credit card and flexible capital for medium and long-term capital needs with a limit of up to VND 150 billion with a flexible lending solution.

The VIB Business Card credit card is an effective cash flow support tool, with an interest-free period of up to 58 days, enterprises can take advantage of up to VND 1 billion in credit from the bank to pay for necessary expenses such as advertising costs, business trip expenses, or regular expenses of the enterprise. If the enterprise makes transactions in the first days of the billing cycle, they will have almost 2 months to use that money without having to pay any interest. In addition, the card also has a point accumulation and cash-back function of up to 1% unlimited for all card payment expenses, along with many discount and rebate promotions when paying by card. This helps businesses maximize cost savings while maintaining a more abundant cash flow for other important business activities. Especially, enterprises can optionally set the Minimum Payment Ratio (from 1% to 20%), Statement Date suitable for the business cycle, and Auto-debit Form (minimum, maximum, fixed amount, fixed %) to proactively balance cash flow.

Acting as a standby working capital source, ready to support businesses when there is a sudden spending need or a short-term capital need without going through complex borrowing procedures, VIB Business Card helps reduce the immediate payment pressure on the enterprise. Instead of having to pay in cash or transfer money immediately to suppliers, businesses can use the card to make payments, especially for online or international transactions, helping to extend the time for actual payment and be more proactive in balancing revenue and expenditure.

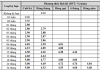

At the same time, VIB provides loans with a limit of up to VND 150 billion, a financing ratio of up to 90% of the value of collateral, and a competitive interest rate from 6.1-7%/year. A big plus is the quick approval process, where businesses can get approval within 24 hours, helping to shorten the time to access capital. This is a lending solution serving diverse business objectives: Borrowing working capital (meeting salary payment needs, purchasing raw materials, paying expenses…); Borrowing to purchase fixed assets and build infrastructure; Borrowing to buy a car for business.

Modernize operations and financial management on the same platform

One of the common challenges that SMEs often face is the lack of tools to control spending between individuals and businesses. Now, the VIB Business Card corporate credit card allows multiple sub-cards to be issued (by department, employee…) and sets separate spending limits and areas for each card, helping businesses manage expenses transparently and effectively.

VIB provides businesses with the VIB Business application, which helps to quickly and accurately grasp the spending situation. All spending on the VIB Business Card is instantly notified via the app with full information on the spender, location, and purpose of use.

The VIB Business app brings a trio of technology solutions to help businesses optimize cash flow management, improve efficiency, and promote digital transformation. The Voice Alert feature instantly notifies transactions by voice, helping business owners and employees tightly control spending, identify risks, and have a real-time financial picture even when busy. The SoftPOS feature turns NFC phones into contactless card payment acceptance devices, saving costs on investing in traditional POS machines, encouraging businesses to participate in the cashless economy, and bringing convenience to both sellers and buyers. The QR Merchant feature allows the creation of separate QR codes for each point of sale, helping to manage revenue separately, simplifying reconciliation, and speeding up customer payment.

Integrating these three solutions, VIB Business creates a comprehensive financial management ecosystem, supporting businesses to operate efficiently and make data-driven decisions.

Accompanying SMEs – From solutions to actions

In the context of many enterprises still struggling with administrative procedures and financial burdens, VIB’s solutions bring a new approach: practical, easy to implement, and technology-based.

Not only providing financial products, VIB is playing the role of a partner, sharing difficulties with the SME community by simplifying processes, reducing operating costs, and enhancing management capacity. Products like VIB Business Card and the VIB Business platform help businesses gradually get used to digital tools, be more proactive in financial planning and expense management, and build stronger internal strength for the future. While capital solutions help businesses enhance their potential to develop their business and optimize the efficiency of idle cash flow. This is an important foundation for businesses to maintain stable operations and sustainable growth in the current period. Refer to additional financial solutions for SME businesses here.

Unlocking Transparency in Management: FPT’s Technological Revolution

As we step into the 2025 Annual General Meeting (AGM) season, Vietnam’s business community is buzzing with renewed vigor following a year of notable successes. This year’s shareholder meetings are prioritizing discussions on attractive dividend payouts, financial transparency, and the integration of technology in assembly organization, reflecting a shift towards enhanced corporate governance and stakeholder engagement.

“Ho Chi Minh City’s Post-Merger Prospects: Unveiling the Coastal Haven”

Introducing the new and vibrant Ho Chi Minh City, now with a coastal twist! With the integration of the rich marine resources of Ba Ria – Vung Tau and the industrial prowess of Binh Duong, this dynamic city has unlocked a realm of endless possibilities for its tourism sector.

“State-Owned Enterprise Partners with Vingroup: Encourages 40,000 Employees to Go Electric with VinFast”

“VNPT is encouraging its employees to prioritize the use of Vingroup’s products and services, with a special focus on VinFast electric vehicles. This initiative is part of the company’s commitment to promoting green transformation in transportation. By embracing sustainable mobility, VNPT aims to lead by example and inspire a wider shift towards environmentally conscious choices.”